Household sentiment towards house prices slows, but still positive

Sentiment plays an important role is determining decisions about whether to buy or sell a home.

1 minute to read

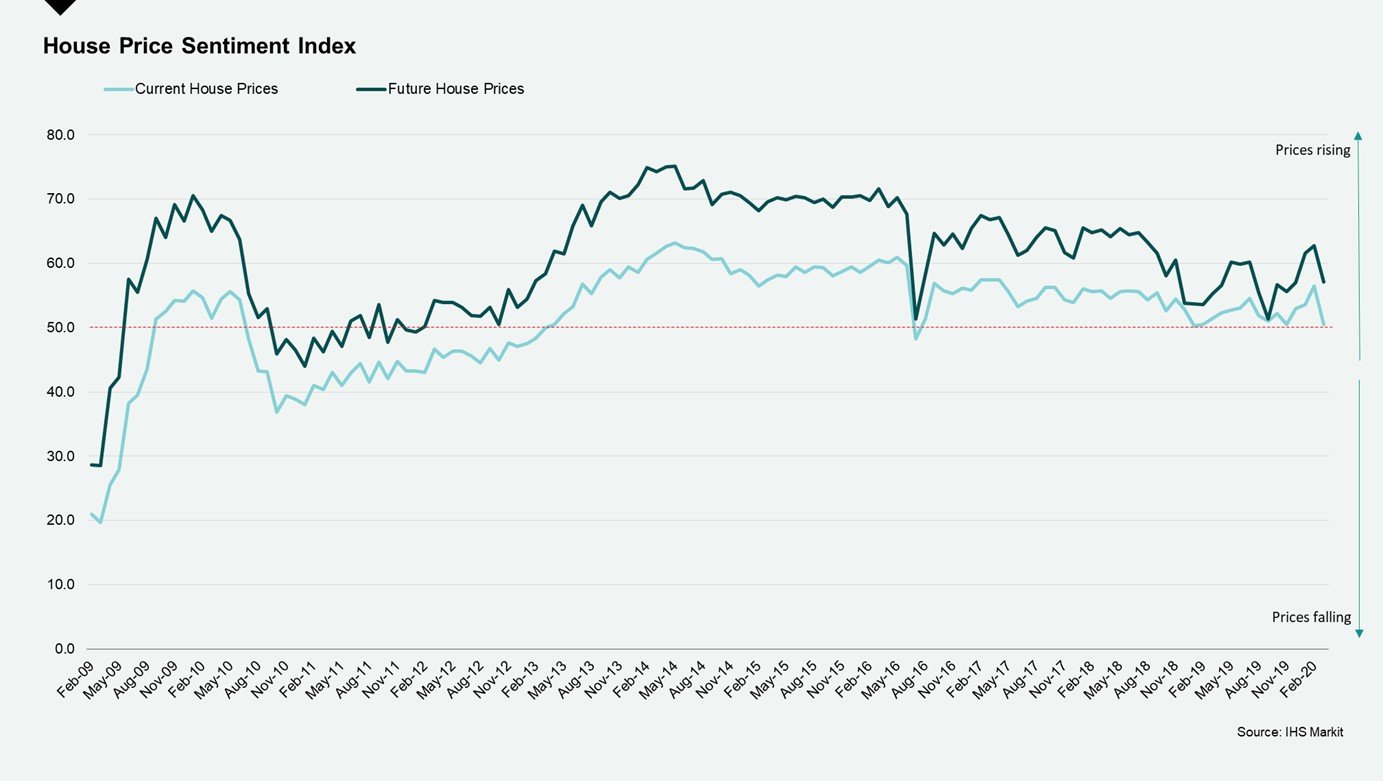

There were signs of housing market conditions softening in March as UK households reported the slowest rate of growth in prices since last November, according to a survey conducted by IHS Markit, the global information and economics provider, conducted between the 12th and 17th of March.

The results are likely to reflect the immediate impact that the Covid-19 pandemic has had on housing market sentiment, with buyers and sellers more cautious in such unprecedented circumstances.

Longer-term the outlook remains positive, for now, with households still expecting a rise in house prices over the next 12 months, albeit at a slower rate than previously foreseen in February.

Household sentiment plays an important role when it comes to the housing market – not least in determining decisions about whether to buy or sell a home, whether to upsize, downsize or just move to a different area.

This is especially true at the current time, with buyers and sellers increasingly exploring their options and initial feedback suggesting that viewing levels have fallen in response to government guidance on social distancing.

However, any impact on pricing is unlikely to be immediate. Property takes time to transact, and this lack of liquidity means values are less subject to sharp rises and falls (compared with stock markets), as my colleague Tom Bill has noted previously.