Weekly rural property and business update

The following is a brief round-up of some of the current issues affecting rural property owners and businesses

3 minutes to read

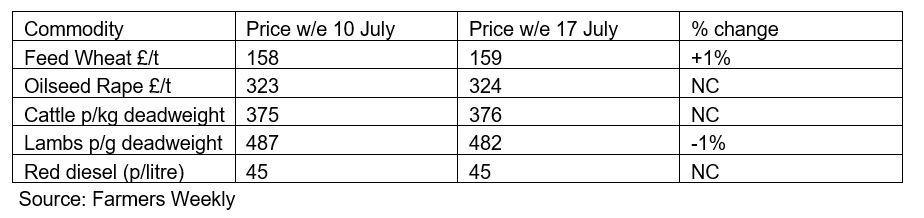

Commodity prices

Prices remained flat on the week with all output prices continuing to trend above the levels seen this time last year.

Trade and food standards – don’t panic says new commission chief

Tim Smith, former Tesco Technical Director and Head of the Food Standards Agency has been named Chair of the government’s new Trade and Agriculture Commission.

The role of the commission, which was set up following pressure from farming bodies, is to ensure that the UK’s food and farming industry is not disadvantaged by any new trade deals that might be struck.

Farmers are concerned their interests will be sacrificed as part of the bargaining process to allow access to lucrative financial service markets. They are particularly worried that the welfare standards they have to adhere to will not be applied to imports.

In an interview in the Daily Telegraph Mr Smith said: “Our trade policy should be informed by evidence, expert opinion and crafted in close consultation with the whole supply chain. There is no reason why it cannot be debated in a sensible and level-headed way.

The alarmism recently around issues like imports of chlorinated chicken and hormone-fed beef – both of which are banned in the UK – do neither the industry nor the public any favours.”

Meanwhile, as reported in Farmers Weekly, the devolved governments are limbering up for a fight with Boris Johnson, who apparently wants all food, environmental and animal welfare standards across the UK to be decided in Westminster.

Capital Gains Tax – Rishi orders a review

Chancellor Rishi Sunak has asked the Office for Tax Simplification to review Capital Gains Tax (CGT) and its associated reliefs, which include “rollover” relief.

In a letter to the OTS, Mr Sunak said: “I would like this review to identify and offer advice about opportunities to simplify the taxation of chargeable gains, to ensure the system is fit for purpose.

“In particular, I would be interested in any proposals from the OTS on the regime of allowances, exemptions, reliefs and the treatment of losses within CGT, and the interactions of how gains are taxed compared to other types of income.”

The move comes as the government’s bill for tackling Covid-19 looks set to exceed previous estimates.

If you have any queries about the impact of capital taxes on your estate or other tax issues such as APR or BPR please contact Alice Huxley of our specialist Valuations team.

Discover more about the farms and estates that Knight Frank is selling.

Farmland market – Bare land in demand

Despite a flurry of new farm launches, the amount of land publicly launched in the UK is still 60% down on the same period in 2019.

According to Clive Hopkins, our Head of Farms & Estates, buyers are still cautious when it comes to rural properties with a significant residential component, but demand is very strong for large blocks of agricultural land.

Knight Frank will be shortly launching a circa 1,500-acre farm in the south-west where most of the £15m price tag is accounted for by the arable and grassland. Please contact Clive for more details.