Graduate retention rates could have wider implications for UK housing markets

More than half of students plan to move directly into a property in the private rented sector following their studies.

2 minutes to read

This week saw the release of the inaugural Knight Frank/UCAS Student Accommodation Survey which captured the views of over 70,000 current university students and new applicants due to start a course in the 2018/19 academic year.

As well as quizzing students about their accommodation choices while at university, the report also contains a trove of data on students’ housing plans post-graduation something which could have wider implications for housing markets.

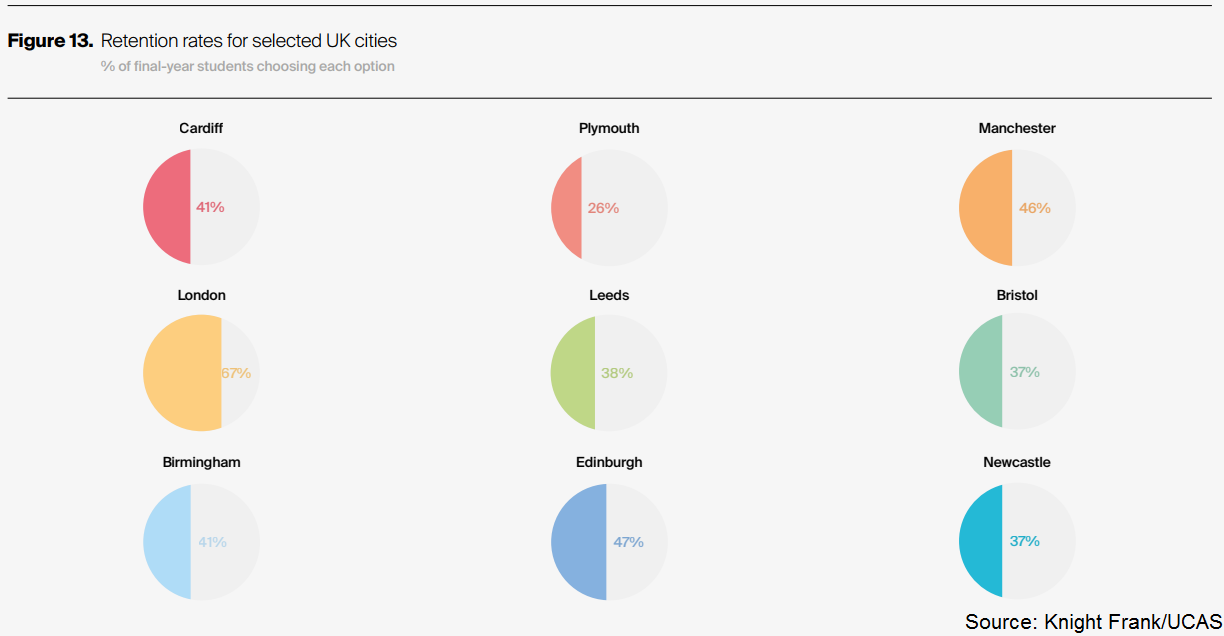

Some 41% of final-year students said they intend to stay in the city in which they study after graduation, for example. As UK cities look to grow and, increasingly, specialise in skilled and knowledge-intensive goods and services, the ability to retain graduates will be of critical importance.

Retention rates were, unsurprisingly, highest in London at 67%. That the capital acts as a magnet for university leavers, either looking for jobs or joining graduate schemes, comes as no surprise. While this is likely to remain the case, the opportunities for graduates in regional university cities are growing.

In Edinburgh, 47% of final-year students said they planned to remain in the city, while in Manchester and Birmingham 46% and 41% of final-year students said the same.

So how does accommodation fit into this? Essentially, cities need to ensure there is suitable provision of vibrant, amenity rich, flexible living space for university leavers. This could, as an example, have implications for the burgeoning Build to Rent (BTR) sector in the UK – helping pave the way for a move from purpose-built student accommodation into purpose-built rented accommodation.

Indeed, more than half of final-year students who responded to our survey said that after graduating they planned to move directly into privately rented accommodation.

There are currently around 132,000 units of purpose-built rented accommodation in the pipeline. Half have been completed or are under construction, while the other half have yet to start construction. Much of this is taking place in major cities including London, Birmingham and Manchester, but there are signs of development activity picking up in other locations (see our recent Cardiff report). Knight Frank estimates that the size of the UK BTR market will increase from £25bn in 2017 to £70bn by 2022.

Ultimately, accommodation influences the decisions student make on where to study, and it will increasingly influence the decisions among graduates on where they choose to work.

Read the Knight Frank/UCAS Student Accommodation Survey in full.