Spanish hotel investment bounces back

Tourists flock back to the popular holiday destination as luxury hotels adapt domestic offering.

4 minutes to read

The hotel sector in Spain is getting itself ready for tourism to regain pre-pandemic levels. Investors are buying up land for new-build hotel projects, as well as other properties that can be repurposed as hotels.

Hotel investment reached over €2,100 million by the end of 2021, an improvement on the figure recorded for 2020 with Madrid and Barcelona the hottest investment targets.

Investment is also being made in refurbishing some existing hotels to turn them into first-rate establishments equipped to offer what today’s tourists are looking for after a prolonged period of being unable to travel.

New and refurbished market

Following the easing of a number of measures, some major hotels have already opened their doors in several locations across Spain.

Madrid’s world-renowned Hotel Ritz, now renamed Mandarin Oriental Ritz reopened its doors following an ambitious refurbishment of both its interior and its range of dining options.

Although many hotels have already opened in recent months, others are planning to do so very shortly and, while resort hotels are currently what the majority of tourists are seeking, some of the upcoming openings also include hotels focused more on city-based tourism.

An example of this is Barceló which is set to open a new luxury hotel in the former Canfranc railway station in the province of Huesca in Winter 2022. El Corte Inglés is another, planning to unveil its first hotel establishment in Madrid’s Salamanca district – a project that will see it convert two residential buildings into a hotel and that already has the City Council’s backing.

Continued investment

It was an extremely tough year for the hote sector in 2020, with the investment figure for the year rising to just €1,000 million. However, the situation began to improve in 2021, with more than €2,100 million invested by year-end – up 105% on the figure booked to 2020 – a trend that extended into the first two months of 2022, with just short of €800 million invested by the end of February.

This growth can be attributed to a number of factors, such as a lack of liquidity among many hotel chains following several months of enforced closures in the hotel market, as well as the interest among some funds to resume their investment in high-potential assets.

There are some notable investments taking place such as an acquisition of a plot of land by the family company belonging to footballer Gerard Piqué, which plans to build a 5* hotel operated by Melia on a plot formerly home to a cinema in Malaga.

Other footballers such as Leo Messi and Cristiano Ronaldo have also invested in the Spanish hotel sector with similar projects. Meanwhile, international chain easyHotel has acquired a plot in Barcelona’s Sagrera neighbourhood, where it plans to open a new 75-room hotel towards the end of 2022.

Luxury hotels adapting

Due to the slump in international tourism, the Spanish luxury hotel segment has switched its focus to domestic and business clientele.

As such, it has been forced to adapt its business model and the service offered, catering for the needs of a more Spanish rather than international-based clientele.

In many cases the lion’s share of the guests at these types of hotels used to be Asian, American or Latin American – nationalities that tended to have a far higher average spend than other nationalities.

For domestic clients, luxury hotels are rolling out afternoon/evening leisure initiatives that can be enjoyed by business travel guests once their working day has ended.

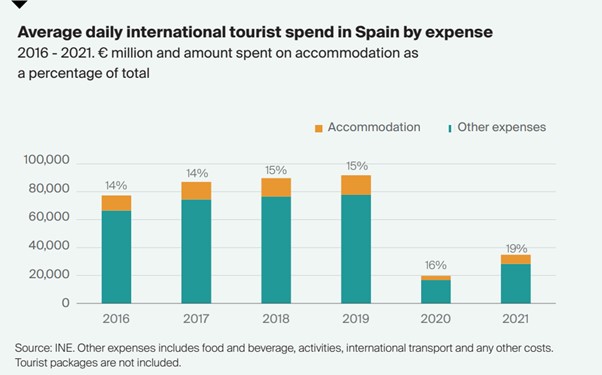

Despite the lower number of international tourist arrivals, people visiting from overseas have spent more on accommodation since the pandemic broke out, allocating a total of 19% of their budget in 2021, compared to 14% in 2016. This is largely due to the fact that tourists have become more discerning in terms of where they stay – a shift that is having a direct impact on the performance of the luxury hotel segment.

However, the latest data to be released is starting to show that this trend is once again reverting, with tourism from overseas starting to dominate once again. In January 2022, more than 5,700 hotels in the gold category (excluding hostels) were open for tourism, almost 40% more than a year earlier and 7% more than in 2019

Adapting for clientele

More attention has also been paid to business travel guests, renovating some areas to ensure its establishment offers spaces from which people can work comfortably and efficiently.

Rooms with comfortable offices and meeting rooms, along with sports and wellness facilities that allow guests to unwind at the end of the working day are some of the things that this type of clientele looks for most.

Current and future hotel trends

The pandemic has changed the way in which we travel and although we are starting to see things get back to the way they were in some aspects, many of the trends that have appeared over recent months will continue to form part of how we travel for some time to come.

Queueless receptions, sustainable hotels, strengthening client loyalty, a move to remote working and an increase in the length of hotel stays are some of the trends that are ongoing or have been born out the pandemic.