The Knight Frank Rural Property and Business Update – 7 December

Our weekly dose of news, views and insight from the world of farming, food and landownership

Who to believe? At the time of writing (Sunday evening) EU and UK negotiators are either on the verge of a post-Brexit trade deal breakthrough or Boris Johnson is going to appease the hard line Brexiteers in his party by choosing “no deal”. I have a feeling what people are predicting is just a reflection of what they themselves want. I’m still going for a last-minute deal! But we do at least now have a roadmap – albeit vague – for the future of farming outside the EU.

Please do get in touch with me or my colleagues mentioned below if you’d like to discuss any of the issues covered. We’d love to hear from you

Andrew Shirley, Head of Rural Research

8 minutes to read

In this week’s update:

• Commodity markets – Horn up, corn down

• The future of farming – Government releases post-Brexit roadmap

• Strategic rural planning – Listen to our webinar for practical advice

• Renewable energy – Solar boost for landowners

• Finance – Rock-bottom interest rates on offer

• International trade – Live livestock exports facing the chop

• Overseas news – China’s farmers told to stick to grain

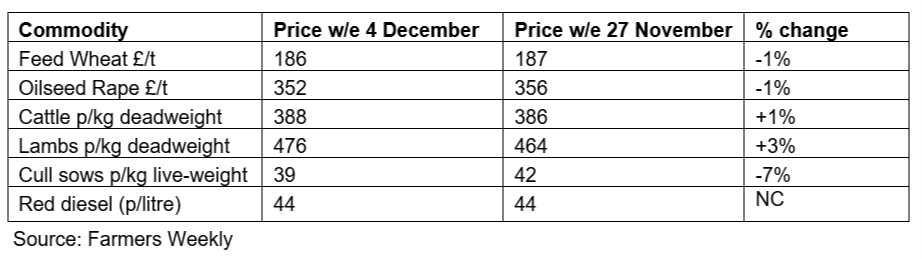

Commodity markets – Horn up, corn down

Grain markets weakened last week, while beef and lamb values headed upwards. Given that the latest lockdown and ongoing Tier restrictions must have dampened demand from the restaurant trade, I was slightly surprised to see livestock on the move, but a friend in the meat industry says it’s down to factories having to pay higher prices to fulfil contract commitments as retail demand increases in the run up to Christmas.

Photo by Mike Tinnion on Unsplash

Chicago Board of Trade wheat futures were 10% below the four-year highs they peaked at in October by close of business last Thursday, according to the latest update from trader Frontier. The increasing size of the Australian, Canadian and Indian wheat crops, as well as a proposed increase in Russian export quota, has apparently turned markets bearish.

The future of farming – Government releases post-Brexit roadmap

I still can’t give you an EU trade deal just yet – Boris and Ursula are apparently going to thrash something out today (7 December) before the controversial Internal Markets Bill goes before MPs - but at least last week the government did eventually publish how it expects the agricultural industry in England to transition from the world of CAP support to a post-Brexit future where the delivery of environmental goods is the main policy driver.

Much of the content of the snappily titled The Path to Sustainable Farming: An Agricultural Transition Plan 2021 to 2024 was old news, but it put into sharp relief how quickly the current Basic Payment Scheme (BPS) will be wound down. By 2024, for example, a 1,000ha farm will have lost 66% of its BPS support.

There will, however, be the option for retiring farmers to capitalise their BPS cash from 2022 (something for tenanted estate owners to ponder) and a new entrants’ scheme.

In general though the plan lacks the kind of detail that would allow farming businesses to plan confidently for the future. As somebody commented it was an announcement about announcements. Given Scotland and Wales are sticking with direct payments for longer, English farmers are also concerned they won’t be operating on a level playing field.

I’ve included some thoughts from my colleague Tom Heathcote, Head of our Agri-Consultancy team, below.

“We welcome the publishing of the agricultural transition plan which has been long anticipated, although there is still some way to go before a coherent strategy emerges. The plan is ambitious, which is to be commended, although the government has set itself quite a challenge where it feels it is trying to appease all stakeholders and lobbyists at once. The concern here is whether or not it is realistic and viable to fulfil on these terms and deliver meaningful change.

“The plan is light on the holistic macro view - instead it focusses heavily on the individual elements, rather than considering the interconnectivity between them - soil, carbon, food, environment, health, climate change and education. By isolating these individual elements there is the potential risk that the agricultural sector misses this once-in-a-generation opportunity to fundamentally change and reform.

“Farming directly and indirectly impacts all UK individuals. A stable and profitable agricultural sector is vital for the future prosperity of us all. There is still time for the government to deliver on this, however, there will need to be clearer and more coherent policies in place for this is to be achieved."

Read the government’s agricultural transition plan in full

For advice on the implications of the transition plan for the future of your business please contact Tom

Strategic rural planning – Listen to our webinar for practical advice

Talking of planning for the future, around 400 people tuned into our webinar - Shaping the future of rural landowning businesses – last week. If you weren’t able to join you can watch it via the link below. It was a fascinating discussion hosted by our Rural Chairman and former CLA President Ross Murray.

Some of the key takeaways from my perspective included the exciting renewable energy options still available to rural landowners that our energy expert David Goatman highlighted and the exceptionally low interest rate deals that Rachel Barnett of Knight Frank Finance is able to procure.

Other topics covered included the impact of the government’s proposed changes to the Capital Gains Tax regime, what the latest planning reforms could mean for landowners and, of course, the ramifications of Defra’s new farming roadmap that I discuss earlier in this update, including the proposal to allow the capitalisation of Basic Scheme Payments.

There was also sage advice from Edward Dixon, of our Rural Asset Management team: “A well-considered and prepared strategic plan can help any estate, farm or rural businesses manage challenges and innovate to unlock new opportunities.”

Listen to the webinar

Renewable energy – Solar boost for landowners

The Department for Business, Energy and Industrial Strategy (BEIS) has confirmed solar PV will be allowed to compete in next year’s Contracts for Difference (CfD) round.

BEIS said the fourth round of the CfD mechanism will proceed with three separate pots, one earmarked for more established technologies like solar PV.

Solar will again compete against onshore wind, while offshore wind receives its own allocated pot and a third pot is reserved for less established technologies, including floating offshore wind.

But BEIS is yet to confirm precise budget allocations and capacity caps, with details set to be revealed closer to the opening of the round.

Despite this, the move was welcomed by David Goatman, of Knight Frank’s Energy team, who works closely with our rural consultants.

“Ground-mounted solar PV is cheap and easy to deliver. By allowing solar PV to compete in the next CfD round this will further incentivise solar developers to source land quickly and take projects through the initial grid and planning stages with the aim of being ready in time for the auction.”

For more information on how you could benefit from renewable energy please contact David

Finance – Lending rates slide below 1%

As mentioned above, banks continue to be keen to lend to the rural sector so I thought I’d ask Rachel Barnett of Knight Frank Finance for a few of her thoughts on the current lending market.

“Rates are at their lowest ever, there are stamp duty holidays in place and the competition among lenders is high. Against land we are now seeing rates as low as 1.5% on a five-year year term; against property we are seeing ten-year fixed rates as low as 2% and against investment portfolios, we are seeing interest rates as low as 0.98%.

“The best bit, for me, is that the hard and fast rules of old are now being relaxed as competition increases. The ‘boxes’ of residential borrowing, commercial borrowing and agricultural borrowing are starting to merge and it is now possible to get really good interest rates when borrowing to invest in a commercial venture.

“Clients are leveraging against their assets at these great rates and investing in other assets making their money work harder. If there was ever a time to review things it is now.”

To find out more do please drop Rachel a line

International trade – Live livestock exports facing the chop

A key benefit of leaving the EU is the ability of Westminster to take its own stance on issues previously under the purview of Brussels. One of Defra’s first statement moves is a proposed ban on the live export of livestock for fattening and slaughter – a Conservative manifesto commitment.

The proposal, announced last week, is part of a general consultation on livestock welfare during transit. The NFU, however, has called on the government to create an assurance scheme rather than an outright ban. It claims the cross-channel trade is an important option for some farmers.

Read the full consultation on live animal exports

Overseas news – China’s farmers told to stick to grain

While farmers here are actively encouraged to diversify into alternative crops or even “rewild” their land, the Chinese government, concerned about the country’s growing reliance on grain imports – it already accounts for 60% of global soybean shipments - is taking the opposite approach, writes Bloomberg.

“We have to stabilize domestic output by prioritising grains production on the limited farmland available,” the agriculture ministry said. Permanent farmland should only be used to grow rice, wheat and corn, it added."

The ministry’s comments followed a State Council directive issued last month to all local governments banning further shifts in farmland to non-grain crops. Local governors will be held responsible for these shifts, and crops will be monitored regularly through use of satellite remote-sensing technology.