Singapore’s cooling measures, Europe’s new digital visa and how long will the housing boom last?

Your international property and economics update tracking, analysing and forecasting trends from around the world.

3 minutes to read

House price growth

Average prices across 150 cities worldwide are rising at their fastest rate since 2005, the latest Global Residential Cities Index confirms

However, the data also reveals that 51 cities saw their rate of annual price growth decline between June and September 2021, with Moscow, Tel Aviv and Perth seeing some of the biggest falls.

The debate about how long the pandemic-induced housing boom can continue is attracting attention globally. Using Knight Frank’s latest data, The Economist gives its perspective and surmises that the phenomenon is likely to endure in the short to medium term, despite the imminent tightening of monetary policy.

It points to three key reasons - robust household balance-sheets, people’s greater willingness to spend more on their living arrangements, and the severity of supply constraints.

Singapore’s cooling measures

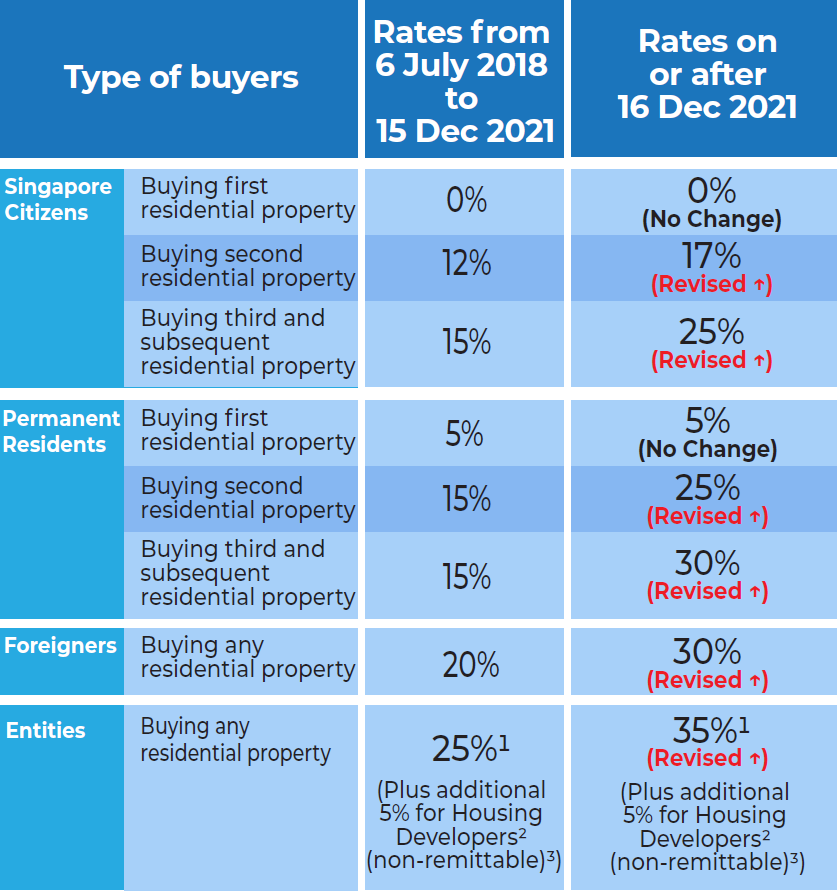

Singapore’s policymakers imposed a fresh round of property curbs in December in an effort to cool double-digit annual price growth and keep house price inflation in line with economic growth. House prices across the city-state increased 10.6% in 2021, their strongest rate of annual growth since 2010.

The hike in Additional Buyer Stamp Duty (ABSD) – which is in addition to a flat rate of 5% - will not affect Singaporean citizens or permanent residents purchasing their principal residence – the core component of demand in the HBD and private homes market. That suggests the rate of price growth may moderate to 1%-3% in 2022 but price falls are not expected.

Developers are expected to pivot their attention to smaller rather than collective sites, whilst foreign buyers will still be drawn by the absence of a wealth tax and capital gains tax.

Source: Singapore Government

All change in Europe

British citizens will need a digital visa called an Etias to enter an EU country for tourism, business or transit purposes from later this year. The document is slated to cost €7 and will mirror the US Esta model.

For those still craving stays of 90 days-plus or free movement within the European Union – assuming there are no close ancestral links to EU countries - the only solution is to seek European citizenship. But some rules are changing.

From 1 January 2022, the focus of Portugal’s Golden Visa has switched from coastal markets such as the Algarve, Lisbon and Porto to inland regions in an effort to expand investment. However, coastal markets will continue to appeal to those looking to take advantage of the country’s non-habitual tax regime which offers low or no tax on offshore income, pensions and dividends.

Spain, Greece, Malta and Cyprus also offer Golden Visa routes to residency and in some cases citizenship, but the EU has long had its concerns with the model. A new report by the European Parliament has proposed five approaches to improve transparency, including a minimum physical requirement, an aligning of vetting procedures and a potential tax on golden visas.

Manhattan’s comeback

Manhattan's fourth quarter home sales were the strongest in 30 years. Closed sales of co-ops and condos reached 3,559 according to Miller Samuel and Douglas Elliman, Knight Frank’s residential partners in the US. In dollar terms, this equated to $6.7 billion of sales.

The surge marks a turnaround from 2020, when a housing market shutdown for several weeks and population losses marred sales activity.

Shrinking inventory levels set against a strong equity market and record Wall Street bonuses has seen the top end of the market outperform lower price brackets during the pandemic. The city registered at least eight sales above US$50 million in 2021.

Some further optimism for the city’s real estate industry may come in the form of its new mayor. Eric Adams became the city’s 110th Mayor on 1 January 2022 and commentators suggest he is keen to build, not regulate, to improve the city’s affordability.

Elsewhere – Evergrande’s woes deepen (Reuters) as Chinese banks cut back traditional lending as economic concerns mount (FT), Hong Kong will ban arrivals from 150 Group A countries for a month (Bloomberg) but zero-Covid strategies are failing (Bloomberg), and finally, 3D-printed homes may not be that far off (FT).