At your service

As business planning horizons have shortened and organisational restructuring has become faster and more frequent, space as a service has grown as a feature of the greater london and south east market.

3 minutes to read

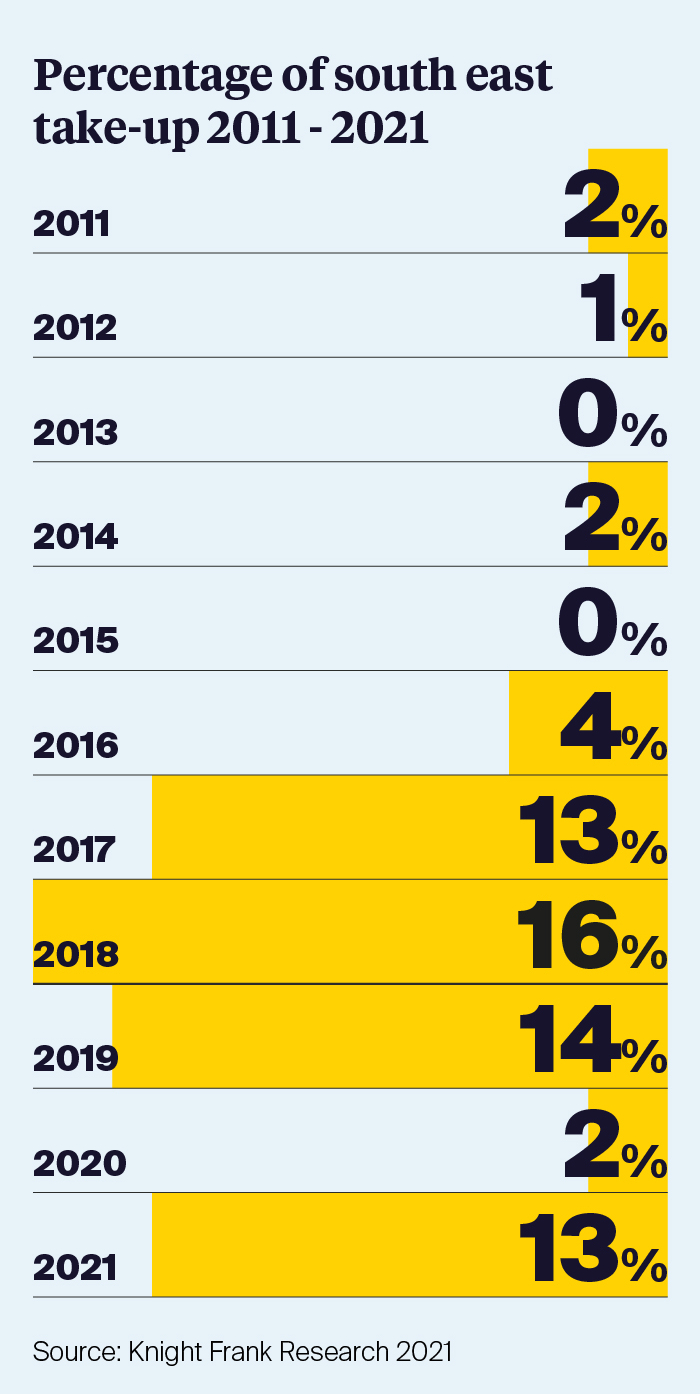

Occupiers, from start-ups to large corporates, have embraced the use of a third party real estate provider, primarily to gain quick access to services, amenities and flexibility in terms of space, leasing models and location. Serviced office providers account for 2.8m sq ft in the current market and, prior to Covid 19, represented 15% of market demand.

But what is the future potential of the sector?

Serviced operators - landlord's friend or foe?

The shift toward flexible working goes beyond simply outsourcing to a third-party provider. Working practices are changing, with the role of the workplace evolving to meet future and post pandemic needs. Flexibility is foremost, and the presence of a third-party flexible office provider as a tenant integrated in a multi-let building could act as a catalyst and an additional tool for landlords to attract new tenants.

The combination of flexible, amenity rich real estate and tailored services creating a connected, collaborative and community-based environment is therefore becoming a common element of the traditional landlord offer and more than just an opportunity to fill space which is hard to let. But not all Landlords are ready to relinquish this level of control, take a flexible managed solution versus a conventional lease or allow a serviced provider compete for occupiers of scale.

Is Covid igniting the next phase of growth?

The Covid-19 pandemic has underlined the need for future operational flexibility and contingency planning. “Hub and spoke” has entered the occupier narrative, a model that may elevate growth projections. Coworking and serviced office providers would be the obvious candidates for creating such a network, as businesses are unlikely to want to agree full lease terms on satellite offices and continue to hold core liabilities. However, occupiers may become resistant to sharing office space with other firms in a typical co-working model, meaning enterprise solutions are likely to evolve and be favoured.

Investors - approach with caution?

While occupiers have been quick to embrace the changing work environment and the concept of space as a service, investors have shown more caution to the presence of serviced office providers in assets. The mismatch between operators long-term lease liabilities and short-term revenues has been exacerbated during the pandemic as occupier businesses have taken advantage of the flexibility and ended contracts, leading to a reduction in operator top line revenues. Lease renegotiation or even surrender has subsequently ensued in some cases, which has raised investor negativity towards owning or investing in assets leased to serviced operators.

Nonetheless, with flexibility central to occupational strategy moving forward, demand for third-party solutions will continue to be fuelled. Landlords are increasingly exploring management agreements and partnerships with a third-party operator. This model realises a premium income to traditional leases, when occupancy is stabilised, but, acknowledging that the income is variable and at risk of falling, with any recessions or shocks to an individual centre. It may take investors and valuation advisers time to understand the valuation impact. However, the structure will evolve and could mutually benefit both parties from a broader perspective.

Conclusion

Whether pursuing a landlord white label or third party operator led approach, adaptation to a new supply side dynamic will continue to escalate. Occupier demands are changing in the traditional office and potentially in the serviced lab sector. Businesses want more choice and flex in their workspace and more services and amenities for their staff; individuals want collaborations, clubs and networks and an alternative ‘home office’. This trend is already disrupting the market but is also opening up new opportunities to add value. Fundamentally, flexible offices are aligned to the changing needs of business and how companies operate. Investment into the sector will continue to rise, supported particularly through private equity. Although the greater flexibility for tenants at first glance appears to be to the detriment of landlords, the model allows landlords to both reinvent difficult space and in some cases, receive rent at a premium.

Freddie Owen

Partner, Capital Markets

freddie.owen@knightfrank.com

Edward Hoyle

South East Tenant Representation and Serviced Office Specialist

edward.hoyle@knightfrank.com