Slowly but surely, UK inflation is receding

Making sense of the latest trends in property and economics from around the globe

2 minutes to read

The UK's annual rate of inflation is continuing its painfully slow return to the Bank of England's 2% target.

The Consumer Prices Index rose 3.2% in the year to March, down from 3.4% in February, the ONS said this morning. Analysts had been expecting a fall to 3.1%. Core CPI, which excludes volatile items like energy and food, fell to 4.2%, from 4.5%. Services CPI dipped to 6.0%, from 6.1%.

Not great, but not bad either. We'll keep an eye on swaps rates, but these figures are probably enough to maintain the prevailing stability in the mortgage market.

The divergence

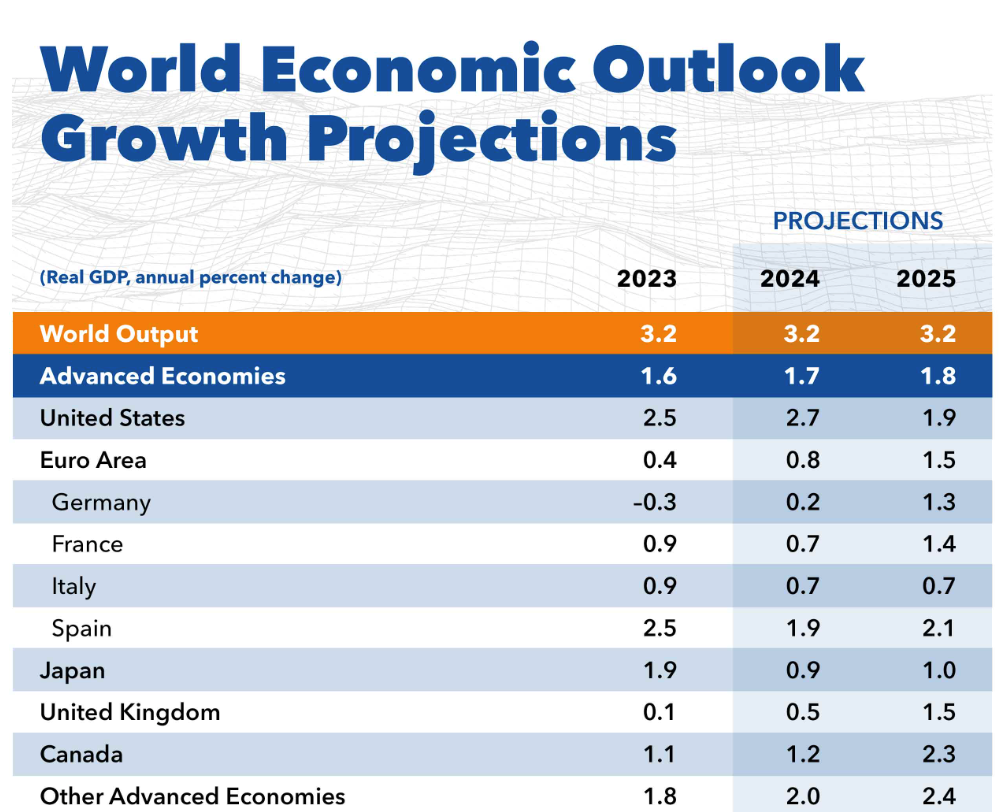

The CPI provides further evidence that the US economy is diverging from those in Europe. Indeed, IMF forecasts out this morning suggest that the US economy will expand 2.7% this year, double the rate of any other G7 nation.

It looks increasingly likely that US rate cuts will only arrive very late this year, if at all. In a panel discussion yesterday, Federal Reserve chair Jerome Powell confirmed that officials would need a meaningful change in the data if they are to have the confidence to ease monetary policy:

"The recent data have clearly not given us greater confidence and instead indicate that is likely to take longer than expected to achieve that confidence," he said, according to Bloomberg, before adding: "Given the strength of the labor market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us."

Different paths

Bank of England governor Andrew Bailey is fielding as many questions about inflation on the other side of the Atlantic as he is at home. I've talked a lot in recent notes about the degree to which the European Central Bank and the BoE will opt to wait for the Fed before cutting rates.

Mr Bailey addressed that question yesterday for the first time since it became clear that the US is on a different economic path. In an interview with the IMF, he pointed out there is more demand-led pressure in the US than in the UK, where he said there is "strong evidence" of price pressures retreating.

“The dynamics of inflation are rather different between Europe — I mean Europe geographically now — and in the US,” he said, according to the Bloomberg transcript. In the UK “we’re still seeing the extension of the process of coming out of the big supply shocks, the impact of the war, the impact of coming out of Covid.”

European Central Bank president Christine Largade is pushing a similar message: “If we don’t have a major shock in developments, we are heading towards a moment where we have to moderate the restrictive monetary policy that we have,” she told CNBC yesterday.

In other news...

Hunt raises possibility of more tax cuts before general election (FT).