Monthly UK Residential Property Market Update - July 2021

Stamp duty deadline drives a record number of transactions in June.

4 minutes to read

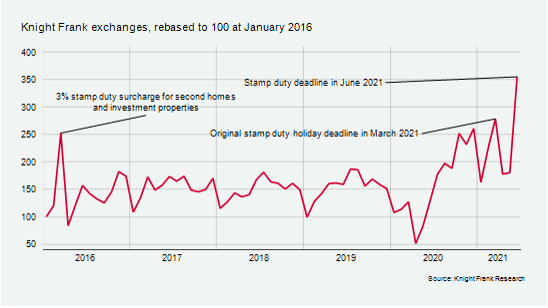

Knight Frank carried out a record number of UK transactions in June, exceeding the previous high, recorded in March 2021, by 24%.

This was driven by the winding down of the stamp duty holiday as well as a continued strong demand for more space.

While the end of the stamp duty holiday taper period in September should see a smaller spike in activity, there should now be a gradual return to normality during the second half of the year.

Although there will be a fall in transactions following the end of the full stamp duty holiday, pent-up demand will continue to underpin activity. Knight Frank saw a record number of offers accepted in the UK in June, which suggests transactional activity will remain strong throughout the summer.

The June RICS Sentiment Survey showed new buyer demand eased somewhat in anticipation of the winding down of the stamp duty holiday. However, a scarcity of new instructions coming into the market means demand is still outstripping supply.

The net balance of instructions in June was -34%, a third consecutive fall and an accelerated rate of decline. This shortage of supply is set to support pricing over the coming months, with +56% of RICS survey participants of the view that prices will increase over the next twelve months.

Knight Frank’s latest Sentiment Survey found that three-quarters of respondents believe the value of their home will increase within the next year, despite the end of the stamp duty holiday.

However, UK house prices dipped for the first time in June since January, down 0.5% from May, according to Halifax. Despite this, house prices remain 8.8% higher than they were a year ago. Whether this represents a peak is uncertain. Halifax said the rate of price growth will likely slow towards the end of this year but people’s desire for more space due to the extended time spent at home is unlikely to fade entirely.

Prime London Sales

The number of transactions carried out by Knight Frank in prime London markets in June was the highest on record. The June figure was 53% higher than March this year, the second highest month on record when transactions spiked ahead of the original stamp duty holiday deadline.

It demonstrates how a £15,000 saving has been a key driver of demand in high-value markets in the capital, despite the sum representing a smaller proportion of the sale price than in mainstream markets.

The fact the saving is relatively smaller will support transaction numbers across prime London property markets in coming months. This is underlined by the strength of leading indicators of activity. The number of new prospective buyers registering in June was 42% above the five-year average for the same month. Meanwhile, the number of offers agreed was 86% higher than the five-year average.

Prime London Sales Report: June 2021

Prime London Lettings

Demand continues to build in prime lettings markets in London and the Home Counties as lockdown restrictions are relaxed and the next academic year approaches.

Underlining the strength of demand, two separate records were broken in June. The number of new prospective tenants registering reached the highest level on record, as did the number of viewings. Compared to 2019, which was an active year in the lettings market, the number of viewings was 82% higher in the month of June. The number of new prospective tenants was 97% higher.

With demand increasing, rental value declines continue to narrow. In prime central London, the average decline in the three months to June was 1.6%, the smallest drop since the start of the pandemic.

Prime London Lettings Report: June 2021

Country Market

Having set a record in March, exchanges in Knight Frank’s Country business were 13% above this previous high point in June. Offers accepted also reached a new high in June, suggesting transactional activity will remain elevated over the summer.

The supply shortage remains particularly acute in the Country market. The pandemic-inspired escape to the country trend has seen heightened sales activity, boosted by the stamp duty holiday. However, due to the challenges of a third national lockdown at the start of the year, new supply has been limited.

Given the strength of the market, prospective sellers have been reticent to sell without somewhere to buy, exacerbating the supply imbalance. However, demand remains high, and there were 11.4 new prospective buyers for each new instruction in the Country market in June. This is down from a peak of 16.1 in January but remains historically high.

Prime Country House Index Q1