Daily Economics Dashboard - 19 January 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 19 January 2021 2020.

Equities: Globally, stocks are mostly higher. In Europe, gains have been recorded by the DAX (+0.4%), FTSE 250 (+0.3%), STOXX 600 (+0.2%) and CAC 40 (+0.1%) this morning. In Asia, the Hang Seng (+2.7%), Kospi (+2.6%), S&P / ASX 200 (+1.2%) and Topix (+0.6%) all closed higher. However, the CSI 300 (-1.5%) was the only index to be down on close. In the US, futures for the S&P 500 and Dow Jones Industrial Average (DJIA) are +0.5% and +0.4%, respectively.

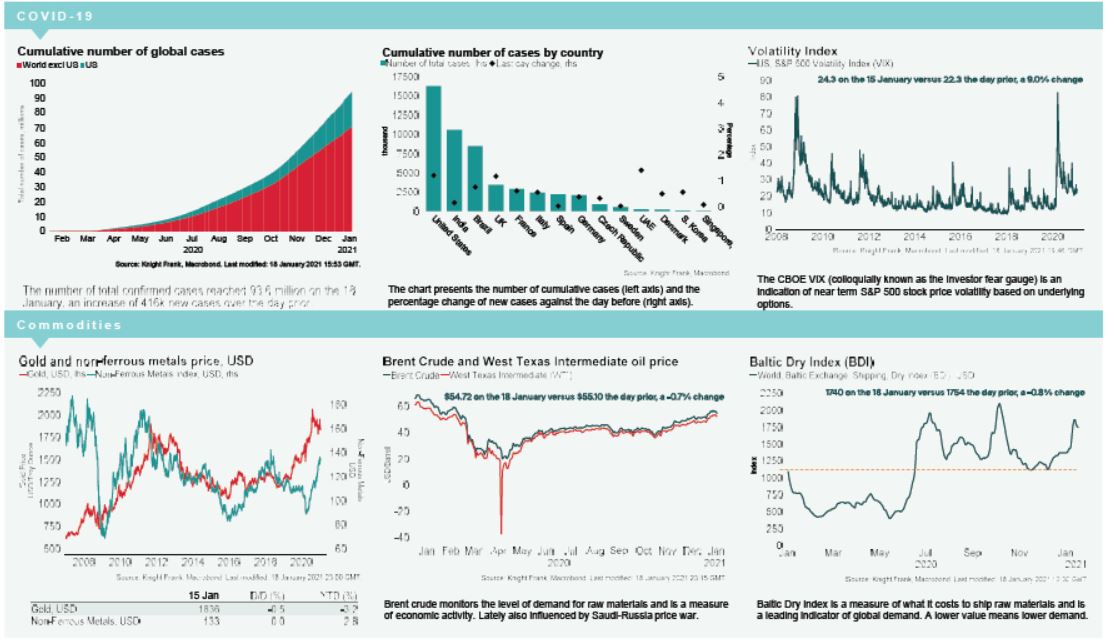

VIX: The CBOE market volatility index has decreased -6.0% this morning to 22.9, above its long term average (LTA) of 19.9. The Euro Stoxx 50 vix is also lower this morning, down -3.8% to 21.1, remaining below its LTA of 23.9.

Bonds: The UK 10-year gilt yield and the German 10-year bund yield have both softened +1bp to 0.30% and -0.52%, respectively, while the US 10-year treasury yield is up +2bps to 1.12%.

Currency: Sterling has appreciated to $1.36, while the euro is currently $1.21. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.61% and 1.37% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) have increased +1.3% and +0.7% to $55.48 and $52.72 per barrel, respectively. This comes as the International Energy Agency (IEA) announced that Global oil demand in Q1 2021 will be 600,000 barrels per day lower than previously expected, driven by renewed lockdowns.

Baltic Dry: The Baltic Dry declined for the third consecutive session on Monday, down -0.8% to 1,740. Cumulative gains over the last 14 sessions are currently +32%, however, the index remains -17% below the $2,097 peak recorded on 6th October 2020.

Shipping Costs: The cost of shipping from China to Europe has more than tripled in the past two months, as a lack of container supply and congestion in ports push prices higher. A survey completed by IHS Markit found that Eurozone manufacturing supplier’s delivery times were the worst they had been since April 2020, with delays in transportation and goods shortages ‘widely reported’. Some companies face running down their raw material stocks, leading to a decline in inventories and potential for increases in input prices.