UK rural property: Farming, in the blood for good or bad

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

9 minutes to read

Opinion

By the time you read this I’ll be off on a four-week sabbatical marking 15 years at Knight Frank. Combined with the time I spent as Business Editor at Farmers Weekly that’s almost a quarter of a century writing about food and farming – scary! One of the common themes I’ve covered over those years has been the lack of equity in the foodchain. I don’t fully subscribe to the theory that it’s all the fault of the supermarkets – they are just as much a product of the society we live in as vice versa – but it’s clear where the power lies. Call me a cynic, but the announcement discussed below that two US food giants are going to set aside a tiny percentage of their profits to encourage farmers to become more regenerative is a good example. For decades they’ve put pressure on prices so agriculture responds by intensifying, then when the political winds change they suddenly demand that farming goes green. The big question is why do so many farmers keep going under this kind of pressure? Many of them have an enviable capital base, so they could sell up and do something else. The answer to me is that farming and the land is somehow in our blood – it’s hard to walk away. Even on my sabbatical I’ll be catching up on my rural reading and casting half a glance at the field opposite our Swedish summer cottage as a potential retirement project, even though I know full well how hard it is to make money from producing food AS

The Rural Update is now on its summer holidays until 14 August.

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update direct to your email here

Andrew Shirley, Head of Rural Research; Mark Topliff, Rural Research Associate

In this week's update:

• Commodity markets – Russian attack boosts wheat markets

• International news – US food giants increase regen support

• Welsh whisky – Protected status provided

• Out and about – Sabbatical reading list

• Planning – Government announces reform details

• EPCs – Government backtracks on residential requirements

• BNG – Statutory credit prices released

• Calf housing – New improvement cash released

• Countryhouses – Prices weaken

• Land values – Price growth slows

• The Rural Report – 23/24 edition is out now

Commodity markets

Russian attacks boost wheat market

Feed wheat prices climbed another 4% last week as Russian attacks on grain-handling facilities at key Ukrainian ports sent jitters through the market. As reported last week, values were already on the rise after Vladimir Putin declined to extend the Black Sea grain corridor agreement.

On the flip side, red diesel prices are also on the rise just as the combines start hitting the wheat. I can clearly remember how much a litre of diesel cost 12 months ago because I forked out an eye-watering £200 to fill up the 100-litre tank of my car before embarking on the long drive to Sweden. This year’s bill of £144 was less wallet-busting, but with crude prices set to register a fifth straight week of gains following strong economic data in the US, speculation over Chinese stimulus measures and potential OPEC+ output cuts, it’s not good timing for farmers. MT

Talking points

International news – US food giants boost regen support

Fizzy drink and snack producer PepsiCo and retailer Walmart have just announced a further US$120 million of funding to help farmers in North America bring over two million acres under regenerative farming practices by the end of 2030. The firms estimate that the two million acres will be able to deliver more than four million tonnes of greenhouse gas reductions and removals.

As reported by ESG newswire Edie, the initiative builds on the good giants’ existing pledges: PepsiCo has already committed to facilitate the adoption of regenerative agriculture across seven million acres globally - equivalent to its total agricultural footprint. Walmart and its philanthropic foundation have an ambition to improve sustainable management practices on 50 million acres of land by 2030 AS

Welsh whisky – Protected status provided

Single malt Welsh whisky - something I wasn’t aware of, but which Defra head honcho Thérèse Coffey says is “acclaimed for its lightness of character” – has just been successfully registered under the new UK Geographical Indication (UKGI) scheme. The scheme provides a guarantee to consumers that the product they are buying is authentic and protects single malt Welsh whisky producers from imitation products.

As some of you may know I also produce the Knight Frank Luxury Investment Index (KFLII), which tracks the value of collectables such as rare single malt whisky. Whether the Welsh dram can challenge the hegemony of Scotland remains to be seen, but the latest KFLII results will be out next week if you interested in how rare bottles of whisky (not to mention a whole host of other collectables like art, classic cars and wine) are performing AS

Out and about – Sabbatical reading list

I’ll be spending the next four weeks on sabbatical after notching up 15 years at Knight Frank. One of the things I plan to do is lie in a hammock with a cold drink or two and make some decent inroads into the stack of books, some of which are pictured above, that has been accumulating on my bedside table, a good chunk of which focuses on food, farming and the countryside. Wish me luck – the boys may have other ideas! AS

Need to know

Planning – Government announces reform details

Last week my colleague Mark revealed that the government was planning to introduce new permitted development rights that would make it easier for farming businesses to convert redundant agricultural buildings into alternative uses. Full details of its planning reforms have now been released. Amongst other things, this note from my colleague Oliver Knight provides a handy guide to the reforms and their potential impact on the construction of new homes in England. If you need planning advice please contact Roland Brass AS

EPCs – Government backtracks on rental requirements

There were metaphorical howls of excitement to be heard over our Rural Consultancy Whats App group when the news broke that the government has backtracked on plans to make it mandatory for all houses being rented out in England and Wales to achieve an EPC rating of at least C by 2028 and for new tenancies by 2025.

The move is part of Rishi Sunak’s new pre-general election drive to ensure that achieving the country’s green ambitions doesn’t become too much of a financial burden for firms and individuals.

It had been feared that the rules would dramatically reduce the stock of rental housing as landlords sold up rather than face the cost of expensive energy efficiency measures. Campaign groups such as the CLA have also long argued that the methodology used to calculate EPCs doesn’t take into account the building materials and methods used in many traditional rural properties. Contact my colleague Jess Waddington if you need advices rented rural residential portfolios AS

BNG – Statutory credit prices released

The government has just released indicative values for the cost of statutory biodiversity credits that developers can buy as a last resort if they are unable to use on-site or off-site units to deliver biodiversity net gain (BNG) requirements. As the option of last resort, the credits are priced accordingly starting from £42,000 (plus VAT) for a grassland credit, through to £125,000 for a woodland credit, and up to £650,000 for a peat lake credit. Confirmed prices will be published when BNG becomes mandatory in November AS

Calf housing – New improvement cash released

From later this summer, cattle producers, as part of the Animal Health and Welfare Infrastructure grant, will be able to apply for grants of between £15,000 and £500,000 to co-fund new and upgraded calf housing that improves social contact and the ambient environment. Options could include funding for an A-frame building to house dairy calves from birth to weaning, or even funding for rooftop solar panels to provide thermal insulation and low-cost energy for calf housing.

Defra says in time the offer will be extended to include grants for adult cattle, pig and poultry housing. For more information on this and other rural grant funding opportunities please contact our resident expert Henry Clemmons AS

On the market

A world of opportunity – Farms for sale on four continents

If your agricultural property horizons extend beyond the shores of the UK, my colleagues around the world in the US, Australasia, Africa and Europe can help. The latest edition of The Rural Report includes a mouth-watering melange of international rural properties from natural capital opportunities in New Zealand to commercial arable farms in Zambia, to vineyards in Italy and France. Download the report to take a look AS

Our Latest Property Research

Countryhouses – Prices weaken

Country house prices came under pressure in the second quarter of the year, as the ‘escape to the country’ trend reset, and buyers re-calculated their budgets due to higher borrowing costs.

The average price of a property fell 2.6% in the second quarter, according to the Knight Frank Prime Country House Index (PCHI), compiled by my colleague Chris Druce. It was the largest quarterly fall since the global financial crisis in Q2 2008. It follows a decline of 0.5% in Q1.

It left country house prices down 4.2% since their peak in June 2022, although the average property is still worth 15% more than before the pandemic, which supported a surge in prices as people upgraded their homes and took advantage of a period of stamp duty savings.

Download the full report or contact Chris for more information AS

Farmland values – Price growth slows

According to the latest instalment of the Knight Frank Farmland Index, the average value of bare agricultural land in England and Wales rose during the second quarter of the year at the slowest rate since March 2021.

Prices increased by just over 1% to £8,845/acre. Annual growth at 8% also slipped into single figures for the first time since the final three months of 2021.

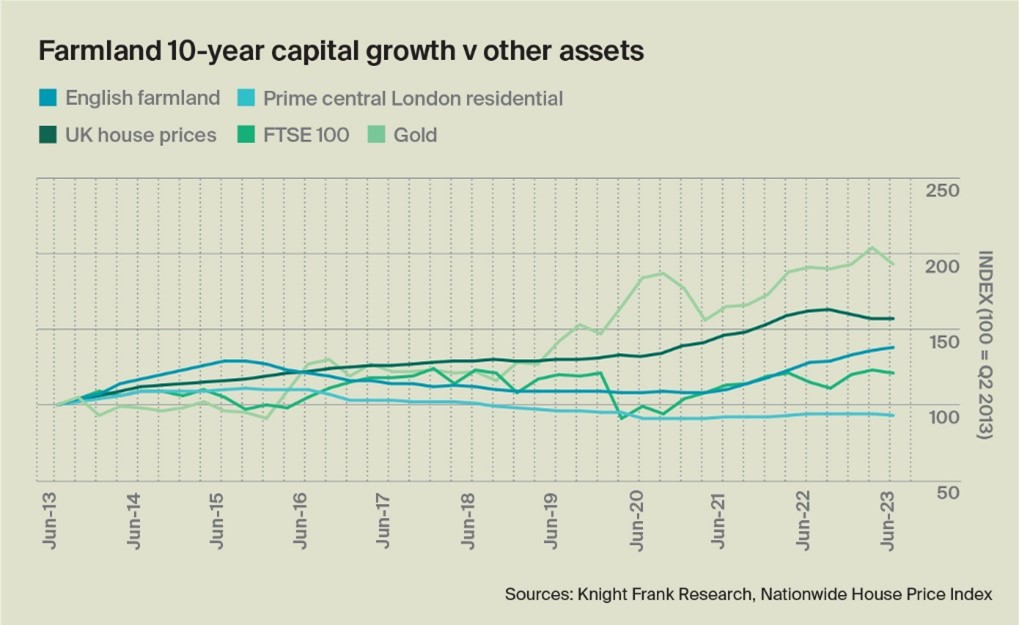

Farmland, however, has outperformed the FTSE 100 equities index, gold, prime central London houses and mainstream house prices over three and 12-month periods. Over five years, only gold has seen stronger capital appreciation.

For more data and insight, please read the full report AS

The Rural Report – 23/24 edition is out now

The Rural Report 23/24 explores the opportunities for businesses, people and this year's theme 'Planet'. With insight and case studies on natural capital, biodiversity net gain and environmental legislation, it's a guide to the ever-changing rural landscape and how Knight Frank's rural teams are supporting their clients make the most of the opportunities on offer.

Whether you are a rural business owner or a commercial business wanting to make the most of your land, read a selection of articles online and download the full report here MT