Heightened uncertainty: Covid-19, localisation and the inflation debate

Covid-19 has plunged the world into one of the most uncertain periods on record. Gold has hit record highs, equity volatility is elevated and government bond yields around the world remain low.

3 minutes to read

Yet against this backdrop, we predict that real estate investment will remain attractive, thanks to lower volatility than other asset classes, a history of returns through longer-term direct investment, and, crucially, its potential to generate income in a world where 60% of bond yields globally are below 1%1 and over $14 trillion have negative yields2.

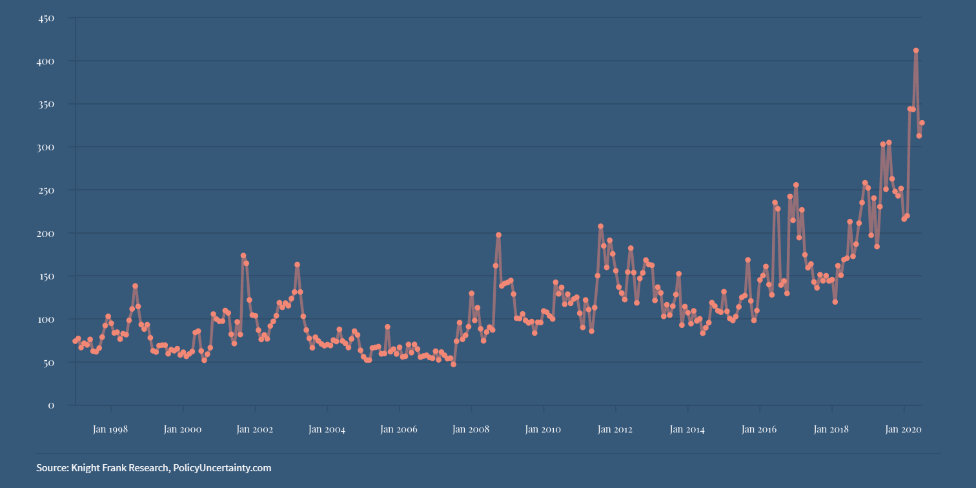

Global uncertainty remains a watchword

Global uncertainty index

Below we highlight some of the key macro themes that are currently shaping real estate investment.

Localisation vs globalisation

Nationalism and the advent of trade wars were already on the ascendency, but recent disruptions to business continuity, and overseas travel caused by the pandemic will only accelerate this trend. This has prompted discussions of reshoring (bringing foreign operations back home), onshoring (bringing supply chains within national borders) and nearshoring (bringing operations closer to home).

Some types of real estate will thrive as a result. The logistics sector is seeing additional occupational requirements, which have translated into an even stronger investment demand.

For the service sector, a greater domestic workforce of support staff will offer renewed demand for office space. Localised employment growth in manufacturing, storage and service sectors will also enhance demand for other types of real estate, including residential and healthcare.

There will also be indirect opportunities for international real estate investment. As an alternative to increased localisation, cross-border property investment offers global diversification and more options to meet revenue targets.

The return of the inflation debate

Globally, Covid-19 has led to unprecedented levels of fiscal and monetary action, raising inevitable questions over the potential for stronger inflation. The outcome in part will depend on the shape of recovery, with those countries seeing sharper recoveries somewhat more susceptible to higher inflation. Real estate can play a strong role as a hedge against such cases of demand-pull inflation.

Yet our central scenario does not position inflation as the threat envisaged by some. Indeed, we expect inflation to remain below target in many countries for some time. Even where we do see higher levels of inflation, this need not lead to rising interest rates. The Federal Reserve has changed its inflation target to an average of 2% rather than a fixed target, while for those countries with fixed targets, such as the UK, there is precedent during the recovery from the financial crisis that when inflation exceeded this level, no interest rate action was taken.

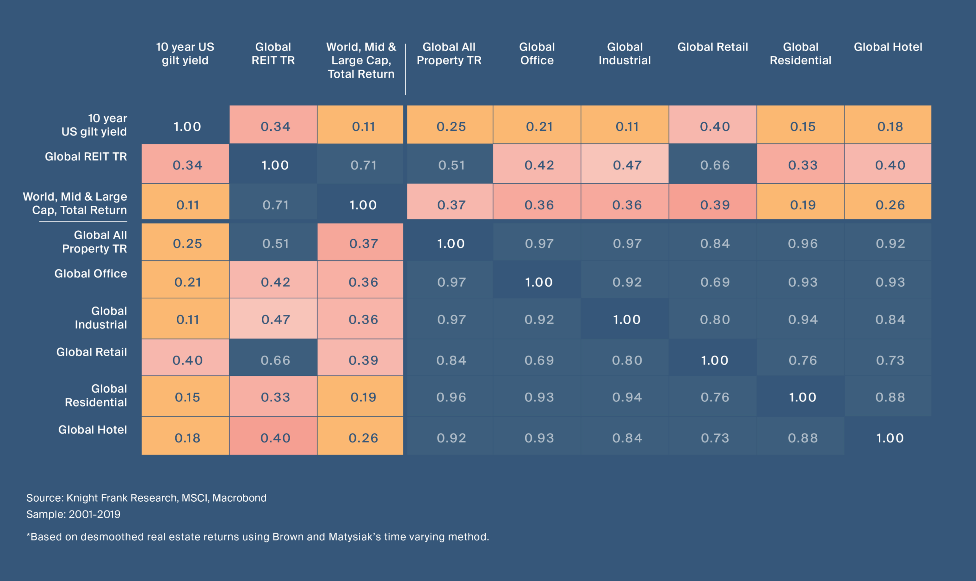

Correlation of returns between different asset types

Relative asset diversification

In an uncertain environment, it is useful to understand how different assets have performed over previous cycles and the extent to which returns have been protected against downside risk.

Direct real estate shows low correlation with other assets such as bonds, equity and indirect real estate, even accounting for the ‘smoothing’ introduced by the typically lower frequency of real estate data.

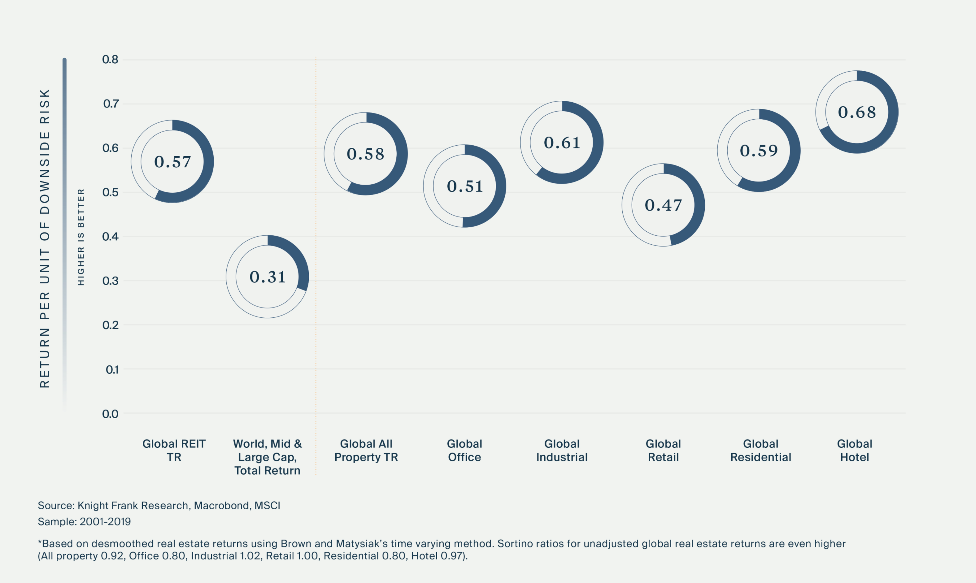

Risk vs return

The resilience of asset returns in relation to downside risk is particularly important in times of heightened uncertainty, and can be approximated using the Sortino ratio. A higher Sortino ratio indicates higher returns relative to downside risk and is therefore preferable. Using data from the past two decades, direct real estate records a stronger Sortino ratio than REITs or global large and mid-cap equities.

Sortino Ratios

1ICE Data Services

2Bloomberg