Renters return, house price curbs Down Under and UK construction suffers a severe loss of momentum

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Construction

The construction sector has suffered a "severe" loss of momentum in recent weeks due to prevailing labour shortages and pressures on supply chains, according to September's IHS Markit / CIPS UK Construction PMI - a closely watched measure of economic activity.

September's data represents the weakest growth in eight months. Common site disruptions now include unavailable transport - presumably due to a lack of HGV drivers - price swings slowing clients' decision-making, plus the usual severe lack of materials and shortages of everything from bricklayers and groundworkers to joiners and plumbers.

House building recorded its weakest expansion since the recovery began in June 2020. The commercial segment was the strongest performer, though not by much. Though disruption is weighing on activity, construction firms remain optimistic about the future, with 51% expecting a rise in output and only 8% expecting a decline.

Inflation

With governments, central bankers and economists at odds over how seriously we should be taking inflation, staff shortages and disruptions to supply chains, it's unsurprising that measures of uncertainty among businesses are ticking up.

The percentage of businesses that viewed the overall level of uncertainty facing their business as high or very high rose to 50% in September, according to the latest survey by the Bank of England (BOE). Covid remains the largest source of uncertainty with respondents, which include more than 3,000 chief financial officers. The share of firms that reported Brexit in their top three sources of uncertainty was 41% in September, up 5% on the previous month.

Respondents pegged inflation at 3.9% in the three months to September and expect it to keep rising. In his first public comments since taking the role of chief economist at the BOE, Huw Pill said "the strength of inflation looks set to prove more long-lasting than originally anticipated," putting him in-line with recent more hawkish comments from the BOE's monetary policy committee. A reminder that the BOE edged closer to a 2021 rate hike at the last MPC meeting.

House prices

We talked on Monday about regulators in Australia, who have been mulling what to do about soaring house prices. House prices nationwide climbed 17.6% over the past twelve months prompting The Australian newspaper to call the housing boom "a symptom of the great Australian disease."

On Wednesday, the Australian Prudential Regulation Authority told lenders it expects them to assess new borrowers’ ability to meet repayments at an interest rate at least 3 percentage points above the loan product rate, up from 2.5% where it currently stands. This Bloomberg headline calls the new measures a tweak, which feels about right, though this may be the first step of many.

Staying with the theme, Halifax yesterday said UK house prices climbed 1.7% in September, the highest monthly rate of growth since 2007. That brings annual growth to 7.4%.

Renters return

The performance of urban rental markets is one of several reliable measures of the resurgence of city life. The FT this morning runs this piece with the headline: Return of the renters: price hikes, bidding wars and bribes.

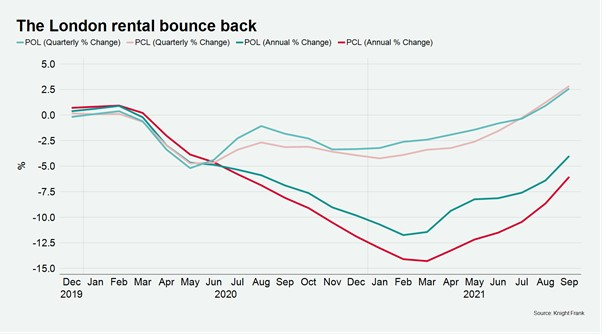

Knight Frank data reveals the bounce back in London's prime lettings market gathered pace in September. In fact, average rental values rose on a quarterly basis by the largest amount in a decade in prime central (+2.8%) and prime outer London (+2.6%) (see chart). The number of tenancies started in September was also the highest monthly total in the last ten years.

Meanwhile in prime central London's sales market, demand continues to outstrip supply.

In other news...

Hotel fundamentals have continued to improve during the summer months of 2021, with the highest level of profitability achieved in both London and the regions since the start of the pandemic. For more, read this piece by Philippa Goldstein.

Following the general election in Zambia, Tilda Mwai explores five charts that show the economic impact of the vote, plus the implications for the real estate market.

Elsewhere - UK hiring activity surges again, though there are signs the London jobs crunch may be reaching a peak, Hong Kong property stocks rally on housing development plans, return to the office boosts Workspace, rise in home working sees Brewin Dolphin ditch office move, positive economic signs from China and the US, and finally, Singapore said to canvas wealth circles on tax plans.