Government funding to unlock housing acting as a barrier to the levelling up agenda

Parts of the UK are still missing out on important funding that could help deliver more homes and revitalise areas.

3 minutes to read

Analysis by Knight Frank has found that a disproportionate amount of Government funding for housing is being given to the UK’s most affluent areas.

Currently, government housing grants - including the Housing Infrastructure Fund (HIF) and the Home Building Fund - are allocated according to the so-called “80:20 rule”, whereby 80% of funding is directed at areas of ‘highest affordability pressure’, defined using the ratio of median house prices to median workplace-based household income figures.

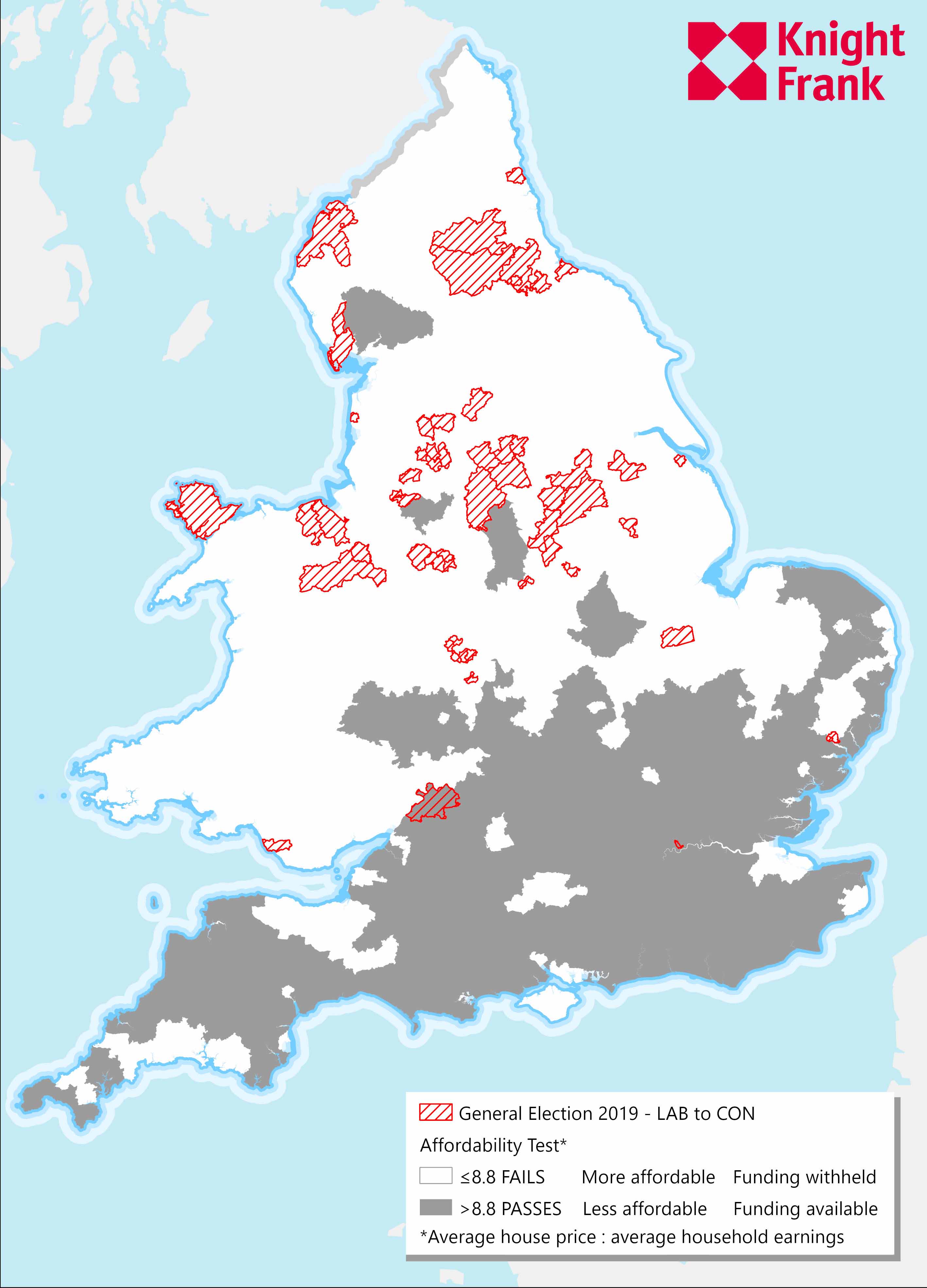

The threshold is set at an affordability ratio of 8.8 times earnings. Put simply, this means that parts of the country where average house prices are more than 8.8 times average household earnings, receive 80% of the government’s funding to unlock housing.

In theory it seems logical – after all, aren’t the most unaffordable areas arguably also the ones where the need for additional housing is most acute?

In practice, however, it means funding systematically disadvantages poorer parts of the country, particularly in the North and Midlands, where house price to earnings ratios tend to be lower, but arguably where investment is more in need.

Interestingly, despite placing “levelling-up” at the top of the agenda, the analysis shows that all of the ‘Red Wall’ constituencies in the Midlands, Yorkshire and the North of England - those which switched from Labour to Conservative control at the last General Election - fail the test and therefore receive only 20% of funding.

Charles Dugdale, a Partner in Knight Frank’s Development Consultancy team, said: “Due to the 80:20 rule, many places across the country have been refused gap funding – and the reality is that these are the areas that need the investment the most. Indeed, 33.5 million people - 57% of the country – live in areas that fail the affordability test.”

The 80:20 rule is evidenced in the award of Homes England’s Housing Infrastructure Fund (HIF), the grant funding awarded to unlock housing projects that are suffering market failure. The regional split of the £4.1 billion awarded shows us that 83% has been awarded to London and southern England.

Levelling the playing field

The Government’s own commission; the Building Better, Building Beautiful Commission (BBBBC), went to great lengths to highlight the “scandal of the left-behind places”, highlighting a vicious cycle where a lack of investment maintains low demand for housing.

Gail Mayhew, of the Building Better Building Beautiful Commission, explains: “The Building Better, Building Beautiful Commission’s recent Living with Beauty Report clearly highlighted the plight faced by the country’s left-behind places, as well as setting out a framework to address this.”

Indeed, the Living with Beauty Report recommends the adoption of a stewardship model as a way to stimulate regenerative investment. It notes that once-thriving towns that have since declined – with derelict sites, disused public buildings and collections of brownfield sites – are ripe for restoration and redevelopment.

Previous research by Knight Frank for the BBBBC has found that minimal funding in these areas maintains a low demand for housing, which in turn ensures values fail the affordability test, thereby perpetuating the problem.

Charlie adds: “The existence of the current 80:20 rule on gap funding means these towns may not receive the necessary support and are instead added to the list of the country’s left behind areas. With the right funding in place, and supported by landed interests that are willing to make the requisite long-term investment in economic activity, these places could thrive once more through a stewardship development model.”