Healthcare property: Five trends shaping investment interest in the sector

2018 represented another very active year for the UK healthcare property sector with a near £1.5 billion invested via fixed-income transactions. As a part of our latest Healthcare Capital Markets report, Knight Frank Healthcare have identified 5 trends vital in shaping this investment demand.

2 minutes to read

1. Unique market characteristics

Investors have taken notice of the unique factors driving the performance of healthcare property. The first and most publicised of these is the UK’s ageing population which has driven occupancy rates close to 90% even before a wave of retirees reach their twilight years.

A second factor is that income for healthcare property is extremely long-dated, typically comprising 30-year lease terms (with RPI-linked rental uplifts) compared to average lease lengths of seven years seen in other commercial sectors. Long leases make healthcare highly appealing to investors looking for secure long-term income.

2. A mix of domestic and overseas interest

High investment volumes are also reflective of a widening pool of buyers, including both UK and foreign investors. Despite the continued dominance of domestic buyers, particularly specialist healthcare REITs and property companies, appetite from overseas buyers remains strong.

Looking at list of transactions for 2018 may show only a handful of overseas transactions but a lack of large-scale opportunities is the main barrier, not the shortage of interest from abroad.

3. Emerging specialist healthcare segments

The elderly care sector remains the most accessible market, but more specialist segments such as primary care, child care and adult supported living are now seeing significant inflows of capital with specialist investors making the most of growth opportunities. This is certainly the case for the supported living market where investment levels are growing in line with calls for community-based models of care that encourage greater independence for vulnerable adults.

4. Robust investment performance

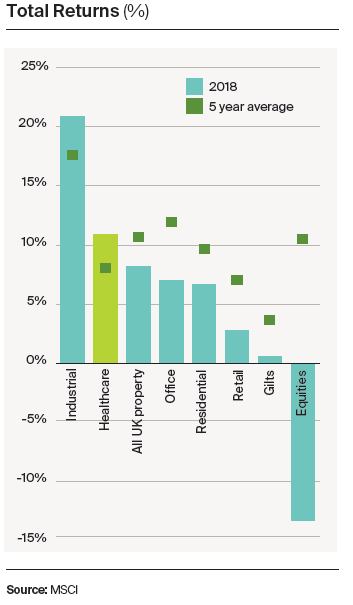

With total returns of c.10%, the healthcare sector outperformed the MSCI ALL UK property average for the third consecutive year in 2018 and continues to look attractive against other property classes.

On the back of this, a range of investors are making enquiries about the sector. New entries into the market means that due diligence and market insight is playing an increasingly important role in aiding investment decisions.

5. UK healthcare set for future growth

All these factors are united by the fact that we expect to see continued strong performance heading into 2019 and beyond. With investors continuing to search for returns in alternative sectors with a long-term horizon, healthcare is expected to remain attractive and transaction activity buoyant.

The UK’s ageing population means there will be no shortage of demand for healthcare property in the approaching decades, while a mature healthcare infrastructure means that the UK will remain a hotspot for global investors.

Joe Brame is a Senior Analyst in Knight Frank's Healthcare Team. To discuss any of the points raised in this article, or to see how Knight Frank can help you capitalise on demand for healthcare property contact our dedicated Healthcare team.