UK land market prices recover in Q3 as activity picks up

Land market values recovered across the board this quarter as deal activity resumed – but buyers and sellers remain selective

1 minute to read

Land market deals picked up in the third quarter, with housebuilders returning to the market to replenish their sales pipelines after many withdrew in Q2.

Some have publicly confirmed resilient sales levels and completion rates despite the pandemic, noting a sustained period of demand during the summer as the market recovered from the first UK nationwide lockdown. Private London developers and well-funded, opportunistic buyers are also active in the market.

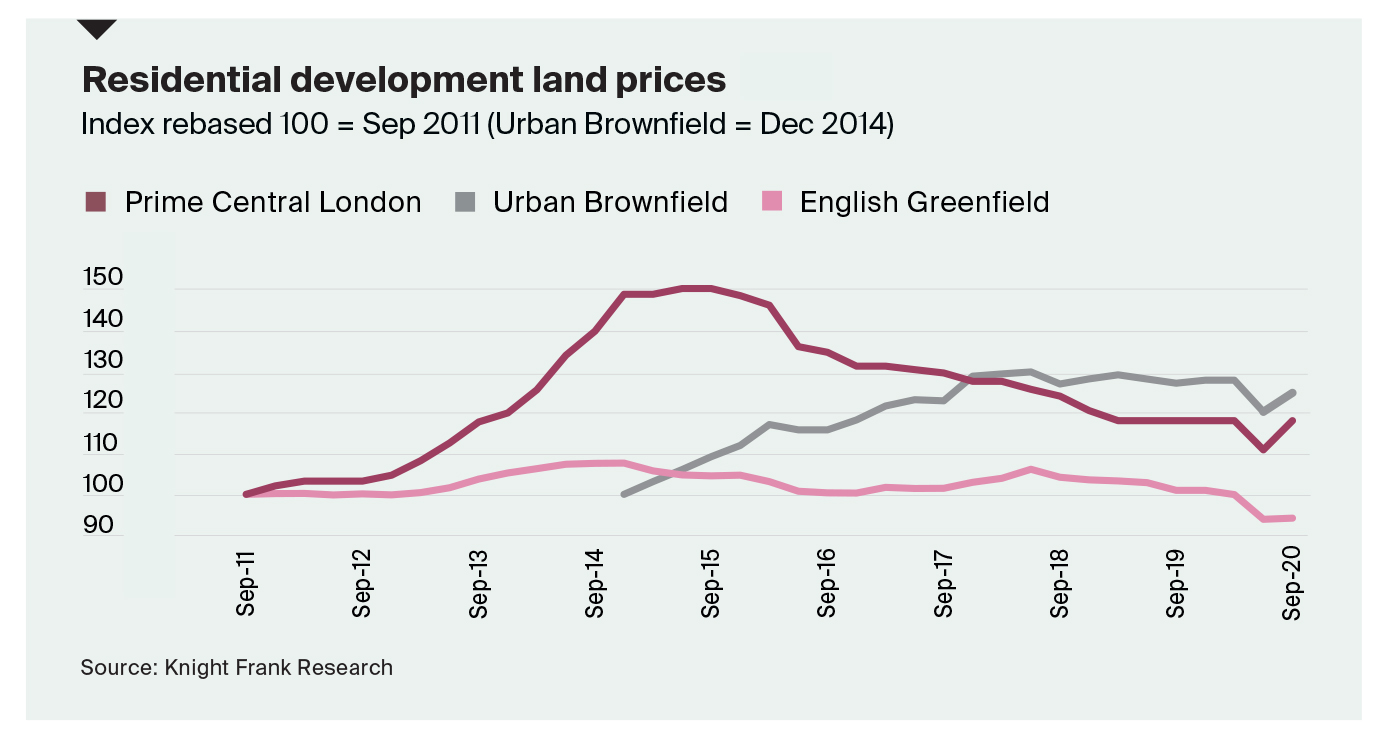

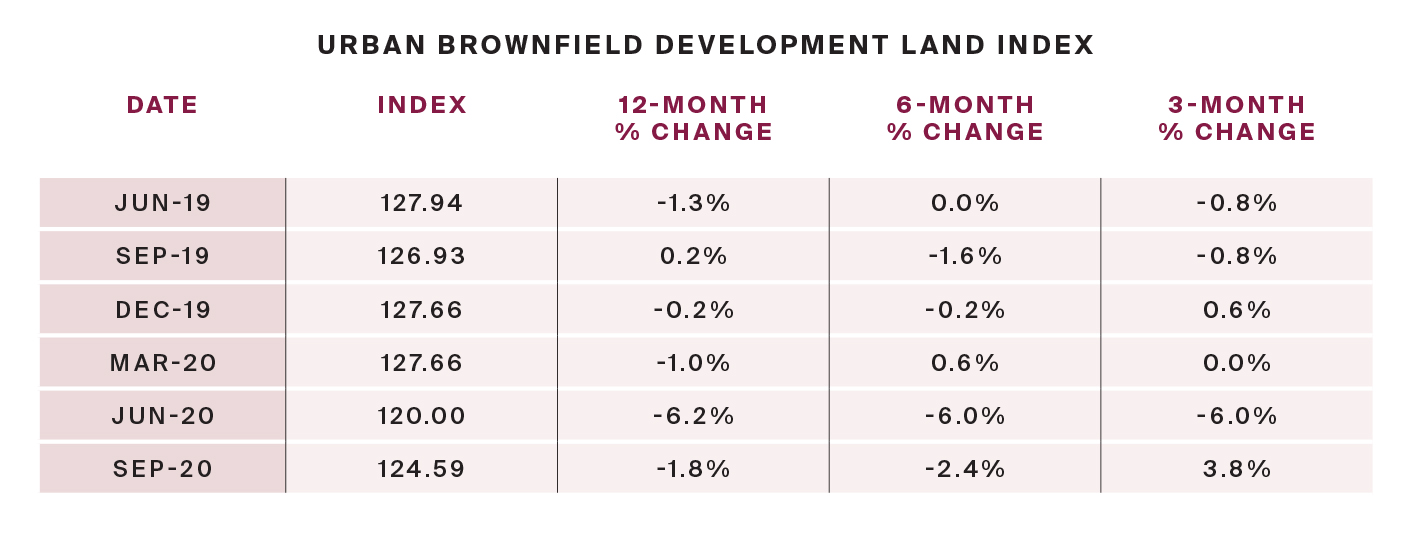

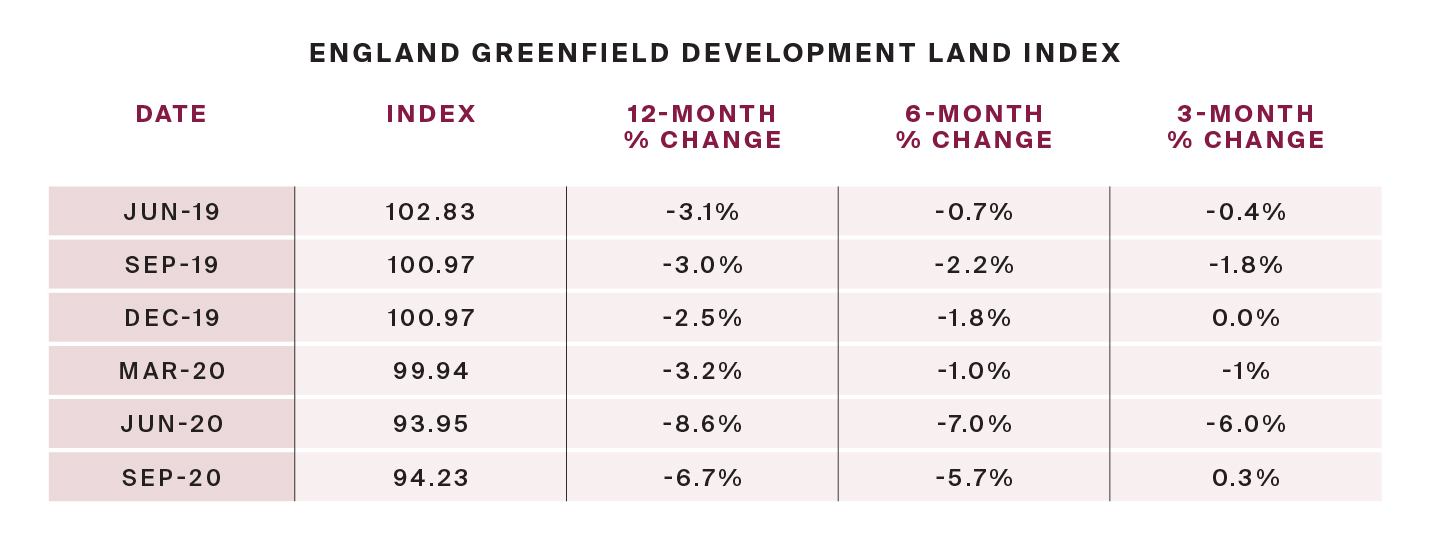

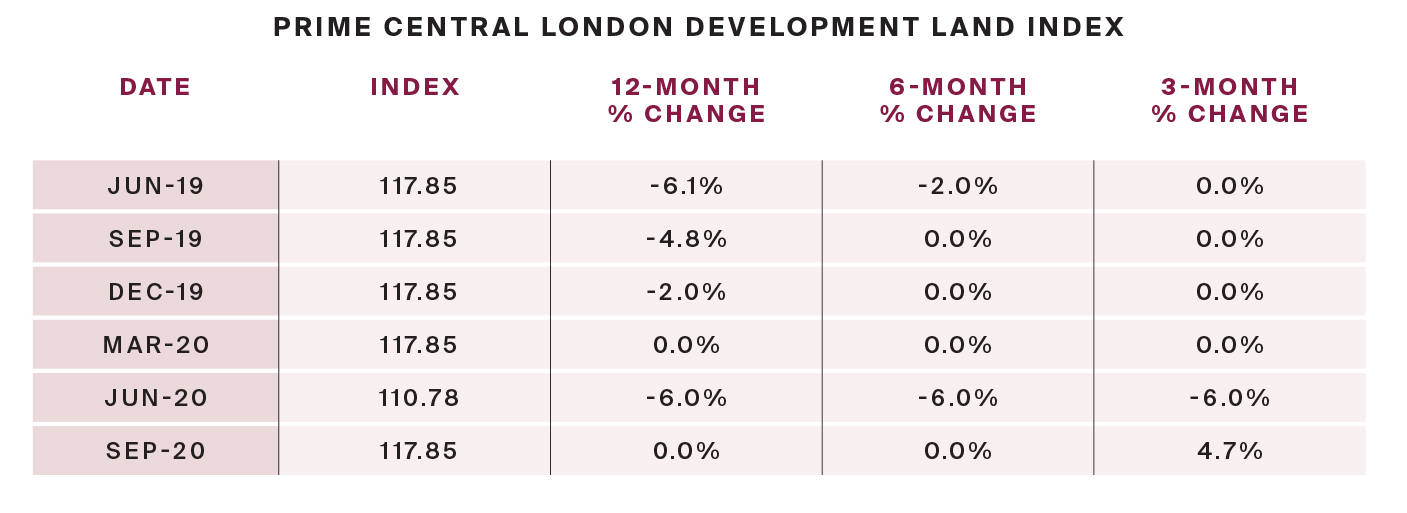

Average land values in prime central London rose 4.7% between July and September, meaning the residential development index has returned to levels seen in the first quarter of the year. Demand for homes outside of the capital has also returned and, accordingly, urban brownfield land values rose 3.8% between July and September, while greenfield values remained stable, ticking up 0.3% on the quarter.

The quarterly increase reflects a marked recovery in the capital’s housing market since the UK emerged from its first lockdown, which contributed to a drop in land values earlier this year.

However, on an annual basis, PCL land values were flat in Q3 compared to Q3 2019, while greenfield values fell 6.7% and brownfield values eased downwards by 1.8%.

Prices continue to be supported by a lack of supply in the market, with few sites coming forward due to the current uncertain economic climate and a shortage of allocated sites due to delays in the adoption of Local Plans. While the majority of developers and housebuilders have re-entered the market, they remain selective and focused on higher profit margins to reflect the increased uncertainty.

Most are looking to maintain their balance sheets and preserve cash. For this reason more land deals are being agreed on a conditional basis or with deferred land payments.

Read the report in full here