Investing in Africa’s Healthcare

Over the years, the case for investing in Africa’s healthcare sector has been a daunting task to investors. On one hand, the exponential growth in population, rising middle class, increasing urbanisation and existing infrastructure gaps all provide strong incentives for investing in the sector. However, the lack of adequate data, Government led initiatives and financing have served as leading obstacles towards investor interest. Although the private sector accounts for 50% of healthcare financing in the continent, the buck of the provision of quality healthcare has continued to rest on African Governments.

2 minutes to read

Despite being a global pandemic, Covid-19 in Africa has presented African countries with the collective opportunity to audit healthcare systems and existing infrastructure gaps. Current data transparency and the working synergies between respective Ministries of Health and the private sector in different countries in a bid to curb the spread of the virus, have effectively ushered in a sense of renewed optimism towards growth in the sector.

This has been apparent in the trickle down of activity over the past three months, such as the recent acquisition of minority stake by South African Tana Capital in Alexandria Medical Investment Company. Also, the Public Private Partnership initiative by Côte d’Ivoire mandating Agentis towards the construction of healthcare units across the country for a total value of USD 150 million, with the support of Deutsche Bank and the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC). Further to this, the $10 million investment into Helium Health, a Nigerian telemedicine start-up to help healthcare professionals meet growing demand.

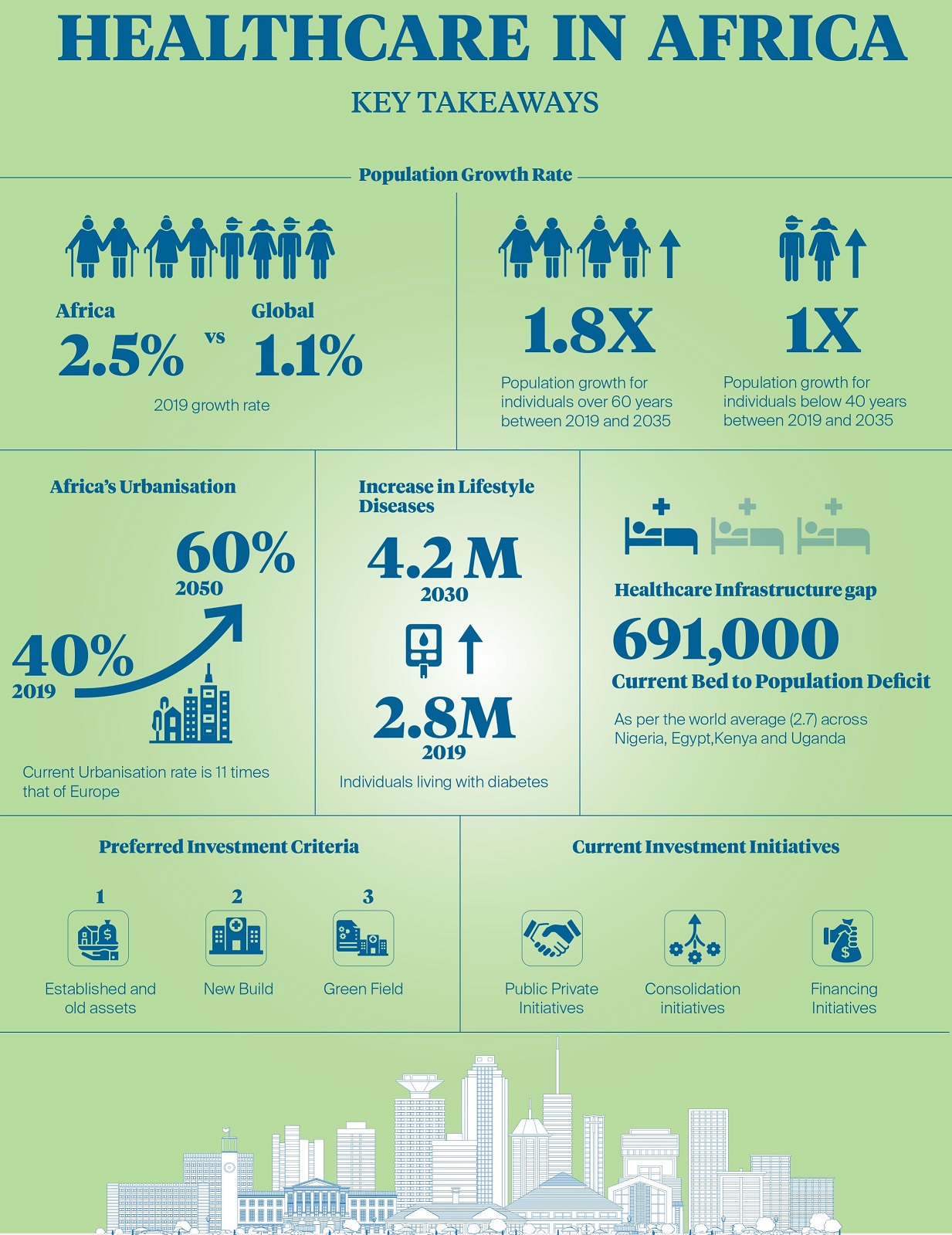

Our Healthcare in Africa report indicates that opportunity continues to abound in the different countries such as the gaping infrastructure deficit of 691,000 beds across Nigeria, Egypt, Kenya and Uganda to meet the global average hospital bed to population ratio of 2.7 beds per 1000 people. The ban on international travel has also served to emphasise the need for quality and affordable healthcare across the continent. According to the Ministry of Health, Kenya loses approximately $100 Millionin medical tourism, while Nigerian authorities had previously indicated that the country loses approximately $1 billion in medical tourism mainly attributed to the rise in non-communicable diseases such as cancer and diabetes.

As an asset class, Investment professionals interviewed for the report opined that healthcare is considered an attractive investment option due to its defensible nature, triple net lease provision and sustainable demand. Healthcare also presents an opportunity for new master planned developments (urban developments) to benefit from the synergies a healthcare component has to offer. Employment at the hospital in the development results in demand for residential assets as healthcare professionals prefer to stay closer to their work. In addition, the footfall of caregivers, patients and hospital staff also spur demand for the retail and F&B facilities in the area. This creates longevity to the masterplan and directly impacts the socio-economic fabric by having a multiplier effect on creating employment.

Whilst the preferred healthcare assets for investment would typically be established hospitals with strong brand equity, the lack of investible grade assets in healthcare in Africa leaves room for consideration of greenfield projects, provided reputed healthcare operators are counterparties to the leasing contract.

Click here to find out more on our Healthcare in Africa Report

For more information, please contact Tilda Mwai