Daily Economics Dashboard 1 March 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 1 March 2021.

Equities: Globally, stocks have rallied. In Europe, gains have been recorded by the FTSE 250 (+1.9%), STOXX 600 (+1.6%), CAC 40 (+1.6%) and DAX (+1.1%). In Asia, the TOPIX (+2.0%), S&P / ASX 200 (+1.7%), Hang Seng (+1.6%) and CSI 300 (+1.5%) all closed higher. In the US, futures for the S&P 500 are +1.2%.

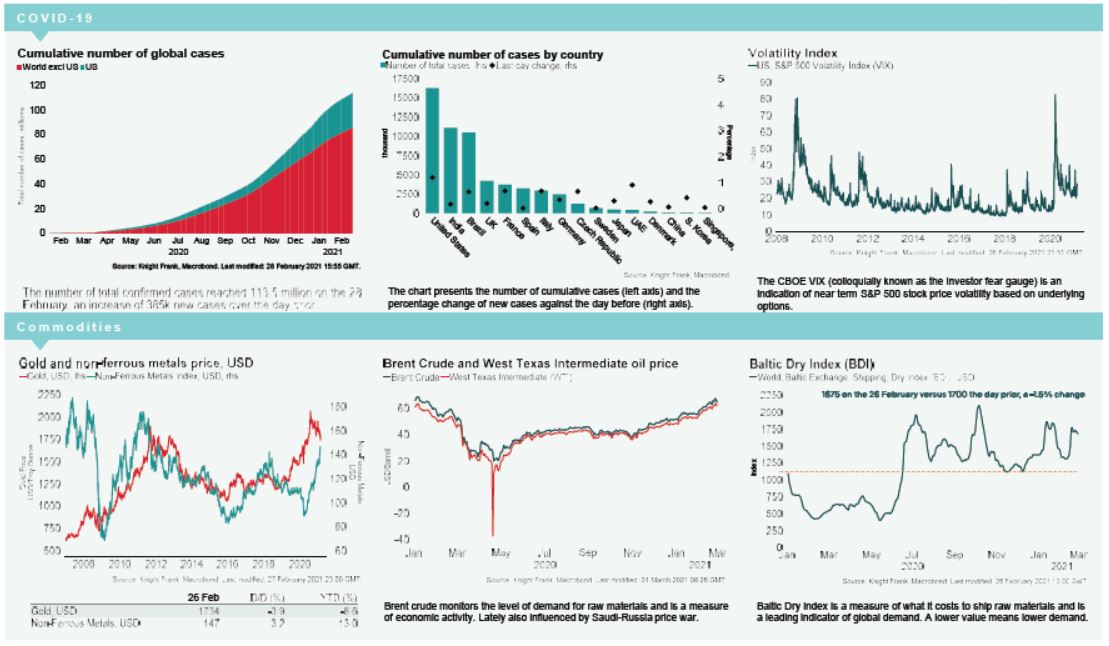

VIX: After decreasing -3% over Friday, the CBOE market volatility index has declined -11.0% this morning to 24.9, remaining elevated compared to its long term average (LTA) of 19.9. The Euro Stoxx 50 volatility index has declined -14.7% to 22.9, below its LTA of 23.9.

Bonds: Following a sell off which saw investors favour more safe haven assets such as currencies, the 10-year US treasury yields rose to a one year high of 1.61% last week. However, the treasury yield is showing signs of stabilisation, currently at 1.43%. Meanwhile, the German 10-year bund yield has compressed -5bps to -0.30% and the UK 10-year gilt yield is down -4bps to 0.79%.

Currency: Sterling and the euro are currently $1.40 and $1.21, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.49% and 1.58% per annum on a five-year basis.

Oil: Brent Crude has declined -1.3% this morning to $65.27, meanwhile the West Texas Intermediate (WTI) is up +1.4% to $62.34 per barrel.

Baltic Dry: The Baltic Dry declined for the third consecutive session on Friday, down -1.5% to 1675, its lowest level since mid February. Prices have been pushed lower by capesize rates which were down -16% over the week.

Eurozone PMIs: The eurozone manufacturing PMI was 57.9 in February, the highest it has been in three years, up from 54.8 in January and above the flash estimates of 57.7. The strong demand for manufactured goods has seen factories across the eurozone increase their staffing levels for the first time in two years, according to Reuters.