Tech – a pillar of strength for office landlords

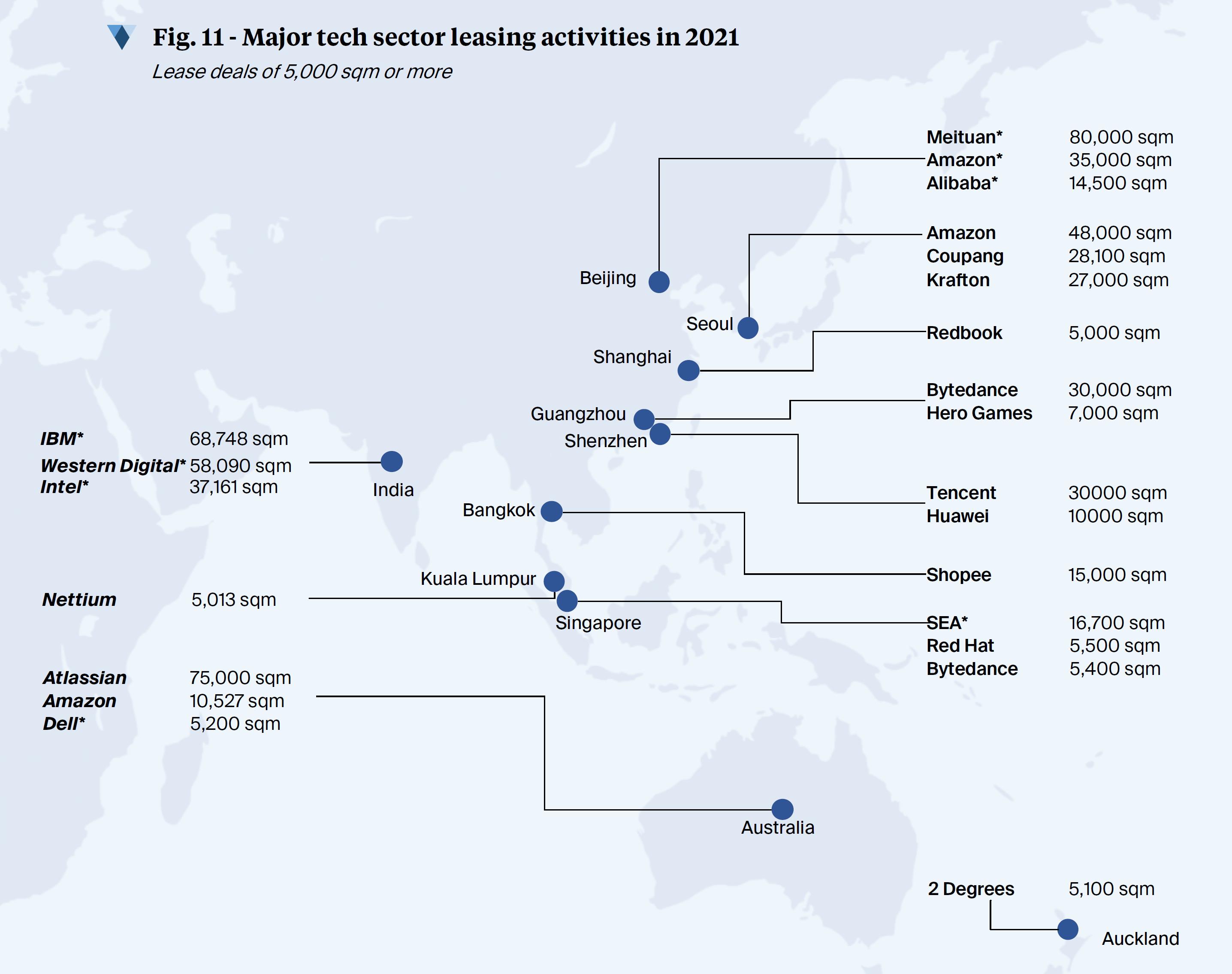

Despite the pandemic’s impact on workplace strategies and overall office occupancy, the tech sector has been the pillar for leasing demand across the Asia Pacific region in 2020 and 2021.

2 minutes to read

The period of restricted movement and social isolation has only increased demand for the sector as more digital services are sought after.

Across the region, tech companies have been noted to take advantage of softening rents to expand their office footprint in both the Central Business Districts (CBD) and decentralised locations.

In tech heavy markets, such as Singapore and Sydney, these occupiers have backfilled spaces vacated by financial firms and driven down shadow spaces.

*Non-CBD locations. Source:Knight Frank.

According to our Innovation Led Cities Index, APAC is represented in the top 20 most innovative cities by Tokyo, Melbourne and Sydney with their deep talent pool and business-friendly environments.

The research has indicated that in innovation-led cities, tech and life sciences businesses are looking for an educated workforce, attracting and retaining population and wealth needed for well-functioning commercial real estate markets.

Modern work practices

Agility and flexibility are also key aspects of the tech sector. With health and wellbeing at the top of the agenda, tech companies have been accommodative in terms of hybrid working and remote working policies to meet the changing needs of mobile tech talents.

These policies offer tech talents healthier environments and better affordability, resulting in the surge in occupier interest in the second-tier or secondary CBD locations. Suburbs and campus-like hubs are alternatives that can offer more open spaces and targeted amenities to achieve this objective.

Flexible workplace trend

One such beneficiary of the changing workplace dynamics is the co-working or flexible office space which is thriving on job growth in the tech sector and digital economy. Tech companies are looking for more flexible work models when offices reopen. On demand co-working spaces are also increasingly popular amongst tech companies.

With the millennial workforce emerging as the largest group across all demographics in the coming decade, the office market is seeing a shift towards agility and flexible workspace and is gravitating towards high-specifications and premium Grade-A buildings. Physical offices continue to be a core element of corporate premises to promote collaboration, learning and interaction.

We are seeing an increased commitment to hybrid flexible workspaces as a part of occupiers’ strategies as we transition towards a Covid-19-endemic Asia Pacific. Occupiers are recognising the impact of flexibility in enabling employee engagement and cost optimisation.

For more insights, you can download the full report here.