St Moritz property price growth soars

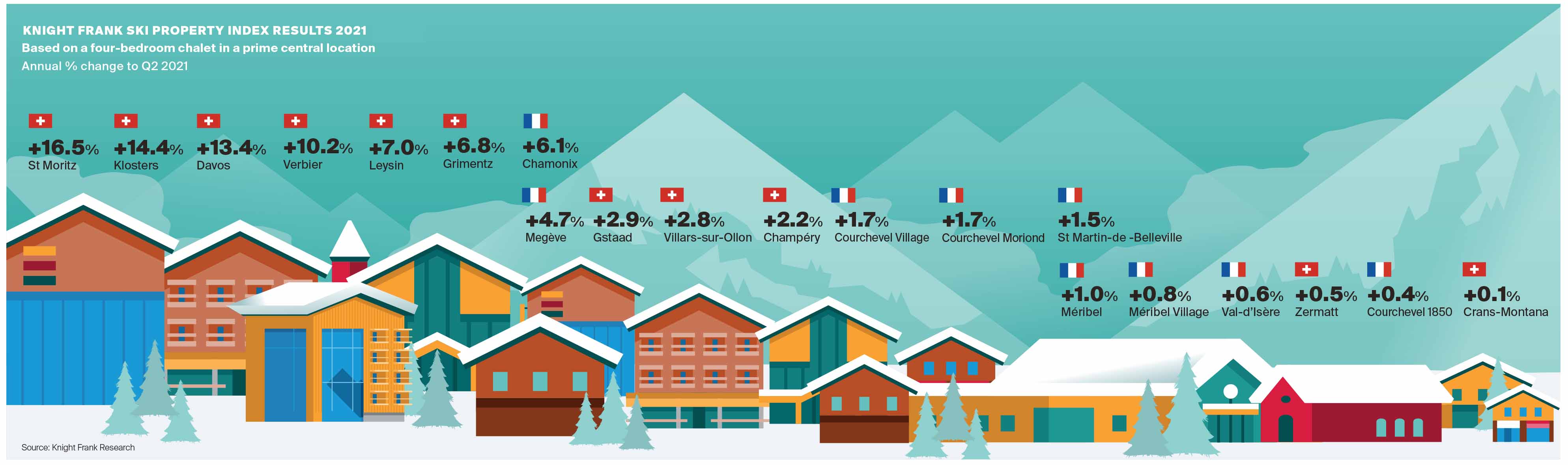

Knight Frank’s annual Ski Property Report, launched today, reveals that Swiss resort, St Moritz recorded strongest price growth in 2021 with property prices increasing by 17% according to the firm’s Ski Property Index.

2 minutes to read

A shortage of stock and strong demand has had an inevitable impact on pricing. In June 2020, 90 ski homes were available to buy in the resort, a year later there were close to 20.

Swiss resorts lead the Ski Property Index for the first time in three years, as well as stock shortages and strong domestic demand; the pandemic also shone a spotlight on the advantage of Swiss Independence. The country’s ability to set its own travel rules, its decision to reopen its ski resorts in December 2020 (the only European country to do so), and its overall response to the pandemic has bolstered its appeal.

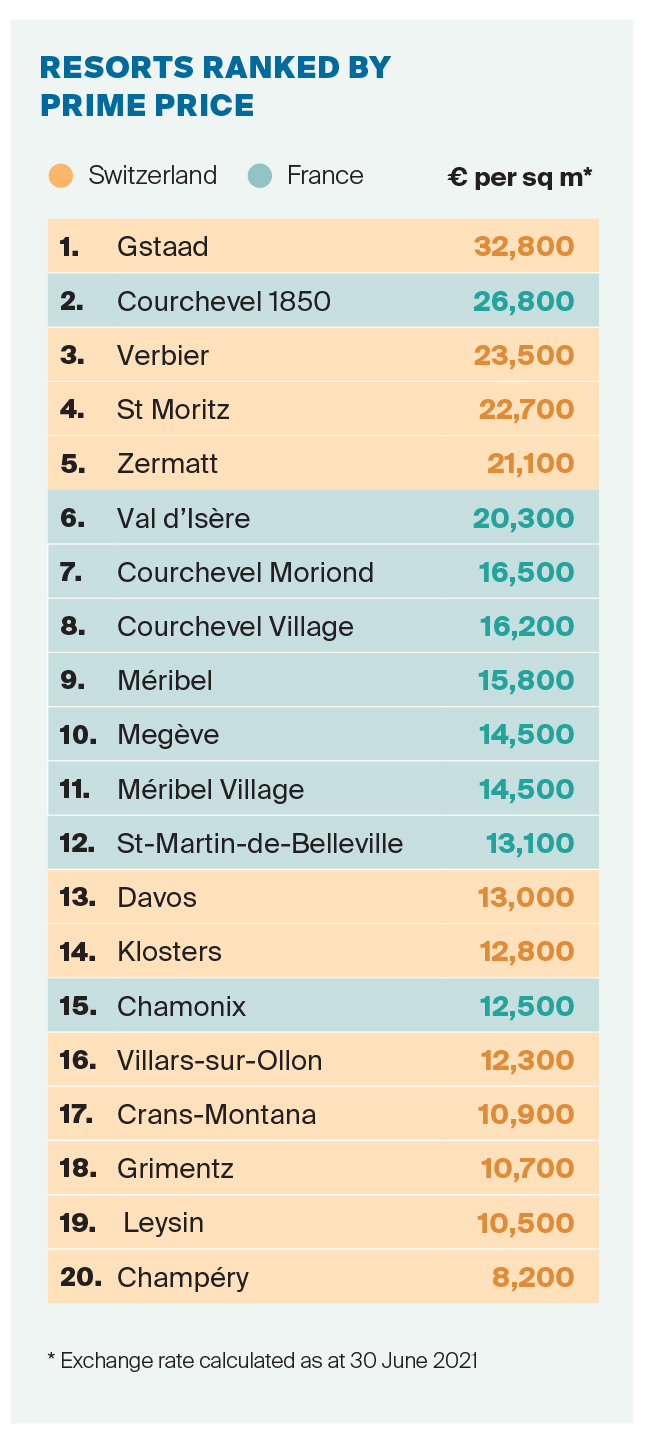

Verbier, also in Switzerland, tells a similar story to St Moritz, prices here have risen by 10% and properties have at times, sold for 12% above asking price, the resort also achieved a record sale price of CHF 30,000 per sq m for a resale apartment.

Kate Everett-Allen, head of international residential research at Knight Frank, said: “This year has been an anomaly. We don’t expect this frenetic pace in Swiss resorts to continue. Supply constraints will ease as the Covid-19 landscape starts to normalise.”

Alex Koch de Gooreynd, head of Swiss sales for Knight Frank, commented: “Would-be sellers have become landlords, and parents that are thinking of selling have put their plans on ice as their children or extended family members have wanted to enjoy the Alps in the last 12 months. Whilst this affection for the mountains shows no sign of cooling, we are hopeful that we will start to see stock levels recover albeit slowly.”

The French Alps also look set for a busy winter. Chamonix (6.1%) and Megeve (4.7%) proved to be France’s frontrunners, due primarily to their ease of access from cities such as Milan, Turin and Geneva and due to their relative value.

Ski Property Report

This year’s Ski Property Report also provides an update on market trends across Colorado’s top resorts, we explore why The 2022 Beijing Winter Olympics may prove a boon for the ski industry and with 90% of ski homes buyers looking to rent their property, we reveal exclusive data confirming which resorts command the highest rental rates.

Look out for our upcoming blog series covering all of the above and more or download your copy.

Sign up to future editions of The Ski Property Report

If you are seeking a 'home from home' in the Alps, or have an alpine property that you are thinking to sell, why not speak with our Alpine specialists for further advice on where, why, and how to buy and sell in the mountains.t