New Frontiers 2021

Although infrastructure investment across Asia-Pacific is largely uneven, its regional population and changing consumption patterns makes it hard to ignore.

7 minutes to read

New Frontiers 2021

Rapid changes are occurring in the industrial and logistics real estate sector. Many of these changes are underpinned by an evolving retail and e-commerce landscape, as well as rising interests in infrastructural development and investments from public and private sectors over the years. The COVID-19 pandemic has only accelerated the pace of change by altering consumer habits, both in the short and long term. In this blog post, we consider how these larger global trends will affect the industrial real estate market in 2021 and beyond.

E-Commerce and Supply Chain Evolution’s Impact on Industrial Real Estate

The retail industry across the globe has taken a beating due to the COVID-19 pandemic in 2020. In its place, e-Commerce has been given a tailwind of growth, on top of its already burgeoning relevance in the retail landscape over the past decade. While the huge short-term growth may be unsustainable, changes in consumer behaviour may prove sticky to an extent in the long run.

In Asia-Pacific, the 11 markets tracked by Knight Frank had shown a 14% average growth rate in retail sales. In Mainland China, Alibaba’s Singles Days sales has set records every year since inception, with 2020’s edition of the event recording US$74 billion generated within the day itself, dwarfing the US’ Black Friday and Cyber Monday sales combined at US$19 billion. Fellow e-commerce player Shopee, operating across its markets of Malaysia, Philippines, Singapore, Taiwan, Thailand and Vietnam, experienced a 300% growth of items sold from 2019 during its same day as well. We believe that the e-commerce market still has ample room to grow in the region, as Asia-Pacific continues to grow in population size and economic development, and the industrial real estate sector will have a key role in facilitating the sector’s continued successes. This development requires industrial real estate investors and owners to be cognizant of the changes in the demand for their assets.

Rising Prominence of Cold Chain and Last Mile Storage

Industrial real estate assets that can serve the role of cold chain and last-mile storage is now becoming increasingly sought after, following the changes in consumer expectations for quicker, more efficient delivery standards. Amazon Prime’s same day delivery, for example, requires warehouses that are cold-storage facilities for its fresh produce storage. Assets in close proximity to consumers, serving as last-mile storage, is also critical in the improving speeds of delivering goods to consumers.

Lastly, with the rollout of the COVID-19 vaccinations set to occur over 2021, cold-storage facilities are critical in ensuring its success. While developed markets such as Singapore are expected to play an important role in regional distribution, other markets may struggle given their lack of cold chain infrastructure, but public sector initiatives to repurpose existing facilities will fill this gap.

Supply Chain Resilience and China-Plus-One

The constant disruptions in 2020 have affected many manufacturing businesses, and this has led to players in these fields seeking added security to their supply chain and business operations. This has been a theme in the market for a while now, but the pandemic has raised the issue to the top of the agenda for many. Over the next few years, many manufacturers will shift their reliance away from purely the Chinese Mainland, to other regions such as Southeast Asia and these geographies’ industrial sectors will be the beneficiaries of this change.

Malaysia has been positioning itself for a while now to be a hub for regional distribution centres (RDCs). This began in the early 2000s, with the Malaysian government beginning promotion of manufacturing-related services, and this has continued till today. This effort has borne fruits, with major Multi-nationals taking up their logistics operations in the market, such as IKEA, Zalora, Lazada, Nestle, BMW, among others. The key driver for the market to serve as a RDC hub are their competitive property market rents, readiness of infrastructure, having a skilled, multilingual labour pool and investor-friendly policies.

Bangkok, Thailand, has been another market eyed to be part of many companies’ China-plus-one strategies. Similar to Malaysia, ready infrastructure, cheap labour costs and relative ease of doing business are key in making the market attractive to many. While the market had experienced short-term headwinds due to COVID-19 battering the tourism-reliant economy, and ongoing political uncertainty, the market has began recovering to expansionary levels at 50.8 in October 2020. This is positive sign that the industrial real estate will see recovery, alongside the recovery of general economic activities. Given the rising prominence of e-Commerce in Thailand, the areas with most immediate growth potentials for the industrial real estate sector would be the Bangkok metropolitan region, given the rising importance of last mile logistics.

Regions of Opportunities: Infrastructure Impact on Industrial in Asia-Pacific

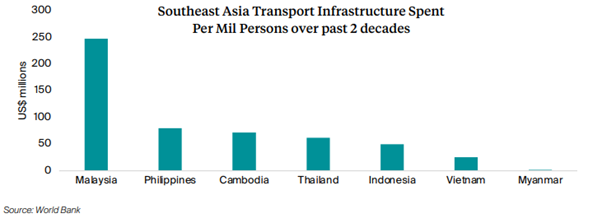

With a large consumer base, expanding middle-class and developing economies, Southeast Asia’s industrial real estate is in a good position to experience great growth. However, much work still needs to be put in to grow the quality infrastructure necessary to support this growth. At the moment, we are seeing an uneven playing field in terms of levels of investments into infrastructure across Southeast Asia, despite international initiatives such as the Belt and Road project injecting capital into developing said infrastructure across the region. As shown below, Malaysia tops ASEAN markets with approximately US$250 million spent on transport infrastructure investments per million capita over the past two decades. By contrast, Myanmar is significantly further behind at approximately US$2 million per million capita.

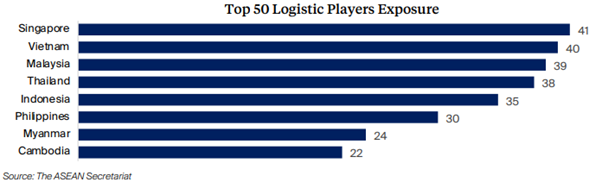

The impact of infrastructural investments in these markets is apparent through the levels of exposure they have to the major international logistics players. Myanmar, the market with lowest levels of investments, only has exposure to 24 of the top 50 companies in the world, having some form of subsidiaries, branches, or representatives’ office present in it. Cambodia, despite its higher level of investments per capita, has a smaller population of 16.3 million people, which would put it at a lower priority compared to its regional peers. However, markets such as the Philippines and Indonesia warrant more focus given their higher levels of investments and larger consumer bases.

Indonesia

The major industrial zones in Indonesia’s capital, Jakarta, are situated to the east of the city, or the ‘Eastern Corridor’ of Jakarta. This region alone, accounts for 70% of the total existing industrial land supply and approximately 40% of Indonesia’s export volumes. The government intends to build on the industrial sector here, and the area will see continued growth as infrastructure investments come in from the public sector. Furthermore, positive policy changes such as the recently signed Omnibus Law, will support the industrial growth prospects in the long run by reducing bureaucratic processes, easing on foreign investment, loosening labour laws, and providing more incentives to increase competitiveness, creating new jobs and making it easier to do business in Indonesia.

Philippines

The industrial real estate sector in the Philippines is set to benefit from the 2017-introduced ‘Build Build Build’ or ‘BBB’ program. This infrastructural development plan will see 20,000 projects nationwide, ranging from roads, seaports, airports, and many others, and has a huge budget of US$165 billion. These projects will alleviate some of the problems that has been challenging the logistics market in Manila, particularly in terms of transportation costs arising from congested physical networks. According to a 2018 study conducted by the Department of Trade and Industry (DTI), logistics costs accounts for 27% of sales in the market. DTI has stated plans to lower this cost to 20%, and the ‘BBB’ program will be a key component of this goal.

Bengaluru, India

Outside the Southeast Asia region, India’s Bengaluru is another market that bears highlighting. The region has, over the past two decades, transformed into the IT capital of India, and this development in its economy has prompted widespread in-migration for employment opportunities. The population within the Bengaluru’s Metropolitan Region grew from around 11.7 million to 16.5 million from 2011 to 2021. With more people and greater levels of wealth, the rate of consumption has grown significantly, and this has strained the city’s infrastructure networks.

According Benguluru’s Revised Master Plan 2015, the city currently has 7.3% of its land area allocated to transport and communications, which is less than half of the 15% allocation across most other major economic hubs in Asia-Pacific. However, around US$11.4 billion in transport-oriented infrastructure projects are in the works. Projects such as the Satellite Town Ring Road (STRR), expected to complete over the coming years, will benefit the manufacturing and logistics sectors by lowering long travel times and improving operating efficiency and cost for industrialists.

To read our full reports from New Frontiers 2021:

- Click here for E-commerce and Supply Chain Evolution’s Impact on Industrial Real Estate

- Click here for Regions of Opportunities: Infrastructure Impact on Industrial in Asia-Pacific