International - Five things you may have missed this week.... 12th March

This week’s round-up of the latest residential market content produced by the global research teams.

2 minutes to read

Paris: Institutional investors increase their exposure to the French residential market as apartment prices in Paris increase 7% in 2020.

The new Paris Residential Report by David Bourla confirms the resilience of the French capital’s residential market in 2020. Despite pandemic-induced lockdowns, sales volumes declined by less than 10% in 2020 and resale apartments registered their strongest price increase (+7%) since 2011. Institutional investors were more active in the French residential sector with over €5.2 billion invested in 2020.

View online

Africa: Prime rents took a bigger hit than prices in 2020 but yields of 6%+ are still achievable in Cape Town and Nairobi

Aimed at tenants, landlords and investors, Tilda Mwai’s Africa Residential Dashboard assesses current market conditions across 26 African cities. Despite an overall slowdown in market activity due to the lockdowns imposed throughout the year, Knight Frank’s sales teams have witnessed a gradual rebound in prime residential sales in the majority of African markets.

View online

UK house price forecast revised upwards

UK house prices are set to increase 5% in 2021, rising from a forecast of zero at the start of this year. Tom Bill confirms that the strength of key market indicators in the first two months of the year meant that an upwards revision was likely even without the measures announced in the UK Budget. Our forecast for Greater London has risen to 4% from 1% in January, whilst we have revised our 2021 forecast for prime central London (PCL) down to 2% from 3%, primarily due to the continued uncertainty around the relaxation of international travel restrictions.

View online

Spain: Sales down 20% in 2020 but prices hold firm

The New-Build Residential snapshot assesses the impact of the pandemic on the Spanish housing market. By November, annual sales were down 20% year-on-year but prices held firm with a drop of 1.2% for resales and a rise of 1% for new homes. Building permits also decline by around 20% but this may help to further insulate prices going forwards. EU buyers represented 45% of all purchases by foreign purchasers but given travel restrictions most of these will already have been resident in Spain.

View online

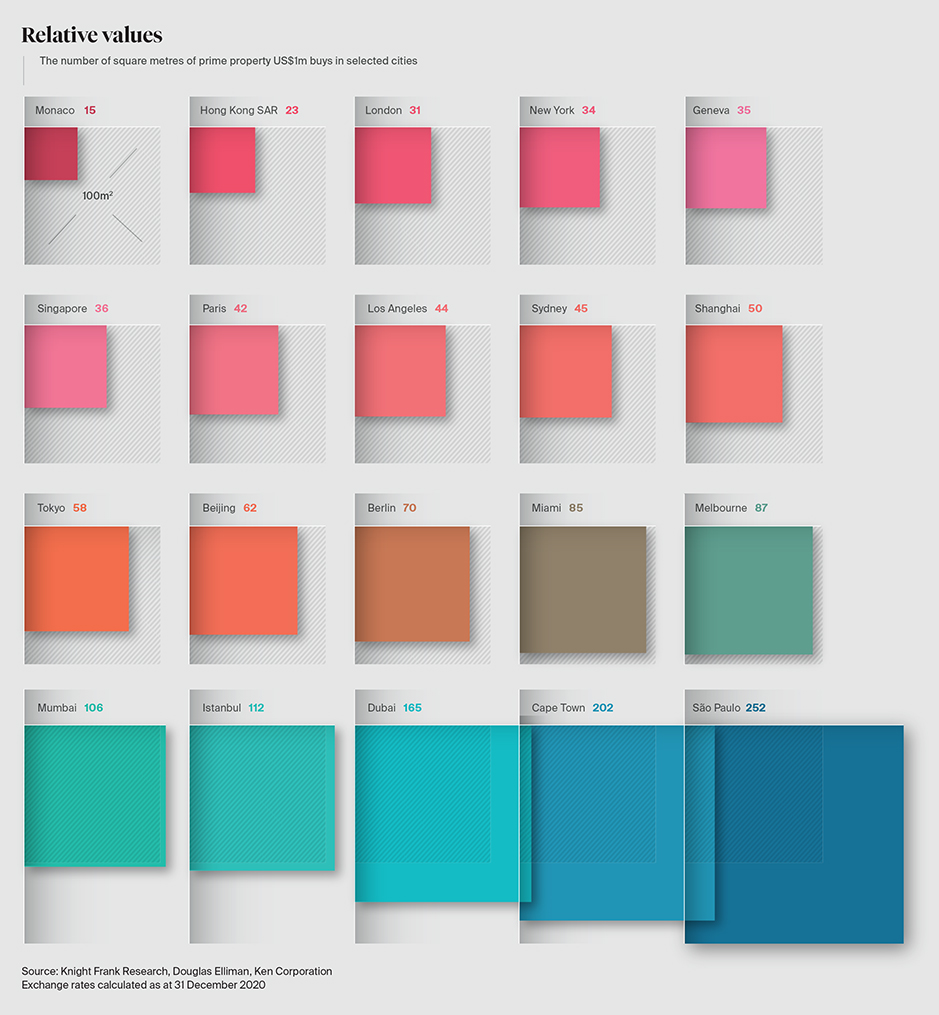

The Wealth Report: How many square metres does US$1 million buy around the world?

Data from #TheWealthReport2021 highlights how many square metres US$1 million buys based on prime residential prices at the end of 2020. Monaco and Hong Kong remain the world’s two most expensive residential markets, where US$1 million buys 15 sq m and 23 sq m respectively. But how do the world’s other top global cities compare? View the results below and download your copy of The Wealth Report 2021:

Cover image by Léonard Cotte on Unsplash