Daily Economics Dashboard - 10 February 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 10 February 2021 2020.

Equities: In Europe, stocks are mixed this morning, with the STOXX 600 (+0.3%) and the CAC 40 (+0.1%) both up, while the FTSE 250 is down (-0.1%) and the DAX is flat. In Asia, stocks were up on close, with the CSI 300 (+2.1%), Hang Seng (+1.9%), KOSPI (+0.5%), S&P / ASX 200 (+0.5%) and TOPIX (+0.3%) all recording gains. Futures for the S&P 500 and Dow Jones Industrial Average (DJIA) are both currently +0.3%.

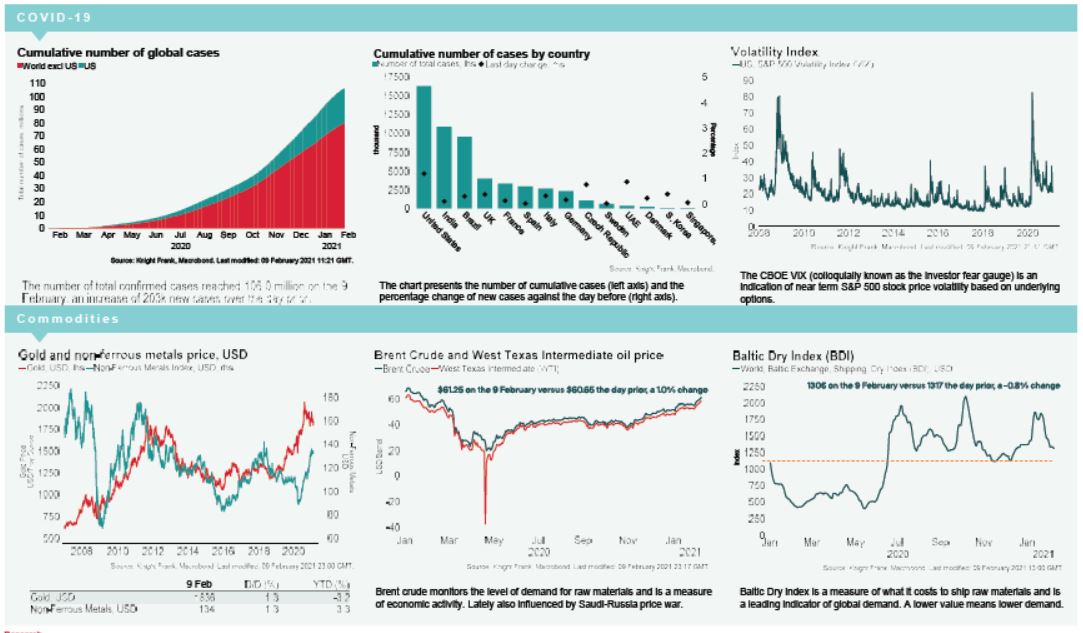

VIX: Following a +2% increase over Tuesday, the CBOE market volatility index is up a further +0.6% this morning to 21.8, remaining above its long term average (LTA) of 19.5. Meanwhile, the Euro Stoxx 50 volatility index is lower, down -1.4% to 20.8, below its LTA of 23.9.

Bonds: On Tuesday, Italy’s 10-year government bond declined below 0.5% for the first time in its history. This comes as Mario Draghi, former head of the European Central Bank, comes closer to forming a new government. Meanwhile, Spanish 50-year government bonds have received circa €65 billion in orders, currently at a coupon of 1.45%, the country’s first 50-year bond issuance since 2016. The UK 10-year gilt yield has softened +2bps this morning to 0.48%, while the German 10-year bund yield is up +1bp to -0.44% and the US 10-year treasury yield has held steady at 1.16%.

Currency: Sterling and the euro are currently $1.38 and $1.21, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.47% and 1.37% per annum on a five-year basis.

Baltic Dry: The Baltic Dry declined for the second consecutive session on Tuesday, down -0.8% to 1306, its lowest level since mid December. The index is now -30% below the four-month high seen in mid January. Declines have been driven by capesize rates, which were down -5.8% yesterday to its lowest level in two months.

Oil: Oil prices have extended their rally for the ninth day, with Brent Crude increasing a further +0.5% this morning, remaining above $60 per barrel at $61.40. The West Texas Intermediate (WTI) is also higher, up +0.4% to $58.59. Brent Crude and the WTI are at their highest prices since December 2019 and January 2020, respectively, supported by producer supply cuts.