Daily Economics Dashboard - 15 January 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 15 January 2021 2020.

Equities: Globally, stocks are lower. In Europe, losses have been recorded by the FTSE 250 (-0.9%), CAC 40 (-0.6%), STOXX 600 and DAX (both -0.4%). In Asia, the Kospi (-2.0%), Topix (-0.9%), and CSI 300 (-0.2%) all closed down, while the S&P / ASX 200 closed flat and the Hang Seng (+0.3%) was the only index to close higher. In the US, futures for the S&P 500 and Dow Jones Industrial Average (DJIA) are -0.3% and -0.2%, respectively.

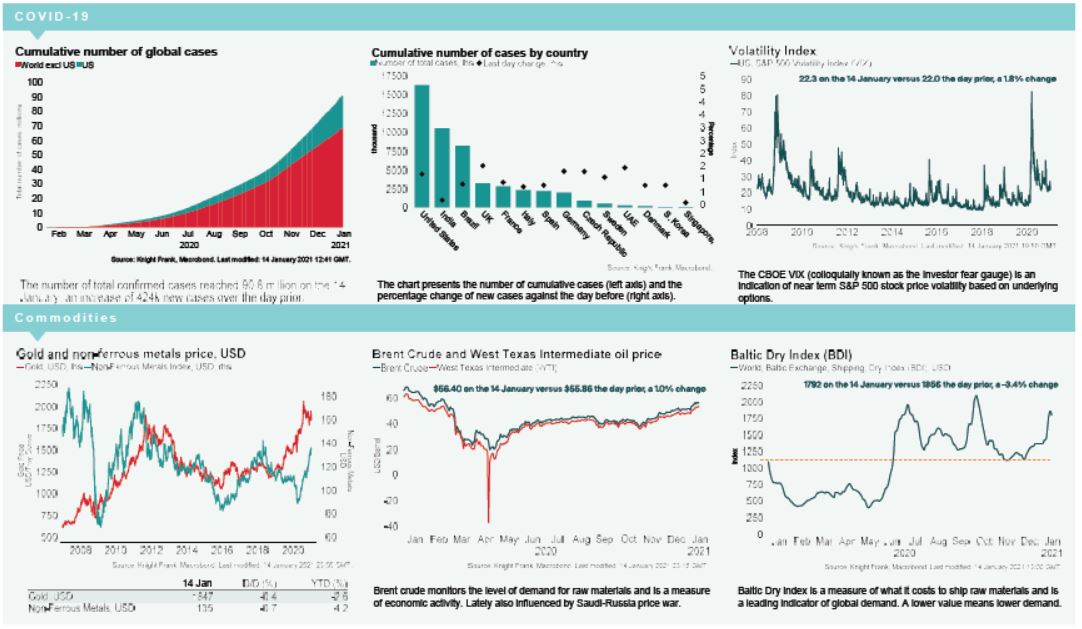

VIX: Following a +1.8% gain over Thursday, the CBOE market volatility index increased +2.2% this morning to 23.8, above its long term average (LTA) of 19.9. The Euro Stoxx 50 volatility index is also higher this morning, up +4.6% to 20.6, albeit remaining below its LTA of 23.9.

Bonds: The UK 10-year gilt yield and the German 10-year bund yield have both softened +1bp to 0.31% and -0.54%, respectively. Meanwhile, the US 10-year treasury yield has compressed -1bp to 1.11%.

Currency: The euro has depreciated to $1.21, while sterling is currently $1.37. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.61% and 1.40% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) have decreased -1.6% and -1.4% to $55.52 and $52.81 per barrel, respectively.

Baltic Dry: The Baltic Dry decreased for the first time in 12 sessions on Thursday, down -3.4% to 1,792. Cumulative gains over the last 12 sessions are currently +35%, however, the index remains -15% below the $2,097 peak recorded on 6th October 2020.

US Unemployment: There were 965k new unemployment applications in the week to 9th January, above market expectations of 795k and greater than the previous week’s reading of 784k. This is the highest number of jobless claims in nearly five months and the greatest weekly increase in claims since the pandemic began.

UK GDP: The UK economy declined -2.6% over the month of November, the first monthly decline in seven months, largely driven by England’s second national lockdown. GDP is now -8.5% below its pre-pandemic peak according to the ONS.