Daily Economics Dashboard - 27 January 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 27 January 2021 2020.

Equities: In Europe, stocks are lower this morning. The DAX (-0.5%) is the worst performing index, followed by the STOXX 600 (-0.3%) and the CAC 40 (-0.2%), while the FTSE 250 is marginally positive (+0.1%). In Asia, equities performance was mixed, with the TOPIX (+0.7%) and the CSI 300 (+0.3%) closing in positive territory while the S&P / ASX 200 (-0.7%), KOSPI (-0.6%) and Hang Seng (-0.3) were all down. In the US, futures for the S&P 500 and Dow Jones Industrial Average (DJIA) are -0.2% and -0.3% lower respectively.

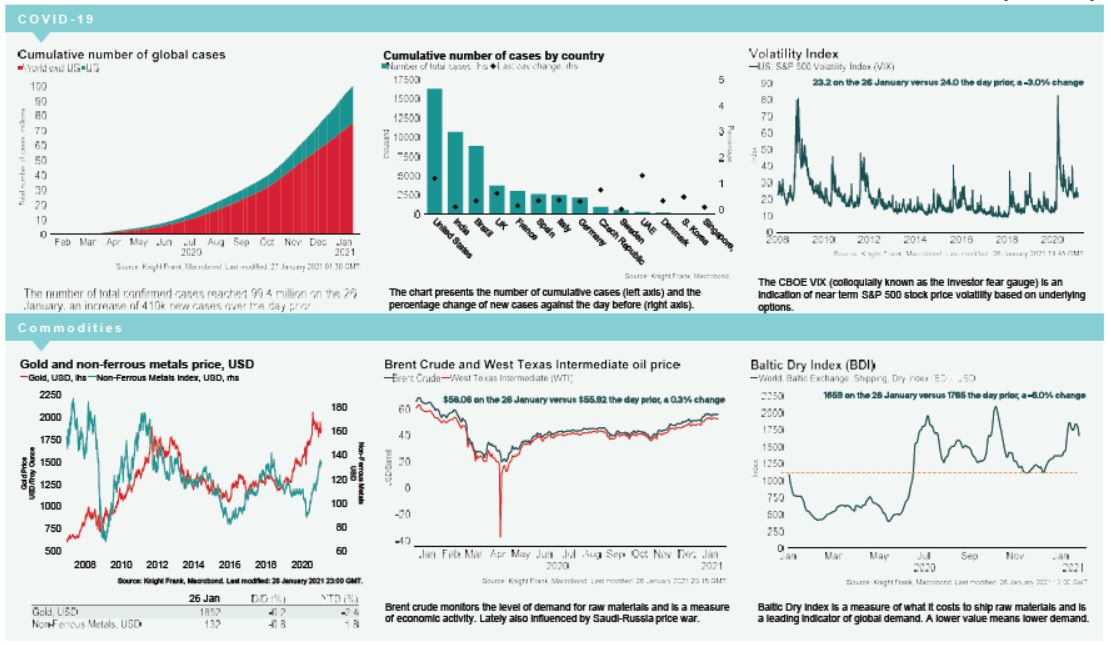

VIX: the CBOE market volatility has increased +6.8% this morning to 24.59, above its long term average (LTA) of 19.9. The Euro Stoxx 50 vix is also up by +6.6% to 24.6, just above its LTA of 23.9.

Bonds: The UK 10-year gilt yield, the German 10-year bund yield and the US 10-year treasury yield remains stable at 0.28%, -0.53% and 1.05% respectively.

Currency: Sterling and Euro trade steadily at $1.37 and $1.21. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.58% and 1.35% per annum on a five-year basis.

Baltic Dry: The Baltic Dry decreased for the third successive session yesterday, declining by -6.0% to 1,659, a level which is -10.6% lower than the four-month high seen last week.

Oil: Brent Crude and the West Texas Intermediate (WTI) are broadly unchanged, trading at $55.9 and $52.9 per barrel, respectively.

Global economic outlook: The global economy is projected to grow at 5.5% in 2021 according to the IMF, a revision of +0.3% on October’s forecasts, reflecting expectations of vaccine rollout and additional policy support in some larger economies. This follows a global GDP contraction for 2020 that is estimated at -3.5%, revised up by +0.9% from previous estimates.