Asia-Pacific real estate: A diverse landscape of opportunities in 2024

As we move into the second half of 2024, the Asia-Pacific real estate market is primed for a significant pick-up in investment transactions. Despite earlier expectations of multiple rate cuts, recent strong economic data has pushed back the timeline for policy easing. The Federal Reserve now anticipates two 25bps cuts in September and December, prompting many Asia-Pacific central banks to hold steady in the near term and gradually ease in 2025.

2 minutes to read

A unique and complex market

As observed in Knight Frank’s Horizon Report III – Look Beyond the Norm, unlike the more homogeneous North American and European markets, Asia-Pacific offers complex economic environments and policy approaches. This diversity makes it challenging to identify consistent market trends, but it also provides numerous opportunities for savvy investors looking to maximise returns. Interest rates across the region vary significantly, from marginal increases in Japan to steep hikes in markets such as Australia, Hong Kong SAR, Singapore, and South Korea. These variations have diverse impacts on real estate values, creating a rich landscape of investment possibilities.

The road to market recovery in the coming year promises to be uneven, reflecting diverse market fundamentals. This inconsistency is particularly evident in the office sector, where a clear bifurcation is emerging. Return-to-office trends differ markedly between countries and even cities, influenced by local work cultures and government policies. Simultaneously, a flight to quality and increasing emphasis on green buildings are reshaping demand, with premium, sustainable office spaces outperforming their older counterparts.

Cross-border investment trends

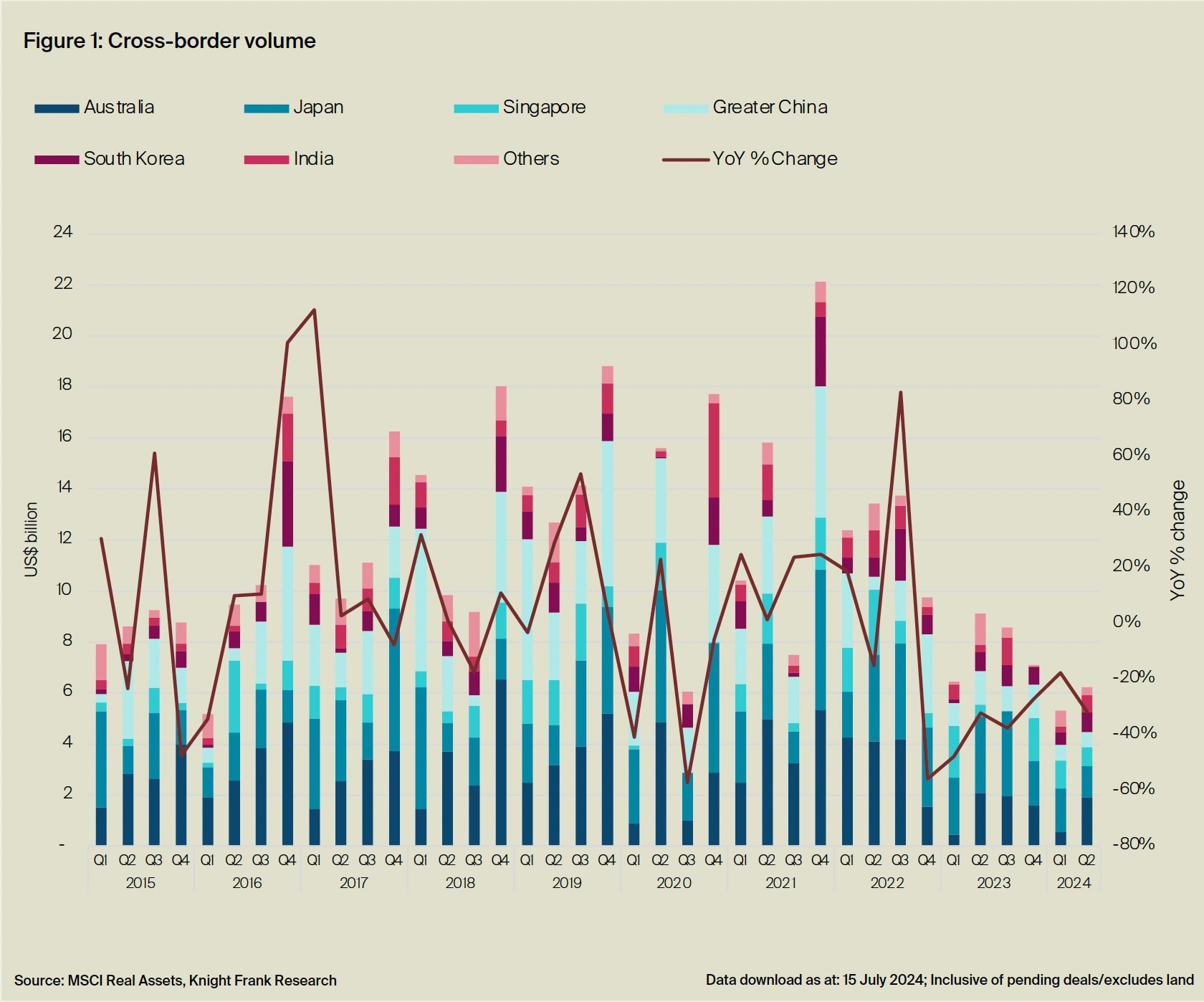

Cross-border investments have experienced a harsh retreat since interest rates started to hike aggressively in the second half of 2022. However, encouraging signs of recovery are emerging. Cross-border transactions in Asia-Pacific recorded US$6.2 billion in Q2 2024, a 17.4% increase compared with the previous quarter.

Our research indicates that Australia is set to receive the highest cross-border investment volumes in the second half of 2024, representing a 129% increase from the same period last year. This positions Australia as the top destination for cross-border capital in 2024. Japan and Singapore maintain their second and third positions, attracting approximately 23% and 11% of cross-border capital, respectively.

Source: Capital Gravity Model 2024, Knight Frank Active Capital Research

Historical data from past crises reveal that transaction volumes in the region tend to return to normal levels within 30 months. As the 24th month of the high-interest-rate-induced downturn approaches, it appears that the second half of 2024 presents an optimal timeframe for seizing investment opportunities in undervalued assets. Preliminary signs of recovery have already been observed in key markets such as Australia and South Korea, signaling a gradual return to pre-crisis levels across the region.

Cross-border transactions in Asia-Pacific recorded US$6.2 billion in Q2 2024, an encouraging 17.4% increment compared to the quarter prior, according to data from MSCI Real Assets. Although it is still nearly one-third lower than the same period in 2023 (see Figure 1), the rate of decline is slowing down, which is an early sign that we are approaching the bottom.

Looking ahead

As we progress through the second half of 2024, we expect a return to normalcy in the Asia-Pacific real estate market. The diversity of the region presents both challenges and opportunities, requiring investors to adopt nuanced, market-specific strategies. With the right approach, investors can capitalise the unique dynamics of the Asia-Pacific market, leveraging its complexity to find valuable opportunities in this evolving landscape.