Economic takeaways from China’s National People’s Congress 2020

China kickstarted its most high-profile political event of the year, The National People’s Congress (NPC), late last Friday after a two month delay due to the COVID-19 outbreak.

2 minutes to read

The NPC is an annual gathering of the Communist Party of China in Beijing where over a two-week period, although just one week this year, a body of around 3,000 members vote on important pieces of legislation. This year, the focus will weigh heavily on China’s next steps for reviving its economy, which recorded its first contraction after decades of consistent growth.

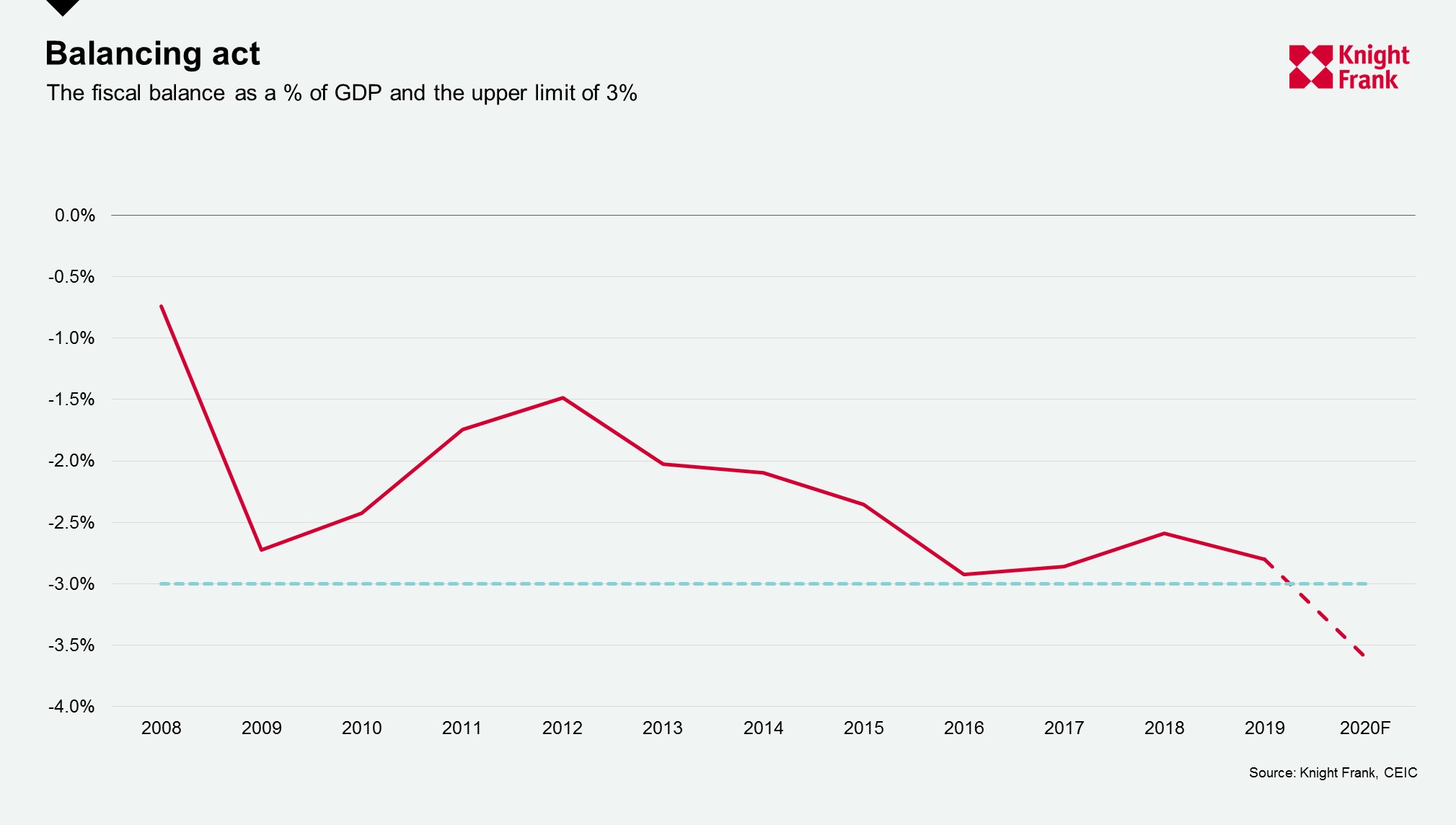

Not surprisingly, the major announcements focused on fiscal policy with the official budget deficit raised from 2.8% of GDP to 3.6%; this has broken through the 3% longstanding upper limit set in place by the government.

The government also announced plans to support credit growth with a view to issuing around RMB 1 trillion in government bonds and raising limits on local government bond issuances from RMB 2.15 trillion to RMB 3.75 trillion. With such aggressive credit growth, infrastructure spending could accelerate, having a positive spill over effect on the real estate sector.

On top of the boost in fiscal spending and credit expansion, the NPC also called for more monetary easing in the form of a reduction in interest rates. The Small and Medium Enterprise (SME) lending support scheme is to be extended to March 2021 and China’s large banks were requested to expand lending to SME’s by at least 40% this year.

Lastly, in a more telling move, the NPC opted not to set a GDP growth target this year – a historical first. It appears that Beijing is being realistic on the speed of China’s economic recovery this year, recognising that the process could be long drawn before returning to pre-COVID levels. Nonetheless, with China now more or less fully reopened, the policies announced will add some much-needed momentum for economic recovery particularly given it is first out of the gate among the world’s major economies.