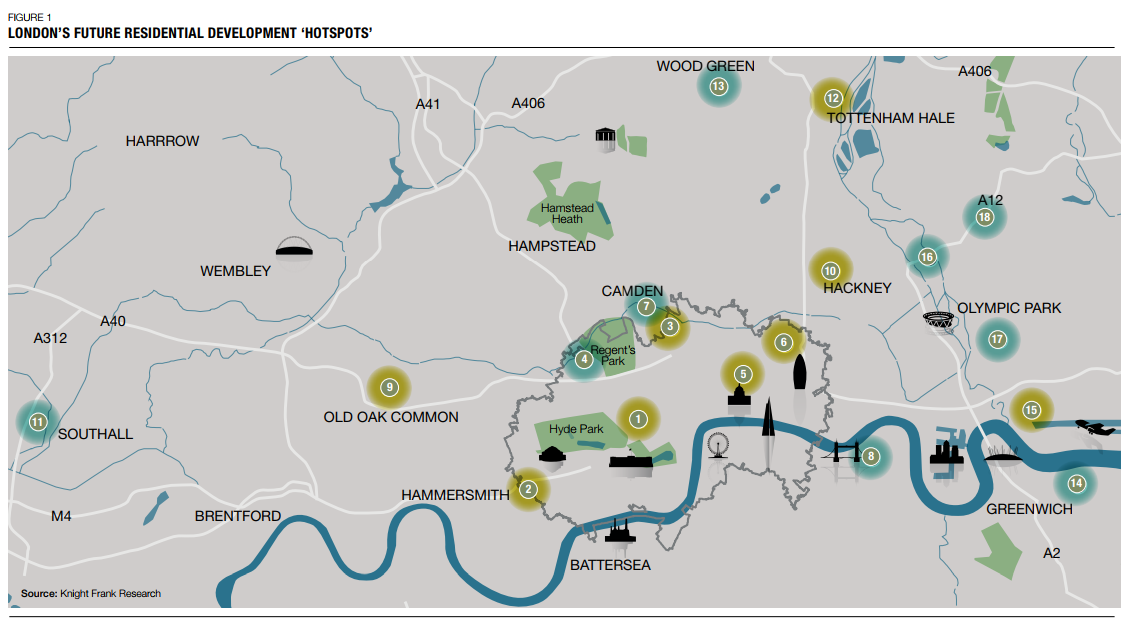

Identifying London’s future development hotspots

Knight Frank's third Hotspots report identifies localities in London where there is potential for price outperformance.

1 minute to read

We have identified 18 Residential Development Hotspots where there is potential for new-build values to outperform the wider market, ranging from Southall in the West, Tottenham Hale in the North and West Ham in the East.

A combination of regeneration schemes, upcoming transport infrastructure upgrades, or wider place-making have underpinned each area’s selection.

The hotspots identified feature a wider geographical spread than previous reports. In terms of values, the majority are localities where new-build developments are priced at sub-£800psf and most are also outside zone 1. This emphasises the changing landscape for development in London, with a greater focus on affordability.

Given the more muted pricing landscape across the capital, the potential price growth needed in ‘hotspots’ to outperform the wider market may not be as high as in recent years, and in some areas of the capital, relatively modest growth will be seen as outperformance.

The timeframe over which we are forecasting (2018-2021) encompasses the opening of the Queen Elizabeth Line (Crossrail). In many cases the opening of the high-speed rail link from the end of next year has already been priced into sales values in and around station hubs, although for stations where large-scale development is still in the pipeline, pricing could reflect this in the future.

As seen in previous reports, transport infrastructure upgrades, regeneration and realm change are all factors which can feed into new-build and second-hand market pricing.