Is 2021 set to be another record year for the Seniors Housing sector?

Investment into the seniors housing sector continues to rise – but what’s driving that growth?

3 minutes to read

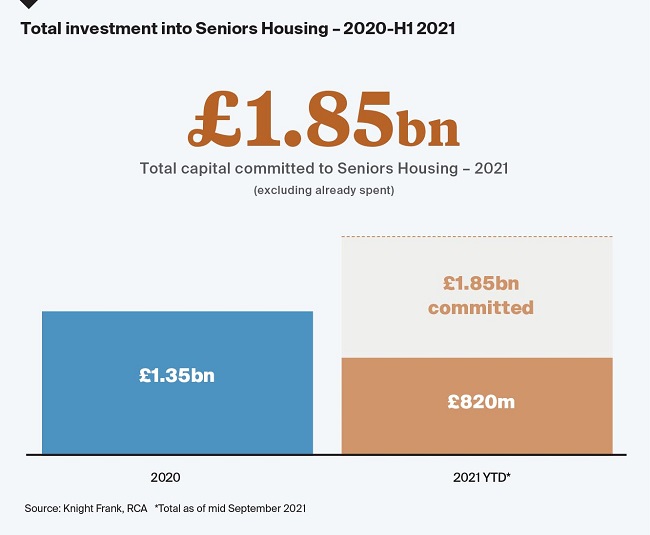

Institutional investment continues to flow into the UK seniors housing market, with more than £800 million spent in the first nine months of the year – up a huge 73% on comparable 2020 levels, according to data from our recent Seniors Housing Annual Review.

Annual investment volumes are expected to hit a record high for the second successive year, with a significant pipeline of deals expected to complete before year-end.

Rising investment reflects strong demand from investors to gain a foothold in a sector which, at its core, is underpinned by solid long-term demographic change. People are living longer, and are healthier in their old age than ever before.

Yet there remains an acute shortage of age-appropriate housing to support our ageing population, something we explored in our latest Development Update.

Volumes are also being supported by a wider pivot from investors away from traditional real estate assets, with the residential sector (which includes student accommodation, PRS and seniors housing) a key beneficiary thanks to its resilience through the pandemic, as well as its potential to deliver long-term secure income.

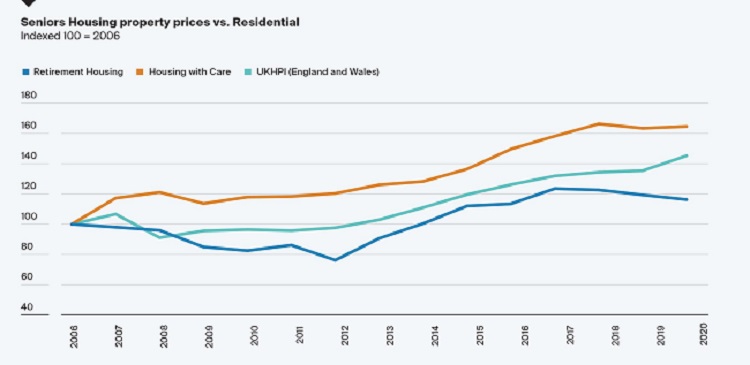

Knight Frank’s Seniors Housing Index shows that, over the last five years, average prices in housing with care schemes have risen by more than 20%. Longer term, price growth in housing with care schemes has outperformed the wider housing market.

Data shared with us by operators, and contained within the Annual Review, also points to the strong operational performance of the sector through the pandemic. Average occupancy levels stand at 81%, rising to 90% for stabilised schemes built before 2018.

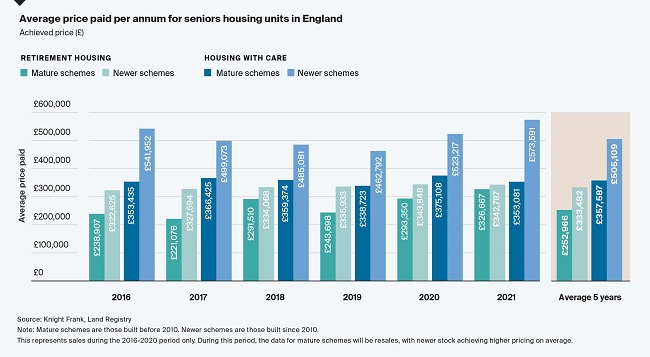

Sales volumes are also recovering, with a 141% uptick across the market in Q3 2021 compared with the second quarter of the year. Further analysis of sales data for units which have sold over the last year shows that achieved prices have risen in 2021 compared with 2020.

Elsewhere, the Review results highlight the diverse sources of income – across different departments and timescales – with deferred management fees, rent, management and service charges, ground rents, care and wellness, and food and beverage all contributing.

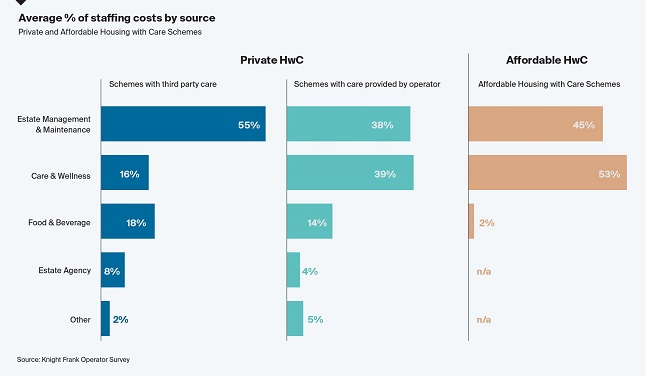

Operating costs, meanwhile, are dominated by staffing as operators, like in other sectors, are focusing on staff training and retention as a way of managing costs.

Who lives in Seniors Housing schemes?

Understanding tenant profiles is crucial to helping the sector plan for the future. According to the results of the Review, the average age of residents in private Housing with Care schemes across the UK is 84 years old.

Around half of residents moved from within 10 miles of a scheme, highlighting the fact that seniors housing is a local product designed and built for local people. While this can vary by operator and motivations of a resident, it highlights the need for local authorities, developers and communities to adequately plan for housing across age brackets.

The average length of stay is just over seven years, though this does vary depending on age of entry and level of frailty, and also by the level of services and care provided by the operator.