UK Property Market Outlook: Week Beginning 14 September 2020

International buyers will have a complex set of considerations to assess in Q4, including a future stamp duty hike

2 minutes to read

The UK property market revival in recent months has been unusual in one key respect: the epicentre is not central London.

In August, the number of offers accepted in the capital was the highest monthly total in 20 years, but demand is higher in areas with a prevalence of family houses. Wimbledon, Islington and Wandsworth were the top three performing areas for price growth last month.

In areas such as Mayfair and Knightsbridge, which led the charge after the global financial crisis, demand is more subdued for the prosaic reason that fewer international buyers are able to get on an aeroplane.

The combined number of viewings in Mayfair and Knightsbridge in July and August was 19% below the five-year average. Meanwhile, there was an 8% increase across the whole of the capital.

Demand may improve among international buyers in coming months but there are multiple moving parts to evaluate.

First, travel restrictions will, at some point, be relaxed. The situation remains fragile but airline stocks have risen by a quarter since the start of August according to MSCI, as traffic picks up from a low base.

Another part of the equation is currency. We are currently experiencing a re-run of the Brexit brinkmanship seen at the end of 2019, which means the pound will remain volatile in 2020. If pragmatism prevails, as it did last year, the pound will ultimately strengthen.

Meanwhile, the US elections make the trajectory of the dollar particularly difficult to assess. Ultimately, if the Covid-19 pandemic is brought under control and the Federal Reserve relaxes its approach to QE, the greenback could strengthen as the dollar’s safe haven credentials are reaffirmed.

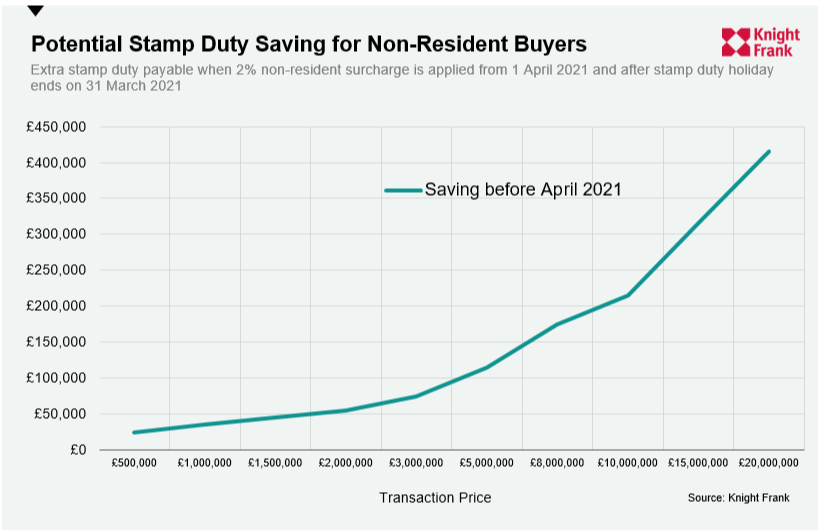

An already complex set of considerations for overseas buyers in Q4 will be made more complicated by the prospect of further tax changes in the UK. From April 2021, overseas buyers will have to pay a 2% surcharge on residential transactions. Its introduction follows the end of the stamp duty holiday introduced in July that lifted the tax-free rate to £500,000.

Irrespective of currency movements, transacting before 1 April will therefore save money for overseas buyers, as the chart below shows. For a £1 million transaction, the combined saving from not paying the 2% surcharge and benefitting from the stamp duty holiday is £35,000. For a £5 million property, the equivalent sum is £115,000, while the saving exceeds £1 million for a £50 million transaction.

Will the government change its mind about introducing the tax given the twin uncertainties of Brexit and the pandemic?

Not according to Sean Randall, a partner at Blick Rothenberg and chair of the Stamp Taxes Practitioners Group, which has been consulting with the government in recent weeks on the overseas surcharge.

“I would say there is zero likelihood of the government changing its mind,” he told Knight Frank. “Discussions have been limited to the technical details and not the policy itself. I sense it is something that international buyers will become increasingly attuned to in the coming months.”