Monthly UK Residential Property Update: November

Residential property market hits new high ahead of second national lockdown

5 minutes to read

Ahead of England’s second national lockdown the residential property market maintained the momentum seen since reopening in May.

There were 105,630 UK residential transactions in October 2020, 8% higher than October 2019 and 10% higher than September 2020, according to provisional data from HMRC. Net mortgage borrowing was £4.3bn in October, and mortgage approvals for house purchase increased further to 97,500, which was the highest level since September 2007.

Total Stamp Duty Land Tax (SDLT) transactions surged between July to September and were 68% higher than in Q2 2020 as a result of the easing of the COVID-19 lockdown measures and the introduction of the residential SDLT holiday. Total SDLT transactions in Q3 2020 were 18% lower than in Q3 2019.

According to Halifax the average UK house price reached a new high in October, standing 7.5% higher than a year ago at £250,457. This was the strongest annual growth since June 2016.

However, on a monthly basis house prices in October were just 0.3% higher, compared to a 1.5% increase in September. The lender added that with the housing market facing a number of headwinds, it expected “downward pressure on house prices as we move into 2021”.

The latest House Price Sentiment Tracker produced by IHS Markit for Halifax reinforces this sentiment. While the net reading remained positive at 51.6% in November, this was down from 52.4% a month earlier with fewer people of the view that the price of their home rose in November compared with October.

The RICS UK Residential Market Survey for October suggests a similar trajectory. The current high levels of activity in the market are expected to be sustained in the short-term based on the strength of buyer enquiries, agreed sales, new instructions and prices in the past month. Sales expectations for the next three months remain positive, with a net balance of +17% of survey respondents expecting an increase. However, surveyors are increasingly downbeat about the twelve-month outlook, with a net balance of -27% anticipating sales will weaken over the next year.

While the market remains open during the latest lockdown, the impact that further restrictions will have on sentiment will dictate the shape the next few months will take. Initial feedback has been mixed, with some agents reporting being quieter in part due to confusion about whether the housing market was remaining open. Others report no noticeable change days into the second lockdown, and some have said the new restrictions have led to a stronger resolve to act amongst prospective buyers.

The stamp duty holiday in England and Northern Ireland is due to end on the 31 March 2021, meaning the window to complete in is narrowing. While the holiday will continue to drive activity in the coming months, lockdown could also increase the strain already being felt by the conveyancing system, which is struggling due to the high volume of transactions. This has prompted calls for an extension to the stamp duty holiday.

Unless an unusually large amount of deals fall through over the coming weeks, transactional activity is likely to remain high into 2021, after an all-time record number of offers was accepted by Knight Frank during October.

Prime London Sales

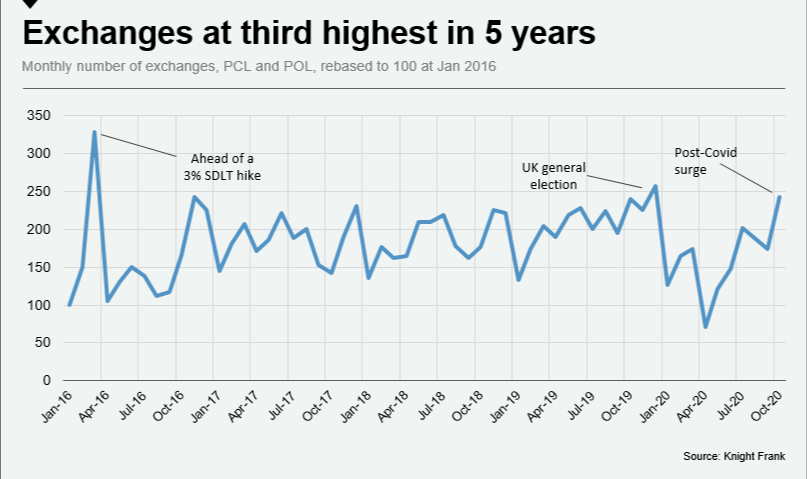

The extent of the post-lockdown surge means October was the third highest month in five years for exchanges in London.

However, this surge should be seen in the context of a market that has behaved erratically over the course of this year. The overall number of exchanges was 19% down in the first ten months of the year compared to 2019, see chart below.

Meanwhile, prices have continued their upwards trajectory of recent months. Quarterly growth remained at 0.2% in prime central London for the second consecutive month. In prime outer London, prices rose 0.9% in the three months to October, which was the highest such rise in five years, as more buyers seek outdoor space and greenery.

See the Prime London Sales Report: October for more.

Prime London Lettings

In prime central London, average rental values declined 9.1% in the year to October, continuing a trend that started during the first national lockdown in England. In prime outer London, the decline was 7.6%.

Supply has increased due to the addition of short-term lettings properties onto the market, a sector where demand has been curtailed by the pandemic.

Furthermore, more owners have decided to let rather than sell due to uncertainty surrounding the trajectory of prices as the impact of Covid-19 on the economy becomes clearer.

See the Prime London Lettings Report: October for more.

Country Market

Country house prices grew at their strongest rate since the start of 2016 in the third quarter of this year, as buyers’ desire for space and greenery after lockdown continued to drive the market.

In the three months to September values rose by 2% taking annual growth over the year to September to 2.3%, according to the Knight Frank Prime Country House Index.

This was the strongest annual price performance since March 2016.

In Scotland, quarterly price growth of 0.8% in Q3 was the best performance in the Scottish property market since December 2014 and pushed annual growth to 0.7%.

And within Scotland, Edinburgh was a star performer in the period. Property values in Scotland’s capital increased by 2.3% in Q3, which was the strongest quarterly increase since Q2 2018. This pushed the Knight Frank Edinburgh City Index to its highest point since inception in 2008.

With no spring market this year, and lockdown providing people with time to reconsider their lifestyles and property needs, Edinburgh saw all-time records set for instructions for sale, viewings and offers accepted between the Scottish market reopening on 29 June and the 22 September.