Rising investment to drive an increase in seniors housing delivery

The sector is benefitting from increased investment from institutions. But delivery is still falling well short of demand.

3 minutes to read

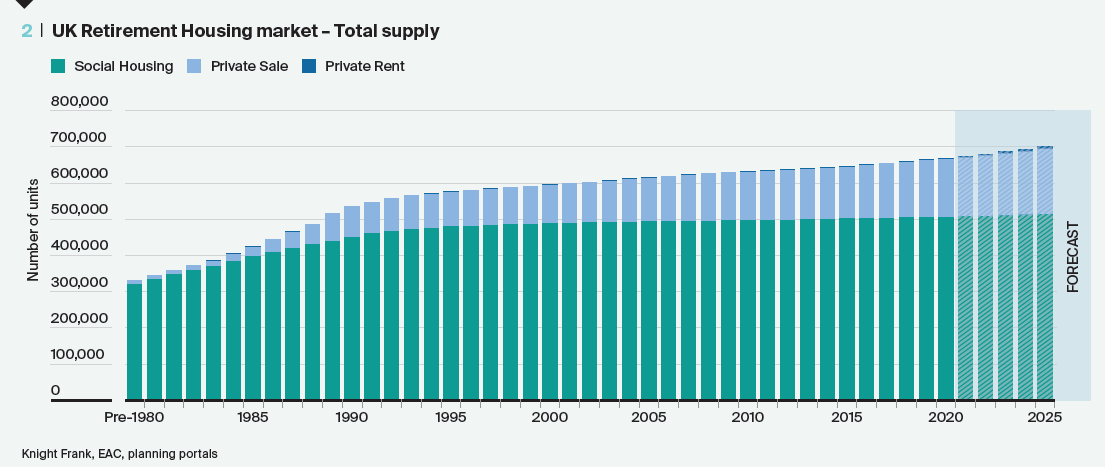

The number of seniors housing units in the UK is forecast to increase by 9% over the next five years, taking the total supply of seniors housing units to just shy of 820,000.

Yet even with this forecast expansion, this will only equate to around 3% of total UK housing stock. Crucially, it will also be dwarfed by the expected growth in the population of seniors in the UK, deepening the supply/demand imbalance that already exists.

Data from the ONS suggests the number of people aged 65+ is forecast to rise by 22% to 15.1 million in the coming decade.

At the same time, increasing wealth and income among this age cohort is resulting in more informed housing and lifestyle choices. The seniors cohort is the wealthiest in the UK in terms of property assets, with an estimated £1.5 trillion of equity.

However, with age comes frailty. An 85 year old is 25 times more likely to require care than a 75 year old, according to LaingBuisson. The current pressures on the NHS and Social Care system are going to be amplified each year for the next 30 years as baby boomers age – and most existing family housing requires adaptation or is not suitable for living in later life.

Supply landscape

There is an opportunity to increase delivery of purpose-built, specialist seniors housing designed and operated to meet the UK's seniors housing need.

Currently, the sector comprises both ‘Retirement Housing’ (age-restricted market housing) designed with the down-sizer in mind, and ‘Housing with Care’ schemes which provide higher levels of services, care and support as an integral part of their proposition.

Retirement Housing accounts for 87% of existing stock, with the remainder Housing with Care schemes.

Investment rising

Growth in delivery of new seniors housing units is being driven by increasing private sector investment.

Last year, a record £1.3 billion was deployed in the seniors housing market in the UK and this momentum has continued into 2021. More than £450 million has been invested in the first half of the year, double H1 2020 levels.

We have identified a further £1.3 billion which has been committed to the sector. At this current rate, investment is expected to increase by 30% year-on-year in 2021.

The macro drivers for the sector are well documented. There is a clear and deepening supply/demand imbalance underpinned by the expansion of our senior population, greater pressure on local NHS services, and a concentration of housing wealth in the senior demographic.

Rising investment volumes also come amid a wider pivot from institutional investors towards residential assets across all age groups, with investors recognising the quality of income streams on offer as well as their strong demographic fundamentals.

More schemes more choice

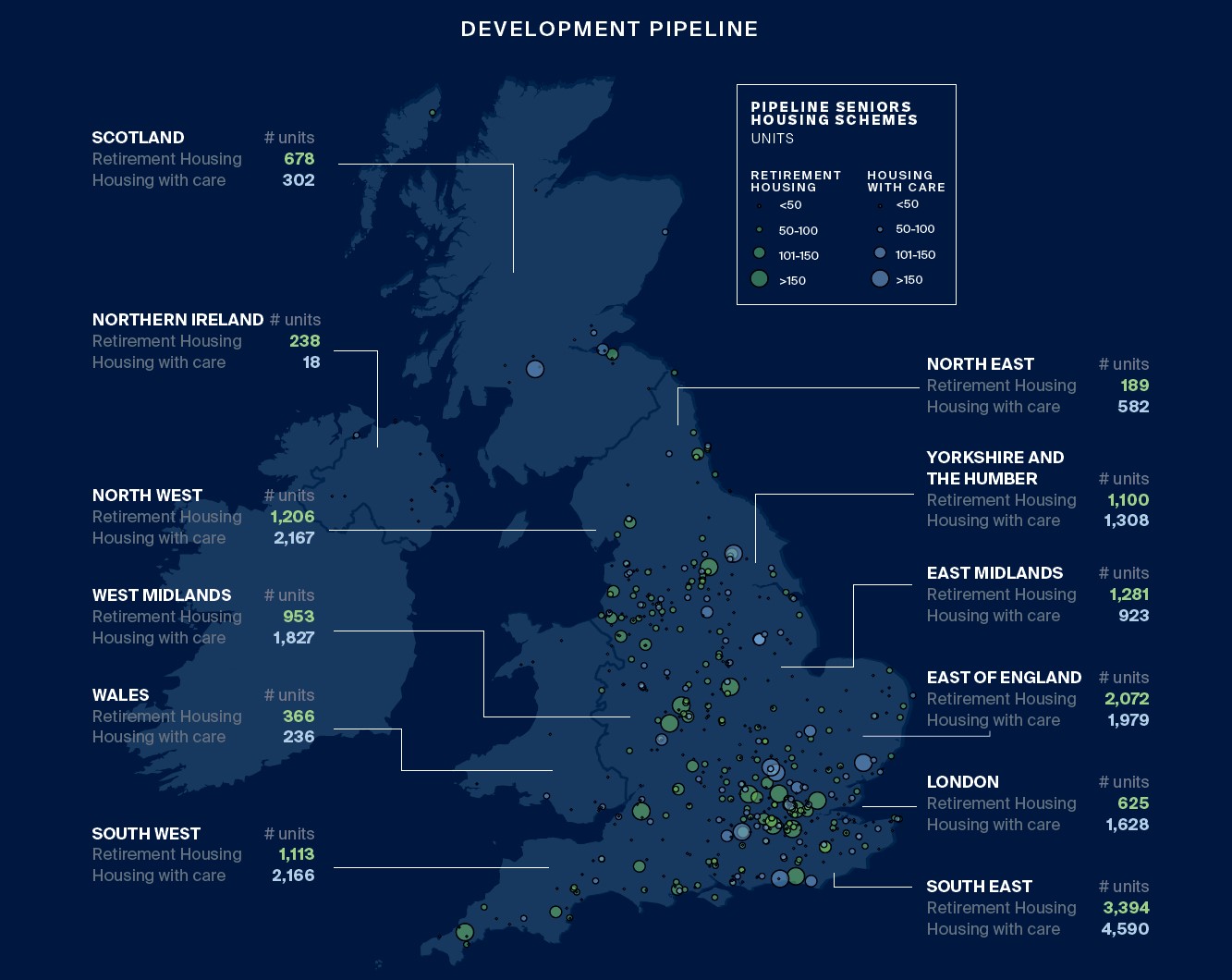

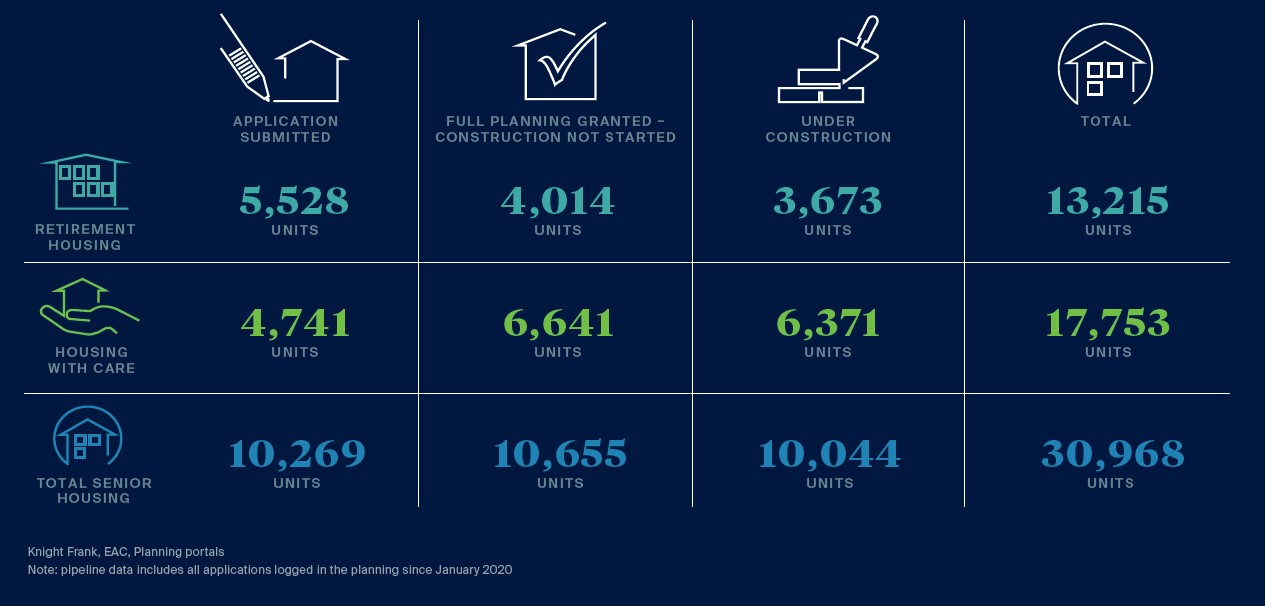

Analysis of the pipeline suggests the composition of the market will shift in the future, with a move toward providing more choice for residents including through mixed-tenure and rental-only options and more schemes with varying facilities and services.

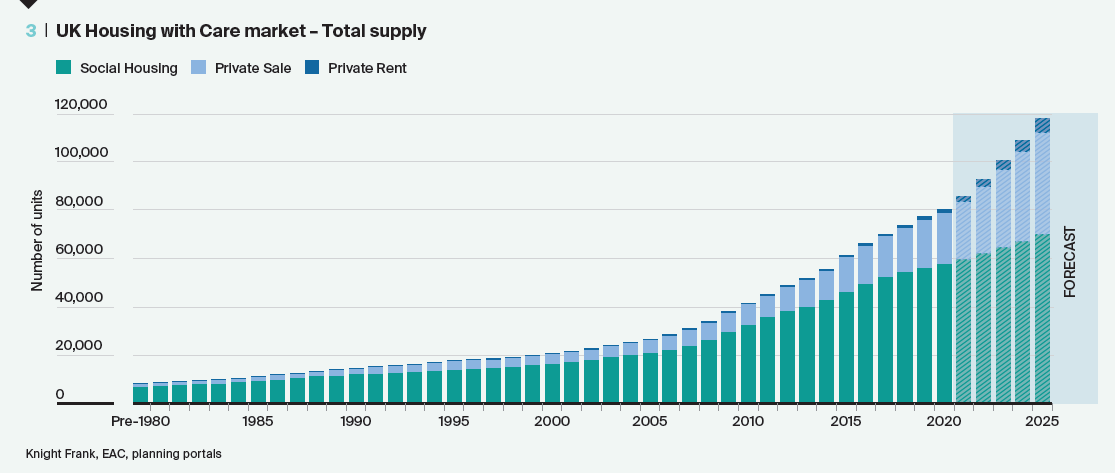

Consequently, we anticipate a 46% (or 37,450 units) increase in Housing with Care supply over the next five years. This is compared with 5% (or 32,650 units) growth in Retirement Housing.

Stronger growth within the housing with care market has been driven by increasing institutional investment. We expect this trend will continue.

Search for scale

At an average of 51 homes per scheme, the size of developments has risen steadily over the last decades up from 41 between 2000 and 2009 and 31 in the nineties. These averages mask increasing development size in the upper quartile where there are increasing developments of 100 to 150 units and 150+ units are being delivered.

![]()

That is partly a reflection of a desire for scale and brand-building from new entrants to the sector as they look to create management platforms with operational efficiencies at pace.