Daily Economics Dashboard - 22 January 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 22 January 2021 2020.

Equities: Globally, stocks are lower this morning. The STOXX 600 and the CAC 40 are down -1.0%, followed by the FTSE 250 (-0.7%) and the DAX (-0.7%). In Asia, the Hang Seng (-1.6%), KOSPI (-0.6%), S&P / ASX 200 (-0.3%) and Topix (-0.2%) all closed lower, while the CSI 300 was marginally up (+0.1%). In the US, futures for the S&P 500 and the Dow Jones Industrial Average (DJIA) are down -0.6% each.

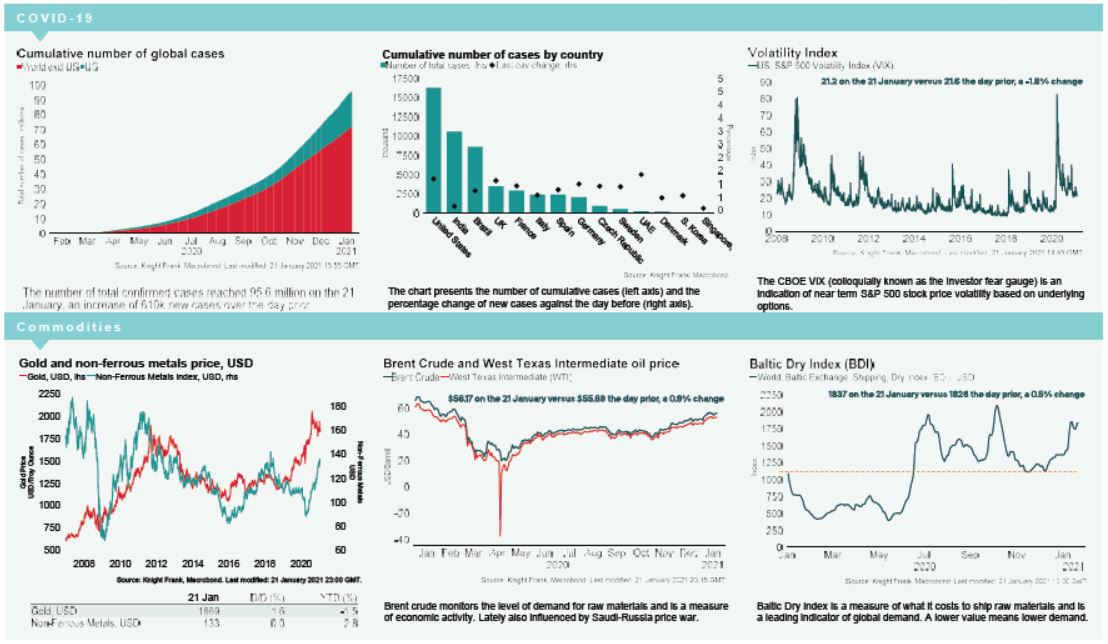

VIX: Following a -12.1% decline over the past three days, the CBOE market volatility index has increased +7.4% this morning to 22.9, just above its long term average (LTA) of 19.9. The Euro Stoxx 50 vix is lower this morning, down -1.7% to 19.4, below its LTA of 23.9.

Bonds: The UK 10-year gilt yield, the German 10-year bund yield and the US 10-year treasury yield all compressed by -1bp to 0.31%, -0.51% and 1.10% respectively. The Italian 10-year bond yield has softened +3bps to 0.69%, the highest level since early November 2020 on the prospect of a snap election.

Currency: Sterling held steady at $1.37 this morning while the Euro increased marginally to $1.22. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.56% and 1.36% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) have both lost -2.2% today to $54.90 and $51.89 per barrel, respectively. Fears over new Covid-19 related restrictions in China, the world’s largest oil importer, have negatively impacted price.

Gold: The price of gold has decreased -0.8% to 1,854. Overall gold is up +1.1% week on week but -3.7% lower over the year to date.

Eurozone PMI: The Flash Eurozone Composite Purchasing Managers’ Index declined to 47.5 in January from 49.1 in the previous month and below market expectations of 47.6. Below 50 is considered contractionary. This is the third month of consecutive decline in business activity.