Covid-19 Daily Dashboard - 5 October 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 5 October 2020.

Equities: Globally, stocks moved higher this morning. In the US, futures for the S&P 500 are up +0.6%. In Europe, the DAX (+0.9%), CAC 40 (+0.9%), FTSE 250 (+0.7%) and the STOXX 600 (+0.7%) are all positive. In Asia, the S&P / ASX 200 was the best performing index closing up +2.6%, followed by the Topix (+1.7%), the KOSPI (+1.3%) and the Hang Seng (+1.3%).

VIX: The CBOE market volatility index increased +6.0% over the morning to 29.2, while the Euro Stoxx 50 vix has decreased -1.0% to 26.7. Both indices remain elevated compared to their long term averages.

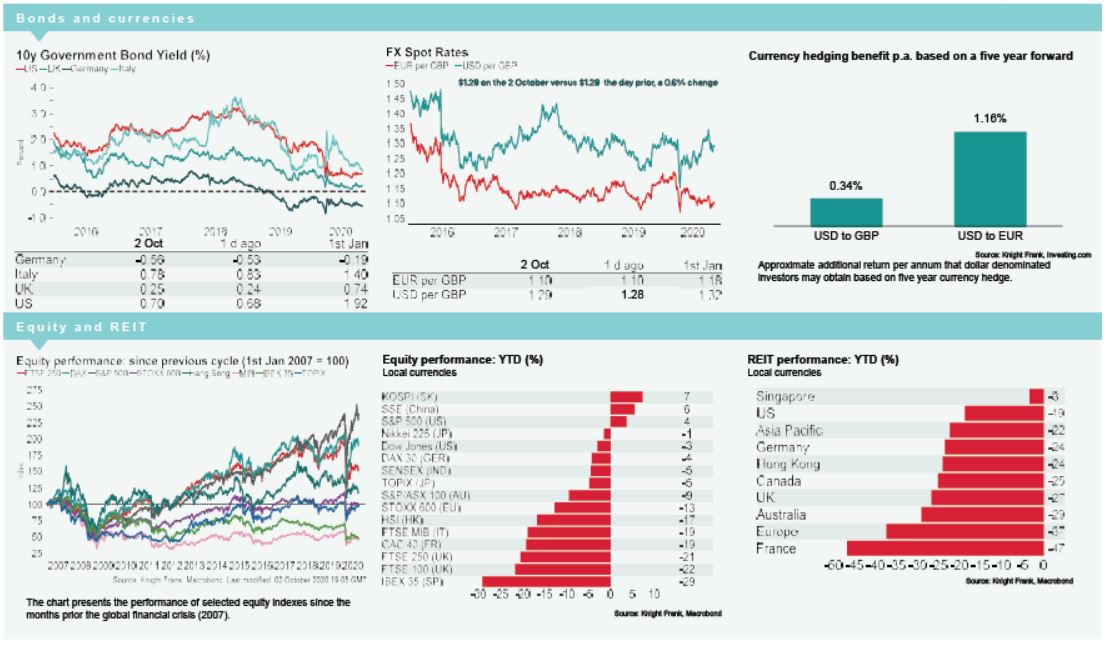

Bonds: The German 10-year bund yield is -0.54%, the UK 10-year gilt yield 0.25% and the US 10-year treasury yield 0.71%.

Currency: Sterling and Euro have appreciated to $1.30 and $1.18. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.33% and 1.17% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) are both +3% this morning at $40.5 and $38.3 per barrel.

Baltic Dry: The Baltic Dry increased +8.0% on Friday to 2,020, to the highest level seen since September 2019. The overall index was driven higher by the capsize index which was up +12.7% at the start of the Chinese holiday. Reuters cites expectations of further stimulus policy measures in China and the re-opening of businesses in the leading steel producing country, as reasons behind the increase.

UK Auto Industry: New UK car registrations declined -4.4% in September, compared to the same month the previous year. This was led by a -31.9% decline in business registrations, followed by a -5.8% decline in fleet registrations. Private registrations were just down -1.1% on September 2019. Electric vehicle sales saw a +184.3% increase over the same period according to the Society of Motor Manufacturers and Traders (SMMT).