Covid-19 Daily Dashboard - 13 October 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 13 October 2020.

England Lockdown: The prime minister outlined a plan to introduce a localised three-tiered system of restrictions which range from ‘medium’ restrictions, where mostly nationwide rules apply, to ‘very high’ where the tightest restrictions apply, including the closure of some hospitality venues and no mixing of households.

Equities: In Europe, stocks are lower this morning, with declines recorded by the FTSE 250 (-0.7%), CAC 40 (-0.3%), DAX (-0.2%) and the STOXX 600 (-0.1%). In Asia stocks were mostly higher, with the S&P / ASX 200 adding +1.0% on close, while the CSI 300 and the Topix were both up +0.3%. However, the Kospi was flat on close and the Hang Seng closed -0.2% lower. In the US, futures for the S&P 500 are down -0.2%.

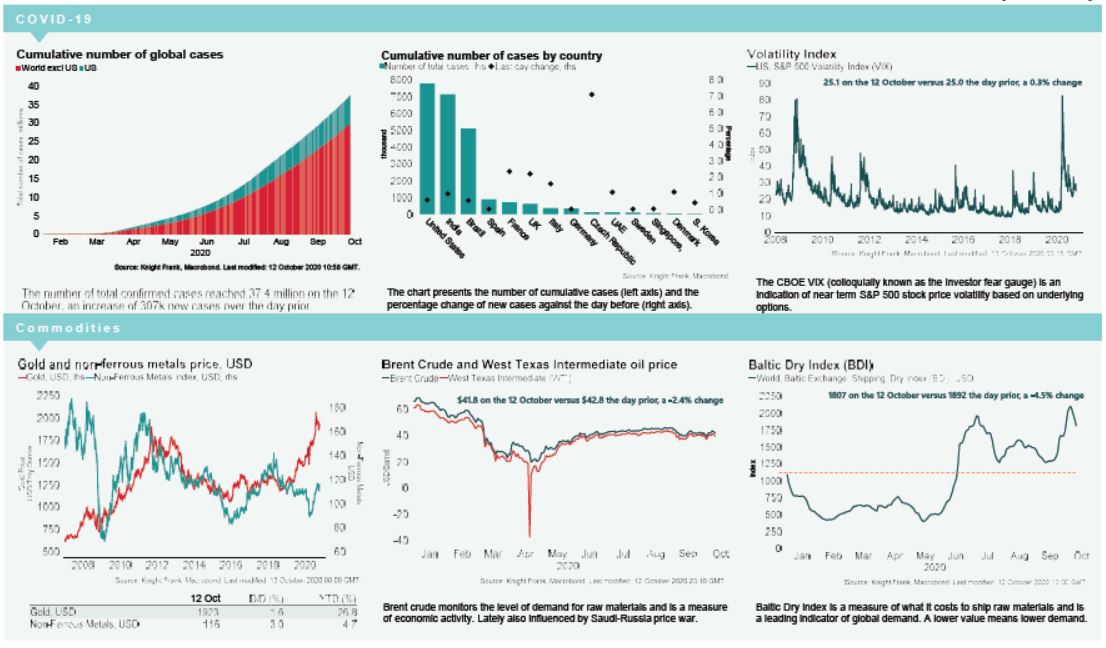

VIX: The CBOE market volatility index and the Euro Stoxx 50 volatility index have increased +2.3% and +1.0% over the morning to 25.7 and 22.5, respectively. While the CBOE vix remains elevated compared to its long term average (LTA) of 19.9, the Euro Stoxx 50 vix is below its LTA of 23.9.

Bonds: The UK 10-year gilt yield, US 10-year treasury yield, German 10-year bund yield and the Italian 10-year bond yield have all compressed -1bp to 0.26%, 0.75%, -0.55% and 0.66%.

Currency: Sterling and the euro are currently $1.30 and $1.18, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.38% and 1.21% per annum on a five-year basis.

Oil: The West Texas Intermediate (WTI) remains below $40 per barrel this morning at $39.88, despite increasing +1.1%. Brent Crude is also up +1.1% this morning, currently at $42.16.

Baltic Dry: The Baltic Dry decreased for the fourth consecutive session yesterday, down -4.5% to 1,807. This is the lowest the index has been in nine sessions and brings cumulative declines over the last five trading sessions to -14%. Declines yesterday were driven by a -7.3% contraction in the capesize rate.

UK Employment: UK employment declined -0.3% in the three months to August to 75.6%, with those employed contracting by 480,000 since the start of the year. Meanwhile, UK unemployment increased to 4.5% in the quarter to August, its highest level in three years. This was above market expectations of 4.3% and higher than the previous quarter’s 4.1%.