Highlights from The M25 Report Q3, 2018

A summary of M25 Q3, 2018 office investment, development and occupational markets.

3 minutes to read

Take-up tops 1m sq ft for the first time in three years

Office take-up in the South East reached 1.2m sq ft in Q3, the highest quarterly total for three years. Consequently, take-up for the year increased to 2.7m sq ft, 30% ahead when compared to the equivalent period in 2017.

Notably, 191 transactions had completed by the end of Q3. This total is 18% higher when compared to the same point in 2017 and is 28% ahead of the 10-year average for the period.

Buoyant M4

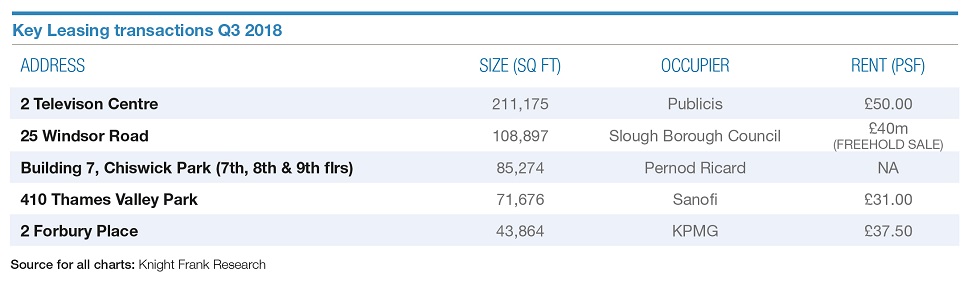

With the French advertising and public relations firm Publicis taking 211,000 sq ft at White City, take-up in the M4 rose to 880,067 sq ft, the highest quarterly total for eighteen years.

This transaction detracted attention from the scale of market activity in Q3. During the quarter, 39 transactions were completed in the M4 corridor, a record total for the market.

Interestingly, stripping out transactions in Hammersmith and Chiswick reveals that 2018 has been a very positive year for the core M4 locations. Take-up for the year in the core area had reached 1.1m sq ft by the end of Q3, the highest total recorded at the Q3 juncture for five years.

"Despite the challenges emanating from the political arena, we are seeing sustained interest in the South East office market. Notably, five transactions over 50,000 sq ft completed in Q3. This demonstrates not only that deals are happening frequently, but that they also have the potential to happen at scale."

_Emma Goodford,

Quality prerequisite to occupier requirements

The drive toward acquiring the best quality space continues to shape market activity. Analysis of take-up across the South East reveals that leasing volumes of Grade B space have dipped to 8.7% of the market in 2018, an all-time low. The effect of this trend is most acute in the M4 where just 3% of occupier transactions have involved Grade B property in 2018.

This occupier focus on high quality space has meant that the spike in M4 vacancy, brought about by record levels of development in 2017, has quickly been eroded. As at Q3, vacancy in the M4 fell below the 10-year average of 9.5% to 9.2%.

This is the lowest level since Q1 2017. Looking ahead, with only six speculative schemes totalling 433,000 sq ft scheduled to complete in the next 12 months, vacancy is forecast to dip below 8.5% by the end of 2019 providing a case for the next wave of new development.

Investor appetite holding firm

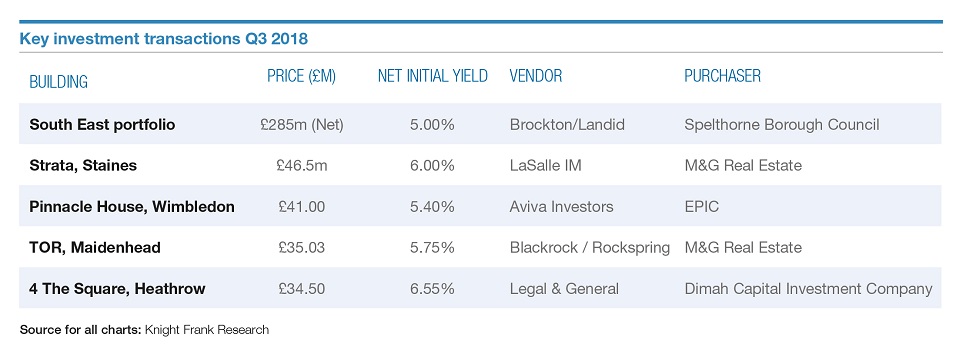

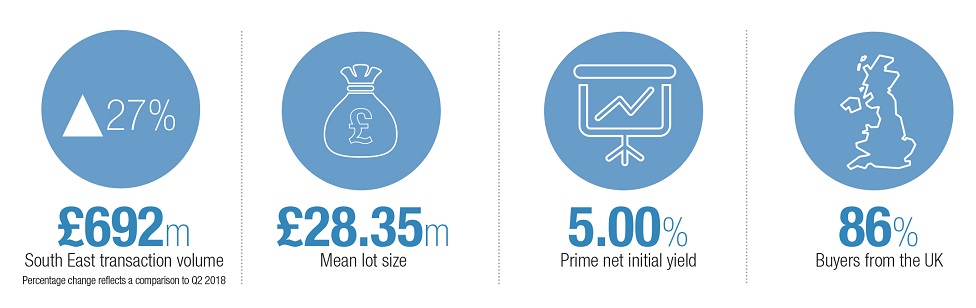

South East office investment volumes increased by 27% in Q3 2018 to reach £693 million by quarter end. This total is 21% above the 10-year average for the region. This meant that at the Q3 mark, investment into South East offices had increased to £1.9bn. Although this is 17% less when compared to the same point in 2017, the total is 23% above the 10-year average for the period.

UK Councils spending continues

The acquisition of Brockton’s South East portfolio by Spelthorne Borough Council for £285m in Q3 provided further evidence of continued public sector spending on South East office assets. Considered over the first nine months of 2018, spending from this sector reached £725m by the close of Q3. Notably, this means that council spending represents 37% of the market in 2018 making the subsector the largest buyer group of the year so far.

Pricing pressure increasing

Prime yields remained at 5.00% in Q3, although prime reversionary assets are trading below this level. Expectations of future rental growth continues to underpin interest, with 30 out of 51 locations tracked across the South East market registering an uplift in prime rents in 2018, partly driven by a greater propensity toward 5-year lease terms or break options.

In prime markets, with severe shortage of stock, competition is subsequently building, as investors look to deploy new funds or recycle capital.