The success of coworking and its effect on the London market

London has experienced rapid change in the provision of flexible workspace and coworking in recent years. Since 2014, the average level of flexible office take-up in Central London has exploded and is now more than double the ten-year average. We explore the drivers of its success, and what effect it will have on the Central London office market.

4 minutes to read

The rise of flexible solutions

The unprecedented rise in demand for flexible working, serviced and coworking space is not attributable to a single factor. A number of influencing trends have taken shape in recent years, allowing a 30-year old industry to essentially relaunch and rebrand itself so it is aligned with a new digital age.

The key drivers are:

• London has seen a 41% increase in small and medium enterprises (SMEs) since 2010, much of which has been driven by a marked increase in funding from venture capital

• The growth of the gig economy has led to an increase in freelancing and contract based working

• Volatile economic conditions have increased the appeal of avoiding long-term lease commitments

• Working practices have evolved to include collaboration, sharing and a desire to be part of a community

What is the effect on the London office market

Source: Knight Frank

The long-term effect of the growth of flexible offices on the traditional office sector remains to be seen. It has been suggested that traditional offices in the smaller size bracket are under threat due to direct competition with the flexible office market.

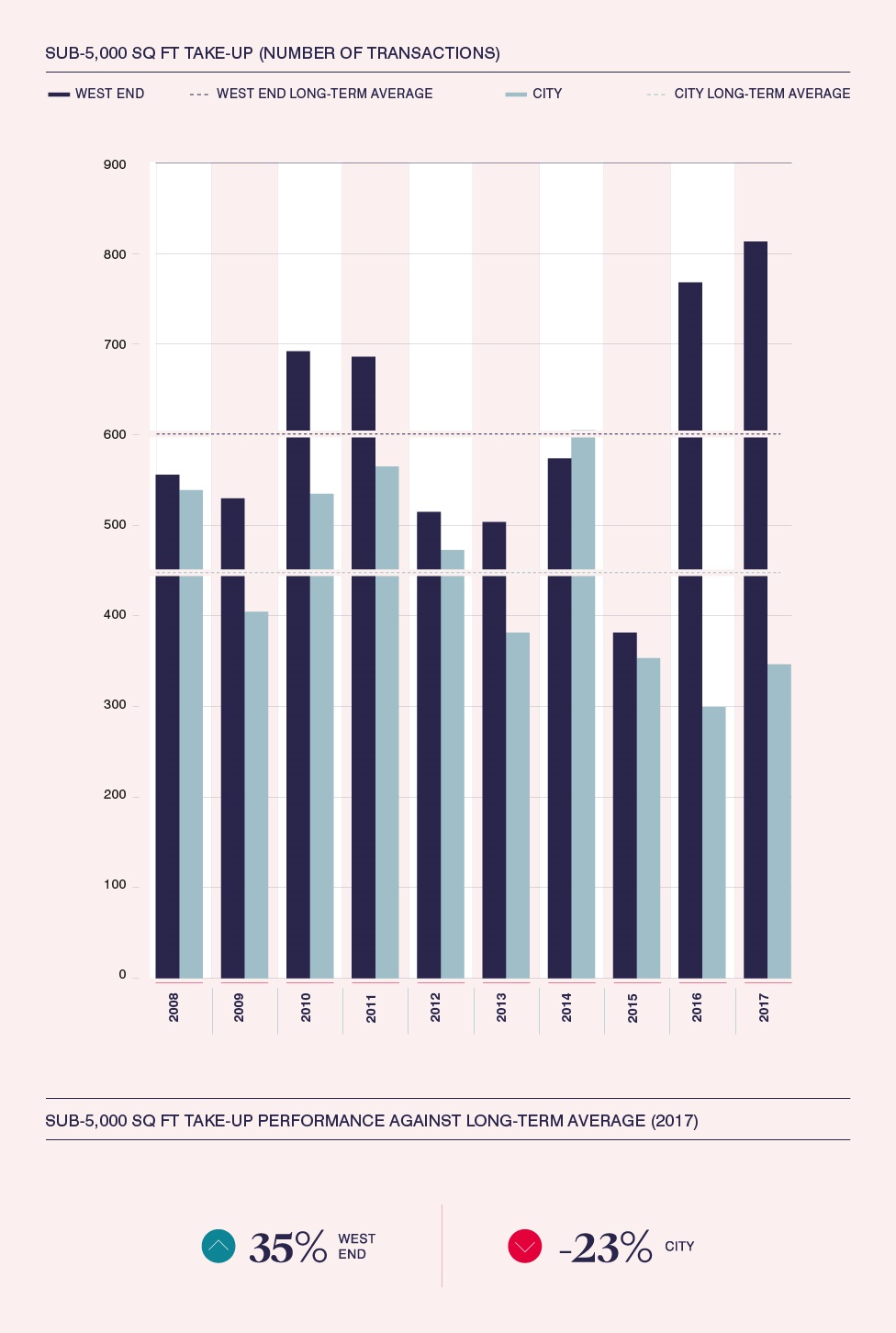

There has been a fall in demand across Central London for sub-5,000 sq ft units on traditional leases over the last three years, which is attributable, at least in part, to the rapid growth in the number of flexible working centres.

However, a more detailed examination of the figures reveals that the West End sub-5,000 sq ft market has actually performed at above average levels for the past two years; in particular the 0-1,000 sq ft size band, which is currently at levels five times the long-term average. The story in the City is the opposite, with sub-5,000 sq ft take-up below average since 2014.

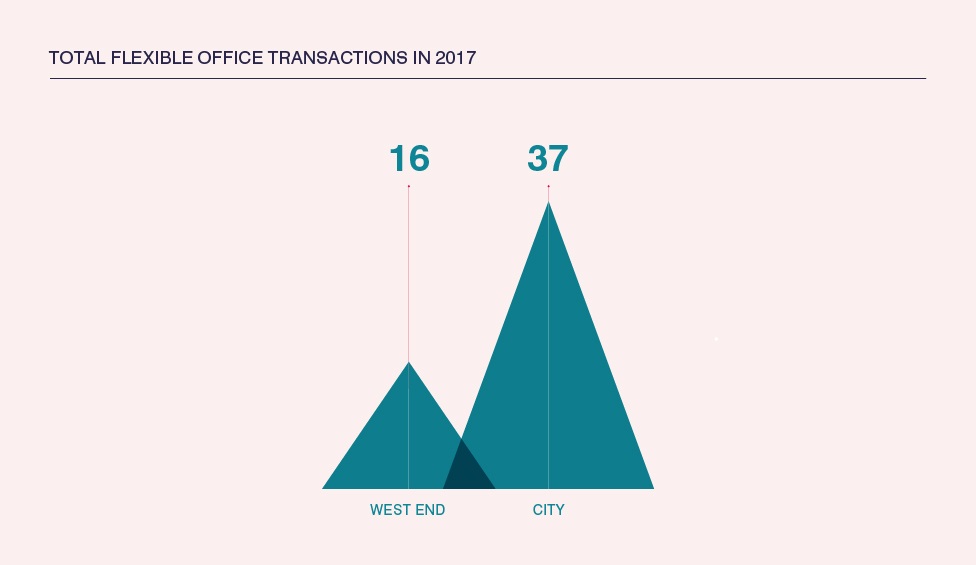

The primary reason for this is that there have been fewer acquisitions by flexible workspace providers in the West End in comparison to the City – in 2017, there were 37 flexible office transactions in the City, compared to just 16 in the West End.

A point to consider is that space being let to small occupiers through coworking creates a neutral position, as coworking providers are committing to large units which are then servicing the small unit market.

The shock of WeWork’s success and speed of growth is only matched by the disappointment of others’ inability to see where the demand sits. Even at 2 million sq ft in London, WeWork are catering for less than 1% of the capital’s working population, or the size of two investment banks. There is scope for much more.”

_Mike Hussey, Chief Executive, Almacantar

According to the Global Coworking Survey 2017, 45% of people currently occupying coworking space were previously working from home before becoming a member, and 26% were in traditional office space before moving, down from 37% in 2016. This suggests that increases in coworking do not have a direct, proportionate effect on traditional take-up.

What will have a greater effect on the traditional take-up is the marketing of flexible space to corporate occupiers on a larger scale. IBM has already reportedly signed a deal for all of the desks in a 100,000 sq ft WeWork centre in New York City; in Central London, partnerships of this nature are likely to provide direct competition to space offered on a traditional lease.

The future of flexible solutions in London

Flexible workspace providers are acquiring new stock at an ever accelerating pace, and will remain a key feature of the London office market in the future. As working practices continue to evolve, many employers, contractors and freelancers alike will experience an increasing need for flexibility in their accommodation. In addition, technological disruption will create a growing need for short-term, flexible project space; for corporates, flexible options will provide convenient solutions.

There will also continue to be many businesses for whom traditional office space will be the appropriate option. Occupiers with more stable and predictable growth projections may find considerable cost savings through opting for a traditional lease, despite the capital expenditure involved in a move. This is particularly true for larger corporates.

Source: Knight Frank

Occupier requirements are evolving to incorporate increased levels of flexibility. If traditional landlords can adapt to provide this, then we believe flexible working solutions can flourish alongside, not at the expense of, existing landlords.

Whether upsizing or downsizing, through our network of UK-wide offices, Knight Frank offers complete brokerage solutions to businesses searching for serviced offices in London or other major cities across the UK.

Contact Knight Frank Serviced Offices

The Central London office market is currently undergoing a period of significant change – but with big change comes great opportunity. Our latest report provides occupiers and investors with thoughts and guidance for the year ahead as the Central London office market continues to shift.