Country market price growth hits levels not seen since before the global financial crisis

Prime Country House Index 269.8 / quarterly change 3.7% / annual change 10.5%

2 minutes to read

A surge in activity ahead of June’s stamp duty deadline and tight supply saw price growth in the country market reach a level not seen since before the global financial crisis (GFC) in the second quarter.

Average values increased by 3.7% in the three months to June, which was the strongest rate of quarterly growth in 15 years. This compares with price growth of 2.8% in the first quarter of 2021.

It means average prices are 10.5% higher than a year ago, which is the strongest rate of annual growth since Q1 2007. Despite this, country prices remain 6% below their peak reached in Q3 2007 before the GFC struck.

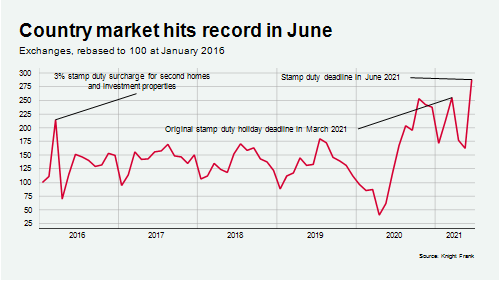

The pandemic-inspired escape to the country trend has seen heightened sales activity in the past year, boosted by the stamp duty holiday. The number of exchanges in the country market was a new record in June, surpassing the previous record, set in March - the month of the original stamp duty deadline, by 13%.

However, due to the challenges of a third national lockdown at the start of the year and the distortions created by the stamp duty holiday, new supply has been limited.

“While market appraisals for sale have been back above the five-year average in recent months this hasn’t yet converted into enough new listings to meet strong demand for space and greenery post-pandemic. This has put upwards pressure on prices,” said Chris Druce, senior research analyst at Knight Frank.

Given the strength of the market, prospective sellers have been reticent to sell without somewhere to buy, exacerbating the supply imbalance. There were 11.4 new prospective buyers for each new instruction in the Country market in June, which is historically high. In June 2019 the figure was 7.5.

The number of offers accepted in June was the highest since October 2020, indicating that transactional activity will remain high over the summer. Our latest sentiment survey has found that there remains strong interest in the county market, with 30% of respondents stating they were more likely to look to move to a less urban or more rural area as a result of the latest lockdown.