The world opens up, prime prices climb higher and the case for build-to-rent

Your international property and economics update tracking, analysing and forecasting trends from around the world.

3 minutes to read

Miami nice

Prime prices across 46 global cities are rising at their fastest rate since 2008. Miami leads the rankings, with annual growth of 26% this quarter.

New data released this week confirms that prime residential prices are rising at an average rate of 9.5% per annum. Miami is one of 15 cities to see prices increase by 10% or more in the 12 months to September.

Wealth in the US has been boosted by sharp increases in the value of real estate and stocks, and according to Oxford Economics, household net worth has increased by $24.8 trillion or 21% during the pandemic.

The case for family rentals

The world of family rentals is attracting big money from institutions, in the UK and Europe - as my colleague Oliver Knight has highlighted in his Build-to-Rent research published last week.

The sector is expanding in the US, too. With inflation on the rise and bond yields at historic lows, investors are looking to rental income as a hedge against inflation. Add to this deteriorating affordability and it’s pretty clear occupancy levels are set to remain high.

Join Oliver for his webinar on Wednesday 24th November where he’ll be discussing the results of the recent Knight Frank European Residential Investor Survey 2022, while sharing the key themes from across the Private Rented Sector (PRS) and Student Housing sectors.

Opening up

Global travel is normalising faster than expected. After 602 days the US reopened its borders to fully vaccinated travellers this week, Australia, which originally said borders would remain closed until mid-2002, also welcomed visitors. Meanwhile, Singapore continues to add more travel lanes.

A whole host of connected industries will be breathing a sigh of relief, including prime property markets with a strong international buyer profile.

We expect activity in these markets to tick upwards as pent-up demand is released from a range of sources, such as expats that are able to return and find a base back home, second home purchasers finally given the green light and potentially some purchases driven by safe-haven capital flows and/or portfolio diversification.

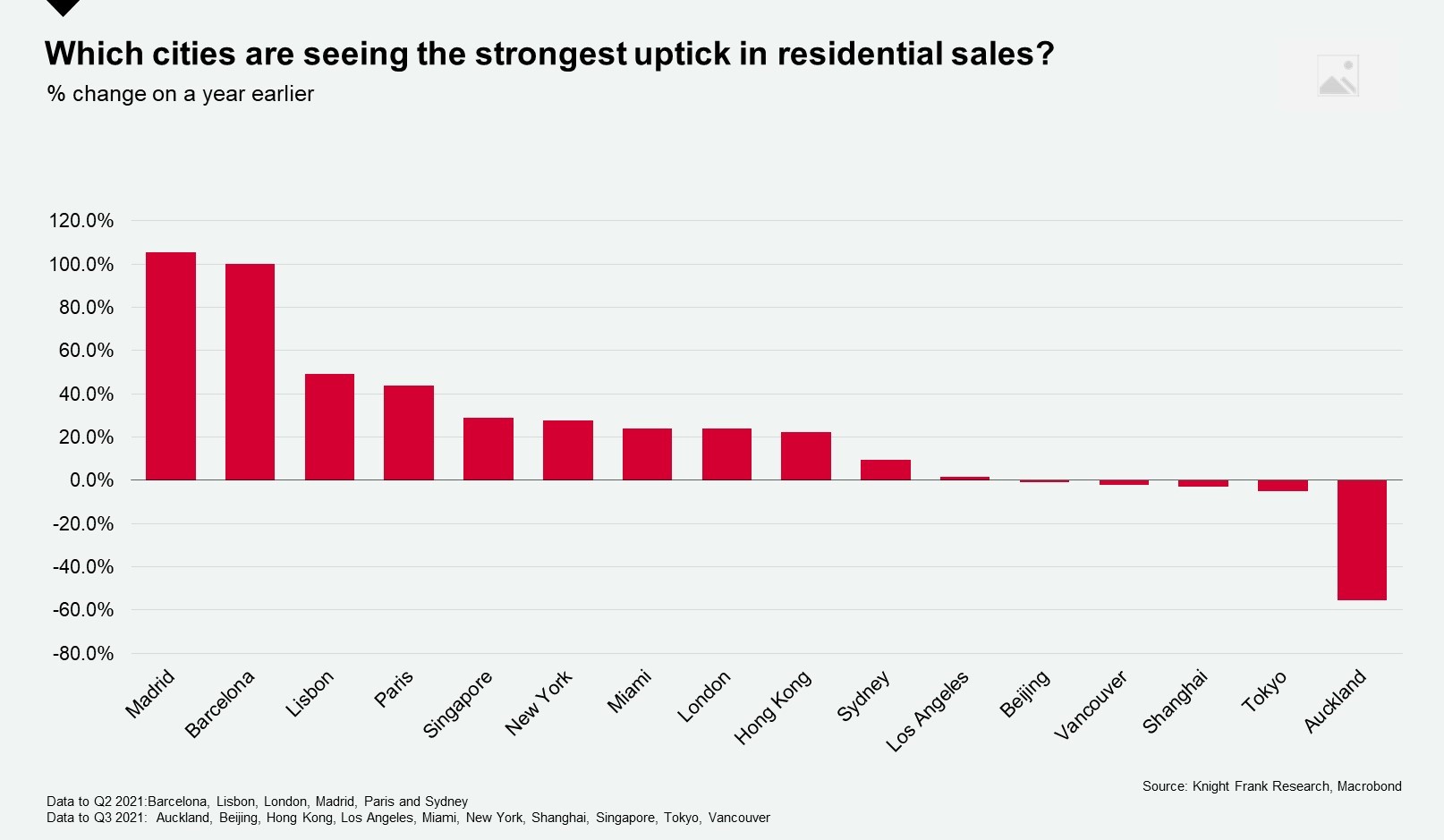

Far from even, the chart below shows the where residential sales are recovering fastest. European cities such as Madrid and Barcelona are bouncing back although data here covers the 12 months to Q2 2021 meaning the base data corresponds to Q2 2020 when housing markets were halted due to lockdowns. Of those cities where Q3 sales data has been published, Singapore and New York lead the pack. However, with monetary policy set to tighten across key markets, talk of higher taxes and cooling measures ramping up, we’ll keep this chart under review.

Barbados shines bright

Of the 2,953 applicants that applied for Barbados’s 12-month welcome visa between July 2020 and August 2021, 1,987 were approved according to the Barbados Government.

The “digital nomad” visa allows applicants to live and work on the island for up to 12 months provided they earn US$50,000 or more per annum or have the same in savings.

According to data from the Barbados Government, the top five nationalities seeking entry under the programme are those from the US, the UK, Canada, Nigeria and Ireland with 71% per cent of them aged 45 or under. To date, over eight million dollars in fees have been generated by the programme.

Our latest Barbados market round-up highlights how the visa, along with an effective Covid-19 strategy and significant investment in infrastructure is influencing the island’s property market.

In other news

Marbella is attracting a younger generation of buyers according to the latest report by our partners Diana Morales Properties, the Zillow/ Ibuyer model comes unstuck as technology-powered home-flipping hits a snag, Hong Kong’s border with the Chinese mainland may not open until mid-2022 and the race is on for a ski chalet in the Alps.

Read our expert research team’s analysis on Cop26, property and climate change, if you missed Flora Harley’s latest webinar on wealth trends catch up here and keep an eye out for our prime residential city price forecast launching next week.