Why Switzerland is back in the spotlight

With taxes around the world set to rise sooner rather than later ultra-high-net-worth individuals (UHNWIs) - those with assets of US$30 million or more - are expected to look more favourably on Switzerland and its lump sum taxation regime.

3 minutes to read

According to the IMF by last October over US$12 trillion had been paid out by governments in an effort to prop up their economies in the face of the pandemic but as Rishi Sunak highlighted in the UK Budget this week, governments will need to raise taxes soon to balance the books.

Switzerland’s lump sum form of taxation offers UHNWIs some degree of certainty. According to the OECD, Switzerland is one of only four countries to adopt a recurring annual wealth tax, down from 12 in 1990.

The regime allows non-Swiss nationals who do not pursue a gainful activity to pay income and net wealth taxes by reference to a lump-sum amount and not based on their effective income and wealth.

The Wealth Report 2021, Knight Frank’s newly-released flagship report, confirms that Switzerland is already home to some 7,553 UHNWIs and 773,000 HNWIs or millionaires.

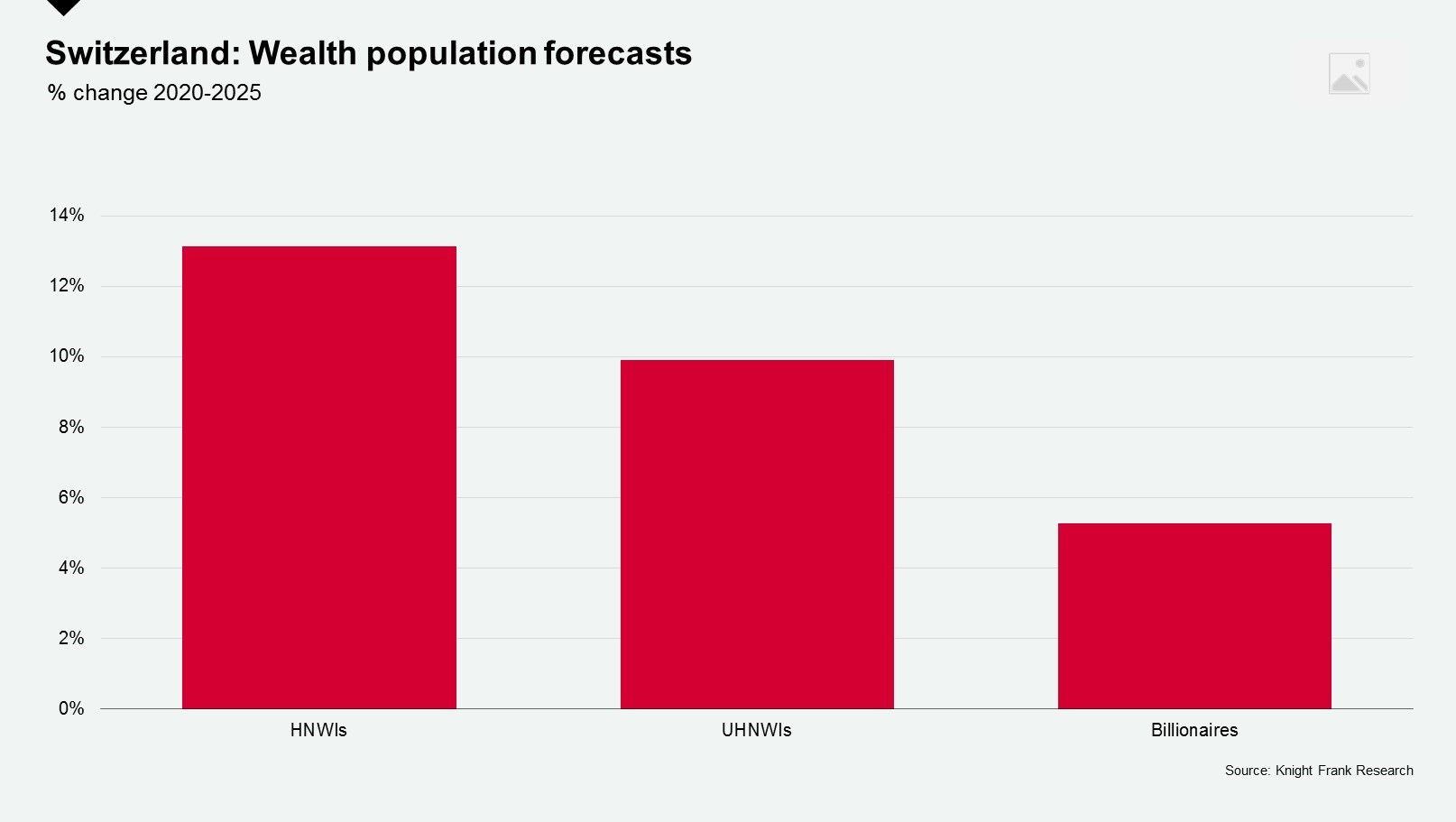

These figures are set to rise over the next five years. According to Knight Frank’s wealth sizing model, the number of HNWIs will increase 13% between 2020 and 2025, exceeding the 8% growth seen in the last five years, whilst the number of UHNWIs will increase by 10% over the same period.

And it’s not all about finances. For the wealthy, the Swiss lifestyle, the high degree of privacy and security it affords as well as its education system is a key draw.

Knight Frank’s Swiss Schools and Lifestyle Guide highlights almost 50 international schools, several based in the ski resorts of Villars, Verbier and Crans Montana that combine the opportunity of a first class education with an unrivalled lifestyle.

The Swiss Franc acts as another pull, along with the US dollar and the Japanese Yen it is one of the world’s top safe haven currencies. As in previous crises the Swiss National Bank stepped in during the pandemic to stem the rise of the franc which attracted safe haven inflows from worried investors.

What impact has the pandemic had on buyer attitudes?

The Attitudes Survey sits at the heart of The Wealth Report and takes the view of over 600 private bankers, wealth advisors and family offices who together manage over US$3.3 trillion of wealth for UHNWIs.

The results this year not only provide us with a unique perspective as to how UHNWIs plan to invest but how attitudes differ from country to country and the impact of the pandemic on their financial plans.

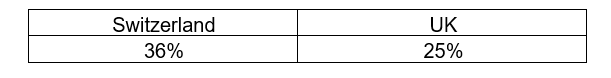

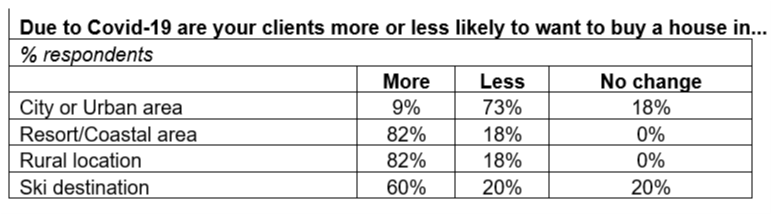

The results confirm that 36% of Swiss UHNWIs plan to purchase a new home in 2021, compared to 25% in the UK and 26% globally.

What proportion of your clients are planning to buy a new home in 2021? - %

Mirroring trends seen globally, Swiss UHNWIs are more likely to purchase in rural and resort locations as a result of the pandemic, with 60% more likely to purchase a ski home.

How is the Swiss property market performing?

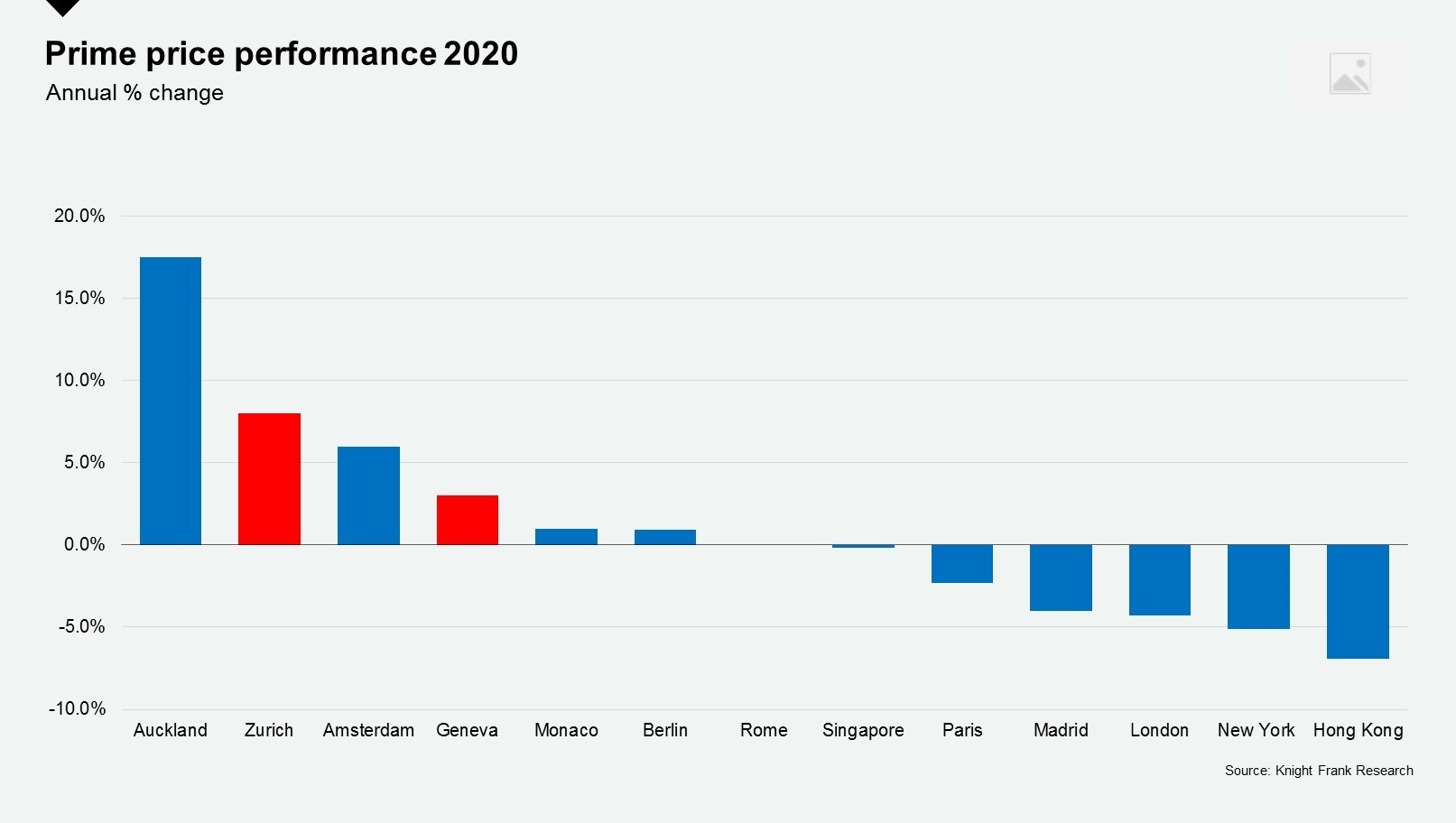

Prime prices in Zurich and Geneva performed strongly in 2020, rising 8% and 3% respectively.

Like prime markets globally, the Swiss market was strengthened rather than weakened by the pandemic with three key sources of demand emerging in 2020.

Firstly, city dwellers seeking larger premises with more outdoor space. Secondly, increased demand from long-term renters keen to make their move while they had a choice of quality stock and finally, some overseas demand who had been toying with a move but the pandemic hastened their decision-making.

According to Alex Koch de Gooreynd, Knight Frank’s Head of Swiss sales: “In September 2020, 187 prime properties changed hands in Geneva, up from 52 in September 2019. This level of activity has continued and the critical factor now is stock. Stock levels have been low in Zurich for some time, but Geneva experiencing a similar shortfall. Prime family homes in easy access of international schools either in Geneva itself or on the Lake are becoming harder to find and this is having a knock-on effect on prices.”

Discover the Nautilus project - a development of three detached homes on the shores of Lake Geneva.

Contact Alex Koch de Gooreynd to discuss the Swiss property market or sign up to receive our Swiss research updates.

Photo by Tim Trad on Unsplash