Lenders take a hit on mortgage lending as sub-4% fixed rates return

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Nationwide this week became the first lender to reintroduce a fixed rate mortgage below 4%.

This threshold is only symbolic, but it's another illustration of just how competitive the mortgage market is. The best five-year fix has fallen from 4.64% to Nationwide's 3.99% deal in the past month alone, and that's without particularly large moves in swap rates. Barclays announced a series of cuts yesterday morning, bringing its best five year fixed rate to 4.04%.

“Margins are already wafer thin, but lenders are eager to make up for lost ground after months of disappointing levels of activity," Simon Gammon of Knight Frank Finance tells the Times.

The lenders' perspective

Inflation data published earlier this month showed little progress on the key metrics. The annual rate of services inflation held steady at 5.7%. However, for large banks, maintaining market share is important. They can take a hit on some deals if it means they hold onto their position as rates begin to fall.

Santander is a good example. This week the Spanish lender posted a record quarterly profit, but its UK arm saw net profit drop by 23%. The group’s share of new mortgages dropped to as low as 4 to 5% last year when it prioritised profit margins over keeping up with competitors’ offering, down from 11%, according to the FT write up. It has managed to push its share of new mortgage issuance back to 10.5%, but that's come at a cost.

“Right now we see a slight pick-up in demand [and] obviously pressure to compete for that increased demand,” José García Cantera, Santander’s chief financial officer tells the paper. “But it looks like the worst in the mortgage market in the UK is behind us. We should gradually see an improvement both in volumes and in profitability.”

Lloyds Bank yesterday reported a 14% fall in pre-tax profit for the first half of the year. Net interest income fell 11%, which it credited to lower margins: "the lower margin reflects anticipated headwinds due to deposit churn and asset margin compression, particularly in the mortgage book as it refinances in a lower margin environment," the lenders said.

Sentiment

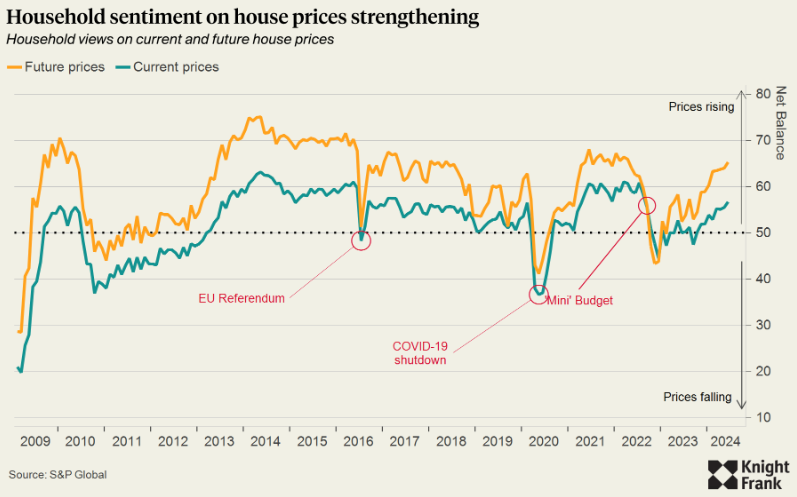

Falling mortgage rates will boost sentiment, which is improving already. S&P Global's measure of household views on the trajectory of house prices now and in the future show a clear post-election bounce (see chart).

UK business confidence is also on the rise. Private sector activity increased during July, according to the latest PMI. New business expanded at the fastest rate in 15 months. Firms increased staffing numbers at the fastest pace for more than a year. Expectations of future activity are near a two-year peak.

“The first post-election business survey paints a welcoming picture for the new government, with companies operating across manufacturing and services having gained optimism about the future, reporting a renewed surge in demand and taking on staff in greater numbers," says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. "Prices have meanwhile risen at their lowest rate for three and a half years, further raising the prospect of a summer rate cut."

Difficult choices

It's not all rosy for the new government. Chancellor Rachel Reeves will provide an update on the state of the public finances on Monday, which is expected to show a near £20 billion funding shortfall for public services.

Reeves and her colleagues have so far been reluctant to share details on how this will be fixed, having made promises during the election campaign that the party wasn't planning to hike taxes, including on property. We may get more details in the Sunday papers, but it sounds like everything is on the table. Here is Bloomberg's report on Reeves speaking with reporters at a gathering of finance chiefs from the Group of 20 in Rio de Janeiro:

"Asked whether she still had “no plans” to raise taxes on wealth, property or inheritance in Britain, as Labour repeatedly said during the election campaign, Reeves did not reiterate that commitment."

In other news...

Hammerson offloads stake in Bicester Village owner (company announcement), LVMH leads sell-off in global luxury shares as downturn fears deepen (FT), Housebuilding must double to hit Labour target of 1.5m in 5 years (Times), sterling dips as investors raise bets on BoE rate cuts (Reuters), UK mortgage rate surge pushed 320,000 into poverty, report shows (Reuters), BoE gets a positive hint about rate cuts from services prices (Bloomberg).