Daily Economics Dashboard - 25 January 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 25 January 2021 2020.

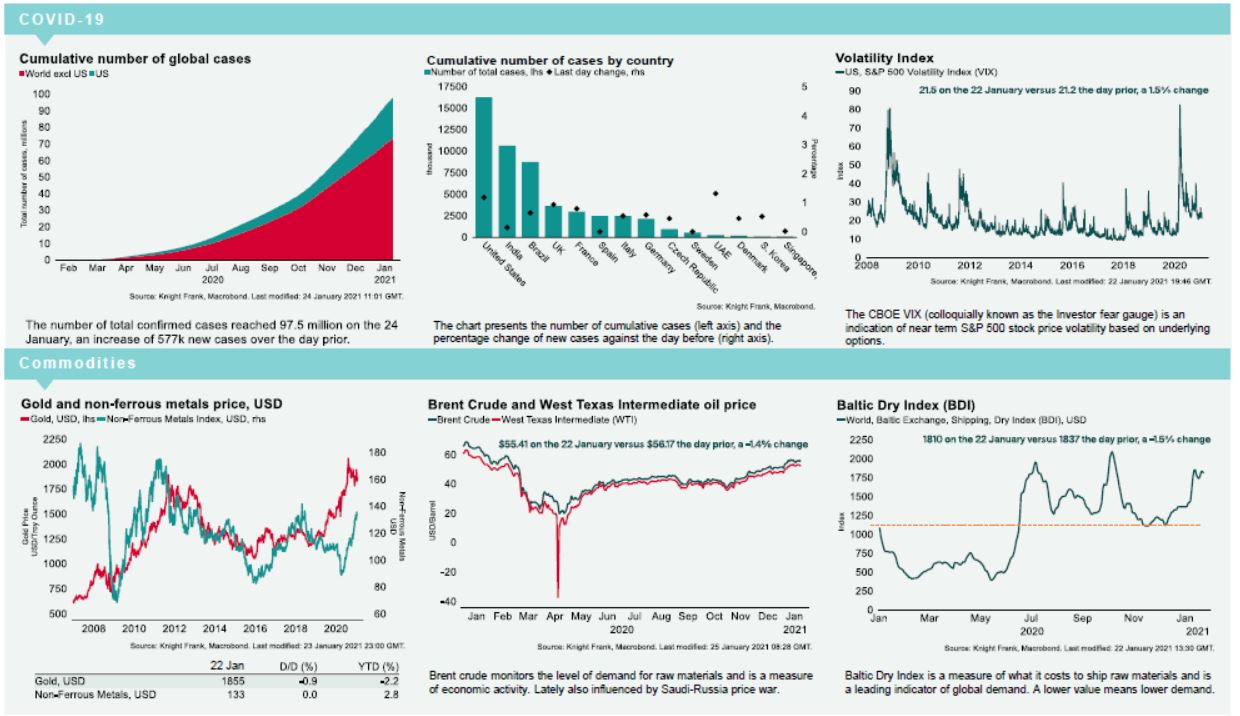

COVID-19: The total number of cases recorded globally reached 99.2 million, an increase of approximately 25% over last month. Reported deaths reached 2.1 million according to Johns Hopkins University & Medicine.

Equities: In Europe, stocks are lower this morning. The CAC 40 is down -0.4%, followed by the DAX (-0.4%) and the FTSE 250 (-0.2%), while the STOXX 600 is marginally positive (+0.1%). In Asia, the Hang Seng (+2.4%), KOSPI (+2.2%), CSI 300 (+1.0%), S&P / ASX 200 (+0.4%) and Topix (+0.3%) all closed higher. In the US, futures for the S&P 500 are up +0.3% while the Dow Jones Industrial Average (DJIA) remains flat.

VIX: the CBOE market volatility has increased +2.8% this morning to 22.54, above its long term average (LTA) of 19.9. The Euro Stoxx 50 vix is up by +2.39% to 21.7, below its LTA of 23.9.

Bonds: The UK 10-year gilt yield and the German 10-year bund yield compressed by -2bps to 0.29% and -0.53% respectively. The US 10-year treasury yield compressed by -1bp to 1.08%.

Currency: Sterling held steady at $1.37 this morning while the Euro is currently $1.22. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.58% and 1.37% per annum on a five-year basis.

Baltic Dry: The Baltic Dry decreased -1.5% on Friday to 1810, a level which is -2.5% lower than the four-month high seen last week. However the index sits 100% higher than pre-pandemic levels at the start of January 2020.

Oil: Brent Crude and the West Texas Intermediate (WTI) increased +0.42% and +0.86% today to $55.64 and $52.72 per barrel, respectively.

Gold: The price of gold has increased +0.3% to 1,861. Overall gold is -2.2% lower since the start of the year.

German Business: The lfo Business Climate indicator for Germany fell to 90.1 in January 2021 from an upwardly revised 92.2 in the previous month and below market expectations of 91.8. It is the lowest reading since July 2020 as companies became less optimistic about current conditions (89.2 vs 91.3) and expectations (91.1 vs 93).