Inflation falls, but not how the Bank of England would like

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

The long way down

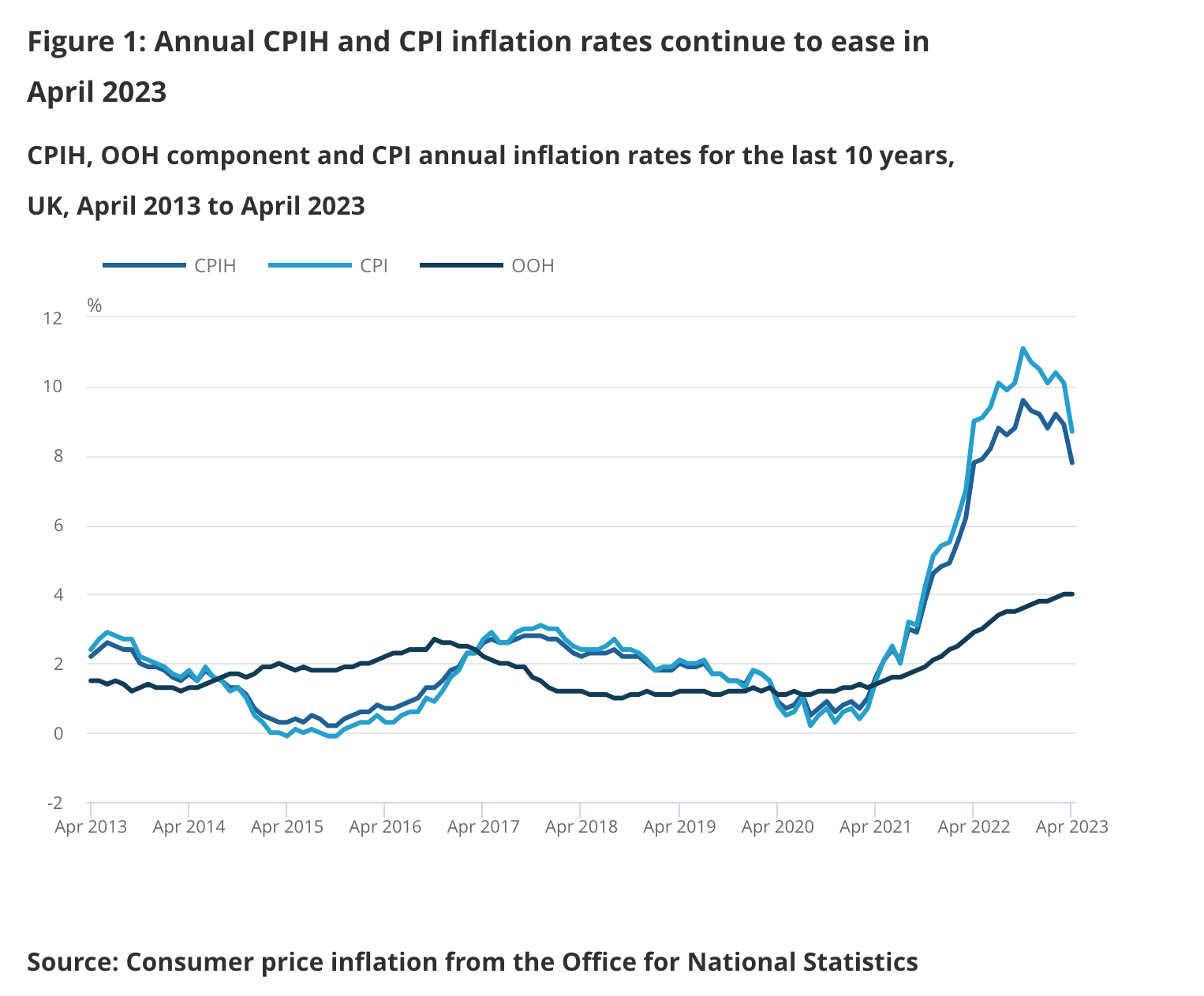

The consumer prices index (CPI), the UK's headline rate of inflation, fell to 8.7% during the year to April 2023, down from 10.1% in March, according to official figures out this morning.

The bumper rise in energy prices that took place last April dropped out of the annual comparison, shaving 1.42% off the headline reading. Still, core CPI, which excludes volatile components like energy and food, rose 6.8% during the year to the highest rate since March 1992. That's up from 6.2% in the year to March.

We'll cover the reaction on Friday but there's little in here to suggest that the Bank of England will feel confident pausing with the base rate at its current level of 4.5%, barring any economic shocks before the next meeting on June 22nd. Indeed, everything we've seen recently suggests that the economy is weathering this period of higher interest rates pretty well, giving policymakers more leeway to keep tightening. We looked at the latest consumer confidence figures on Monday, for example.

The IMF doesn't like stamp duty

Monetary policy will indeed need to remain tight in order to keep inflation expectations well-anchored and bring inflation to target, the IMF said in its latest UK update yesterday.

It now expects the UK to avoid a recession this year, "buoyed by resilient demand in the context of declining energy prices". The financial system has also weathered the recent global banking system stress well. The IMF now expects growth to slow to 0.4% this year, a 0.7% upgrade from its April forecast. Growth is projected to rise gradually to 1% in 2024 as disinflation softens the hit to real incomes, and to average around 2% in 2025 and 2026, mainly on the back of a projected easing in monetary and financial conditions.

"Realizing the UK’s full growth potential will require wide-ranging, further evidence-based reforms, including addressing the post-pandemic rise in labour inactivity, mainly due to long-term illness; removing impediments to business investment, especially policy and regulatory uncertainty; and enhancing public investment and transformational spending to boost productivity and accelerate the green transition," the group said.

Interestingly, part of the IMF's solution would be "to reform property taxes, including by updating real estate valuations and rebalancing away from transaction taxes that constrain housing and labour mobility" - in other words scrapping stamp duty. The group also calls for more incentives for the green transition, for example expanding the grant program for low-income households' heat pump installations.

Homeworking

A survey of 558 central London workers by the think-tank Centre for Cities and researchers at Imperial College London offers a fresh update on the return to the office. As of last month:

(a) Central London workers came into the office 2.3 days per week, 59% of January 2020 levels.

(b) The most common working pattern was two days in the office. Of those who go to their workplace, 31% do so two times per week. That said, almost half of workers went into their workplace for three, four or five days.

(c) Younger workers were more likely to be in the office than older workers, as were workers who lived within Greater London.

(d) Three quarters of companies have mandated that their workers come into the office at least one day per week, and over a quarter of workers come in more frequently than this baseline requirement.

The data chimes with our Global Corporate Real Estate Sentiment Index, which suggests that the return to office will continue to be slow and steady rather than explosive. It also affirms that the endpoint is likely to be short of pre-covid levels of occupancy as businesses continue to adopt and adapt new styles of working.

Data from Transport for London on Tube exits in parts of the Capital dominated by offices shows how the recovery has played out from virtually no commuting during lockdowns. There was a large increase in exits in the second half of 2022 (despite storms and strike action), with exits up 40 percent between April and November 2022. Since January exits from the same TfL stations have remained around 70% of February 2020 levels.

High-productivity, knowledge-intensive activities which make up the most productive parts of the UK economy are concentrated in central London, and Centre for Cities warns there may be "long-term costs from reduced spontaneous interaction between colleagues."

In other news...

German coalition in crisis over plans to ban gas boilers (FT), Natural England blamed for blocking new homes (Times), and finally, UK's chancellor-in-waiting lays out plan for more activist state (Bloomberg).