The next challenge? …. a shortage of prime housing stock

Evidence is emerging of prime stock shortages in European residential markets brought about by an uptick in pandemic-induced sales and the ‘race for space’.

3 minutes to read

In the UK, the number of houses listed for sale across the UK was 33% lower over the 12-month period to March 2021 while the number of flats was 7% higher according to analysis undertaken by my colleague Tom Bill of OntheMarket data.

In Europe, it’s resort, coastal, rural and alpine markets that are feeling the pinch and it’s likely to become more constrained in the coming months.

“The strong sales rates we’ve seen in the last 12 months have been driven almost entirely by domestic buyers, once borders reopen and cross border transactions normalise, we expect stock levels to reduce further,” says Mark Harvey, Knight Frank’s Head of International sales.

Mark adds: “We’re making contact with clients who have sat on the side-lines as a result of the uncertainty over the last few months. Not only are we able to share with them a number of off-market properties that we hold exclusively, but also explain that now is a key window of opportunity as we await a second surge in demand as travel restrictions start to ease and overseas buyers return.”

Why now may be a good time to sell

• Prices expected to rise in key prime markets

• Demand outweighs supply for the best-in-class properties

• Once borders reopen, we expect to see a second surge in activity as overseas buyers return

Robust demand combined with a nervousness on the part of sellers to list their home until they can identify their next move has led to fewer listings in recent months.

With listings declining, existing inventory being absorbed and construction rates lagging, stock levels are becoming increasingly constrained, and inevitably it is the best-in-class properties that are selling fastest.

European cities are also back on the radar of second home buyers and investors. Searches for properties in European cities on Knight Frank’s website were up 10% in April month-on-month with Lisbon, Florence and Paris attracting the most attention.

We expect prices to increase across most of the European markets we track in 2021 with Lisbon, London, Geneva, Berlin and Paris to be amongst the frontrunners, as highlighted in Knight Frank’s flagship publication The Wealth Report 2021

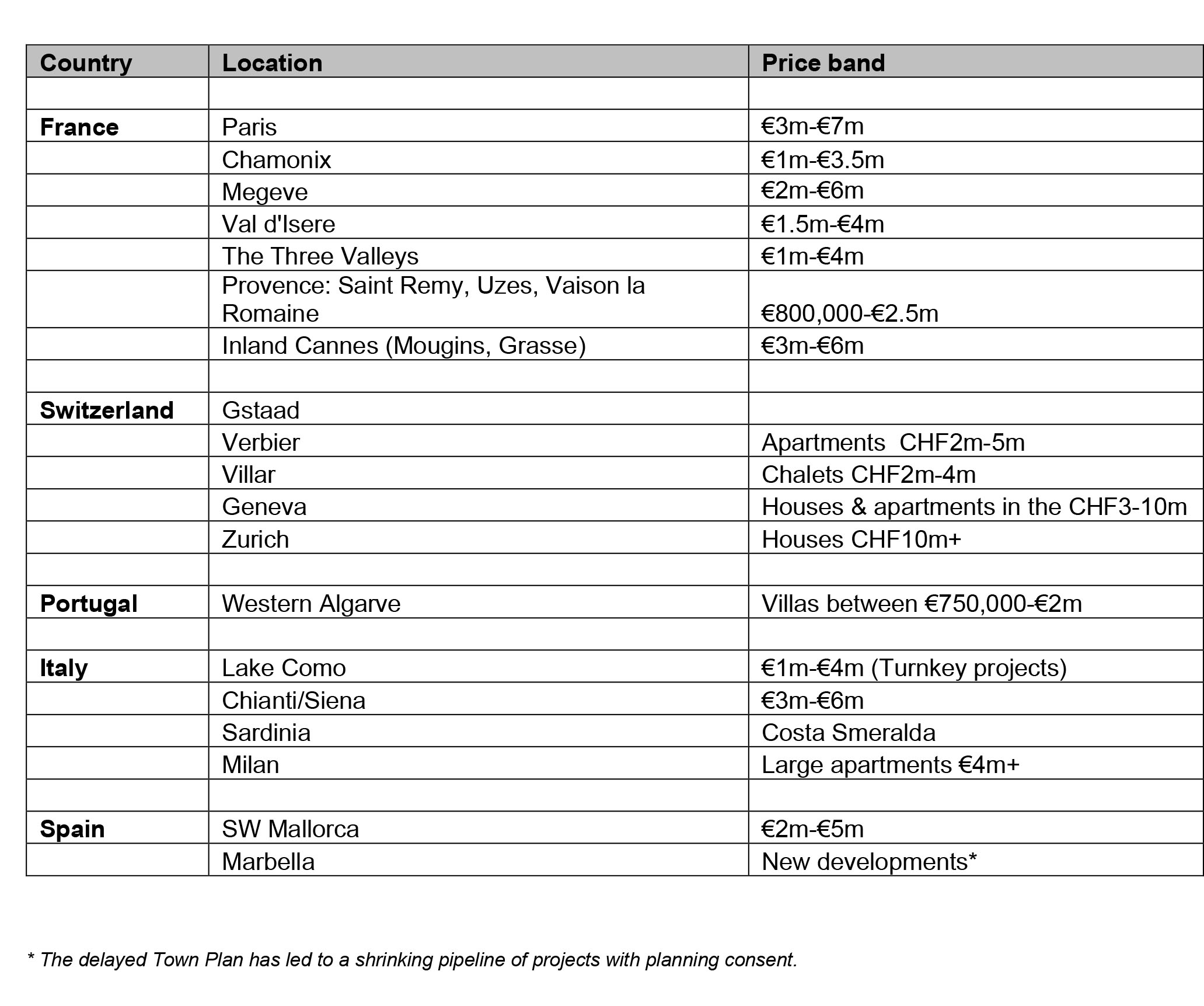

Where in Europe are the stock shortages?

A survey of our prime sales team reveals where and which price bands are seeing the most constrained levels of stock.

Why is sales activity strong?

Spurred on by lockdowns and ‘stay-at-home’ orders, many domestic purchasers keen to upgrade their homes or change their lifestyle have opted to either relocate or purchase a second home from which to work on a semi-permanent basis.

Lower interest rates have encouraged people to take out bigger mortgages at a time when they craved new surroundings and were less tethered to the office, plus trillions of dollars of stimulus have protected incomes and mortgages allowing people to spend more on housing.

Data on the number of second homes purchased across Europe is slow to be released but mobile phone data suggests over 1 million Parisians moved outside the capital in March 2020.

What next?

The big question is will prices accelerate or will sales slow as a stand-off emerges between buyer and seller.

In the short-term prices look likely to track higher. Knight Frank’s latest Prime Global Cities Index which tracks the movement in luxury prices across 56 cities confirmed that 11 recorded double-digit price growth in the year to March 2021, up from just one a year earlier.

But cooling measures are coming as policymakers act to curb speculative investment and keep a lid on prices.

Despite the shortage of stock, buyers remain price sensitive and are well-informed having had several months to research their planned purchase thoroughly during lockdown.

Interested in selling? Contact Mark Harvey for a market appraisal or sign up to our global research to keep up to date with global real estate trends.