Coins, comics and collectors cards set record prices at auction

The editor of Knight Frank’s Luxury Investment Index talks to Mark Salzberg of the Certified Collectibles Group about a booming trend

7 minutes to read

Despite having compiled our Luxury Investment Index (KFLII) for the best part of a decade, I had never come across the work of the US-based Certified Collectibles Group until a chance email landed in my inbox after the publication of The Wealth Report 2021.

One thing led to another and I was delighted that the group’s Chairman and founder Mark Salzberg was able to join one of our webinars discussing the world of luxury investments.

Of course, there is only so much you can cover during an online discussion so I thought it would be interesting to carry on the conversation with Mark.

Not everybody in the UK will be familiar with the services offered by firms such as the Certified Collectibles Group. How do they benefit collectors? We are comprised of eight independent companies with offices and submission centres across Europe and Asia that provide expert and impartial authentication, grading and conservation services for collectibles. Our experts first review collectibles for authenticity and then only genuine collectibles are assigned a grade according to an internationally recognized scale.

The authenticated and graded collectibles are then encapsulated in tamper-proof holders with labels that provide identifying information and unique certification numbers that can be verified online, 24/7. The services provided by the CCG companies are backed by comprehensive guarantees, which gives buyers the confidence necessary to transact online.

Since 1987, the CCG companies have certified more than 60 million coins, banknotes, comic books, trading cards, sports cards, stamps, estate items and related collectibles— a testament to the trust collectors and dealers have in our services. Many of these collectibles have gone on to break records in sales around the globe. We’ve also had the opportunity to certify famous collections as well as museum collections, such as the Smithsonian Institutions’ greatest numismatic rarities.

Blastoise Commissioned Presentation Galaxy Star Hologram, graded CGC 8.5. Realized: $360,000

How is the collectibles market doing in 2021?

Looking back over the last 18 months, I am happy to say I feel very optimistic about the strength and future of the collectibles markets.

The internet has made collectibles accessible to everyone, and third-party certification has made buying collectibles far safer and more transparent. The CCG companies give buyers everywhere in the world confidence that collectibles are genuine, accurately graded, properly described, securely protected by state-of-the-art holders and backed by comprehensive guarantees.

With greater accessibility, safety and confidence comes increased and broad-based interest. This interest has brought massive numbers of collectors, dealers and investors into the collectibles markets, transforming our industry almost overnight in the midst of a global pandemic.

Why is there so much interest in collectibles right now?

First, more information and data continue to become available online, making our industry more transparent by the day. The CCG companies have long been at the forefront of providing free educational and collecting resources on our websites, including collector forums, certification verification tools, price guides, population reports showing relative rarity and set registries that make collecting easier and more fun.

Secondly, with increased liquidity and volatility in the marketplace, people are diversifying their assets across an increasing range of items, including collectibles like coins, comics, trading cards and sports cards, all of which are realizing impressive sales amounts.

1787 ‘EB’ on Wing Brasher Doubloon, graded NGC MS 65★. Realized: $9.36 million

Why should people consider purchasing collectibles?

Today, there is no question: Collectibles are a booming market and an asset class. Spurred by our internet-driven economy, a broad range of collectibles, including coins, banknotes, comic books and trading cards, have become more accessible, liquid, fungible and high profile — as demonstrated by headlines in the Wall Street Journal, Forbes and other mainstream publications.

What are some of CCG’s highlights from 2021 so far?

This has already been a remarkable year for Numismatic Guaranty Corporation (NGC) and the numismatic marketplace as a whole. Ten NGC-certified coins already have surpassed $1 million at auction in 2021. These coins include two Brasher Doubloons from the Donald G. Partrick Collection, which were sold in January for $9.36 million and $2.1 million respectively, and two Chinese Coins pedigreed to The NC Collection of Vintage Chinese Coins that were sold in May for more than $1 million each.

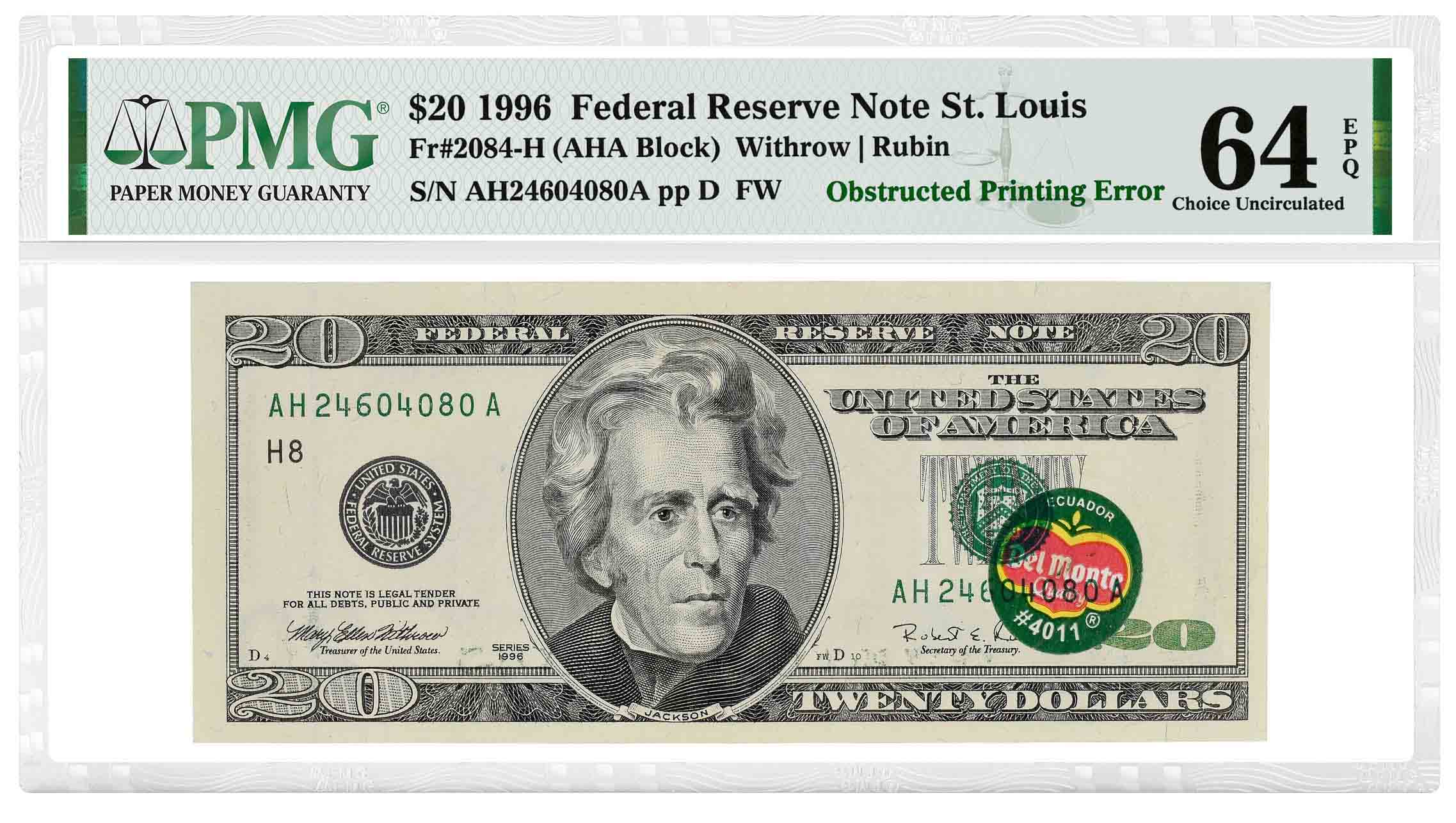

The "Del Monte Note", Realized: $396,000

Are any other collectibles doing well in the marketplace?

Absolutely. There is staggering growth throughout the hobby industry. For example, Paper Money Guaranty (PMG) has now certified more than 6 million banknotes, including some of the world's greatest rarities. One of my favorite notes that sold this year is the famous “Del Monte” note, which sold for $396,000, several multiples above its pre-auction estimate of $25,000 to $50,000. This note set a world record for any error note and for any piece of small-size US currency.

What about other collectibles?

Certified Guaranty Company (CGC) achieved its own milestones in the last year — over seven million collectibles certified, primarily comic books but also magazines, concert posters, trading cards and other collectibles. Notably, CGC has graded over 1 million collectibles in the past year alone.

Recently, a superb example of Action Comics #1 that was certified by CGC sold for a record $3.25 million in a private sale. The June 1938 book is beloved for introducing Superman to the world.

Superman isn’t alone in being desired by collectors, however. Just this month, a Detective Comics #27, which introduced Batman to the world, realized $1.12 million.

Trading cards have emerged this year as an extremely hot market. In May, eBay reported seeing a record 142% domestic trading card growth, with Pokémon topping the list as the most popular category. CGC Trading Cards was launched to provide authentication, grading and encapsulation services for virtually all Pokémon and Magic: The Gathering cards.

Detective Comics #27, graded CGC 5.0. Realized: $1.12 million

Another collectible card market – sports cards – is blazingly hot right now. In 2021 alone, 11 of the top 16 highest-value sports cards have realized prices greater than $1 million – including a 1952 Mickey Mantle and a 2003 LeBron James, which both sold for $5.2 million.

Certified Sports Guaranty (CSG) was launched in late 2020 to provide collectors and dealers with expert, impartial and efficient authentication, grading and encapsulation services for sports cards. In just a few months, CSG has authenticated thousands of sports cards.

Do you have any final words for our audience?

Today, I am elated to say that the collectibles markets are thriving. For years, I have said that collectibles are an emerging asset class. Now, there is no doubt: collectibles are an asset class. A broad range of collectibles, including coins, banknotes, comic books and trading cards, have become highly liquid and fungible. There is even fractional ownership of collectibles.

Now is truly an exciting time to be part of the collectibles community. We are only in the earliest stages of the convergence of the collecting and investing worlds, and there are still incredible opportunities for growth. As always, third-party certification has and will provide the confidence, transparency and security that are necessary to support our vibrant markets and propel them forward.

Mark Salzberg

One of the world's most respected numismatists, Mark Salzberg has been working in the collectibles industry for over forty years. In 1999, he formed the Certified Collectibles Group, which offers independent, third-party certification services for a variety of collectibles including coins, paper money, comic books, trading cards, sports cards, estate items and more.

Salzberg has been a key supporter of the collectibles hobbies for decades, helping to bring trust into the marketplace with the integrity, expertise and reliability of a proven process and by increasing the reach of CCG’s independent companies. He has worked with the US Mint to educate and spark youth interest in collecting, has graded some of the world's most high-profile coins and has sponsored the Smithsonian Institution’s Legendary Coins & Currency exhibit through endowment and conservation of some of the country's most treasured artifacts.

To learn more visit CollectiblesGroup.com

Banner image by Mick Haupt on Unsplash