Global Residential Outlook 4 June 2020

A roundup of the latest data and insight on key global residential markets

6 minutes to read

Residential digest

Housing market data for April is now filtering through and for a handful of markets, who report almost on a real-time basis, such as Hong Kong, Brazil and Iceland data is now available for May.

Some markets are displaying a surprising degree of resilience. As the Financial Times points out, “The scale of economic collapse makes it tempting to deduce that prices must fall sharply. Precedent, at least in big global capital cities, suggests otherwise.”

Prices in Australia dipped just 0.4% in May, whilst transactions in Hong Kong increased 45% month-on-month despite challenging headwinds.

Need to Know

Singapore, France, Greece, Turkey, Australia and the UK are amongst those countries to have announced a further lifting of lockdown measures in the last week with schools and businesses starting to reopen after two months of lockdown.

Our real-time economic data tracker shows all of the 18 cities we monitor saw an increase in visits and time spent at places of retail and recreation in the past month. The highest increases in mobility were recorded in Milan, Paris and Vienna.

The UK Government is sticking with its plans to introduce a 14-day quarantine period from 8 June but the Home Secretary confirmed yesterday that discussions are underway with Portugal, France, Spain and Greece to open air bridges. Such bridges will go one step beyond a simple agreement between countries who both have low transmission rates, they will also mean recognising each other’s departure screening measures for passengers.

More airlines have announced plans to increase capacity with Easyjet confirming it will resume flights to three-quarters of its destinations by August and in the US, United Airlines is due to increase its international flights from July onwards.

The data visualisation below provides a valuable perspective on global mobility levels and recovery rates. Most of the countries witnessing high rates of recovery and improving population mobility (top right quadrant) are located in Asia Pacific with most EMEA economies yet to see mobility rates recover strongly (data as at 29 May). Click here for the full version of the graphic.

Source: Visual Capitalist

Europe

The European Commission’s economic sentiment indicator rose by 2.6 points to 67.5, based on a poll of some 135,000 businesses and 32,000 consumers across the region in May with the Netherlands, Germany and Spain registering the largest uptick in sentiment, albeit from a low base.

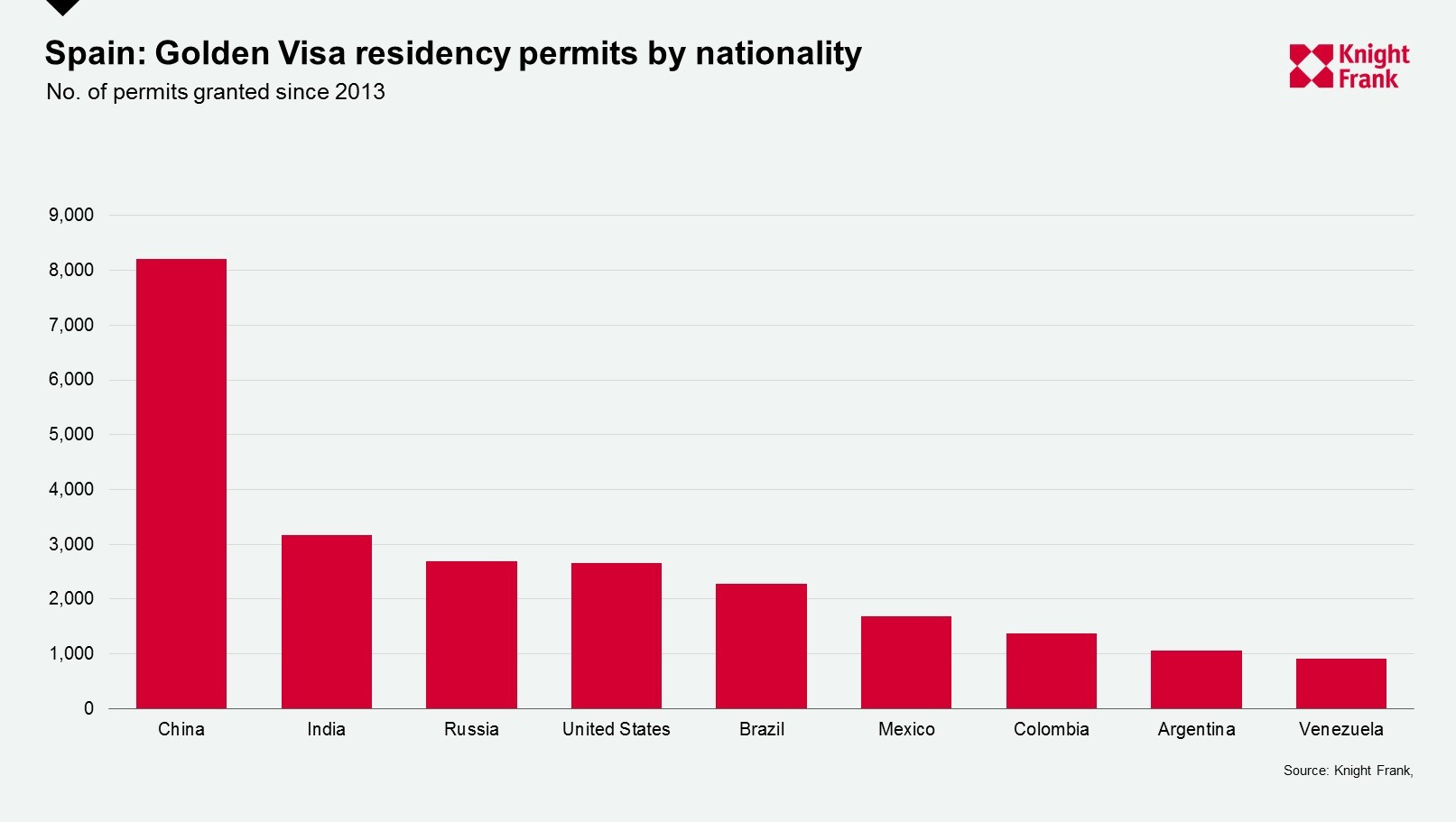

In Spain, the latest Golden Visa statistics reveal that 8,061 residence permits were issued "for investment reasons" to non-EU citizens in 2019, of which only 700 were for residential purchases (€500,000+). According to Government data, since 2013 when the initiative commenced, Chinese nationals have accounted for the largest number of applicants by some margin.

In the UK, we set out our latest residential market outlook at the start of the week. Demand has surged and supply will take a while to catch up, a fact buyers and sellers looking to act quickly should recognise. In London, demand for property is recovering towards pre-lockdown levels faster than supply, reducing downwards pressure on prices. Average prime central London prices fell by 1.4% in May, taking the annual change to -5.1%.

Asia Pacific

Our weekly sentiment survey of Asian research teams shows residential activity continues to pick up across the region, with China and Hong Kong leading the way in terms of activity, although Seoul and Kuala Lumpur are now seeing sales volumes increase for the first time since the crisis. Price rises remain largely confined to Shanghai, Shenzhen and Seoul.

Our latest Hong Kong Monthly Report confirms that transaction volume increased by 6% month-on-month to 4,102 in April, but data has subsequently been released for May showing a jump to 5,984 sales, a 45% rise month-on-month.

Some notable transactions were recorded in April as highlighted below.

Both Hong Kong and Singapore are to start allowing transit flights from 1 June, a further step to the normalizing of travel rules.

In China, my colleague Justin Eng highlighted the economic takeaways and property implications from China’s delayed National People’s Congress, an annual gathering of the Communist Party of China in Beijing where a body of around 3,000 members vote on important pieces of legislation.

On top of the boost in fiscal spending and credit expansion, the NPC also called for more monetary easing in the form of a reduction in interest rates.

In Australia, dwelling values are proving resilient, declining by just 0.4% in May according to CoreLogic, their first monthly decline since June 2019, but still 8.3% higher year-on-year.

Meanwhile, Prime Minister Scott Morrison is set to announce a multibillion-dollar construction stimulus by offering grants to build more than 100,000 new homes and create thousands of jobs. The package is expected to include grants of up to AU$20,000 to new-build purchasers.

Additional new stimulus in the form of a AU$11 billion new metro line linking the new Western Sydney airport and St Marys railway station has also been announced and will complete in time for the opening of the Western Sydney International Airport in 2026.

Despite a backdrop of relative resilience and new stimulus, Australia’s economy fell into recession for the first time in 30 years with GDP contracting for two consecutive quarters. Nonetheless, Oxford Economics forecast a peak-to trough fall in GDP below 10% - a better outcome than many other developed nations. The Australian dollar surged on the back of this news, reaching a five-month high of 69.83 US cents.

US & Canada

Data from the US has defied expectations in recent weeks. Firstly, new homes registered a 0.6% increase during April which Capital Economics attributes to relatively affluent buyers, a streamlined selling process and incentives from developers.

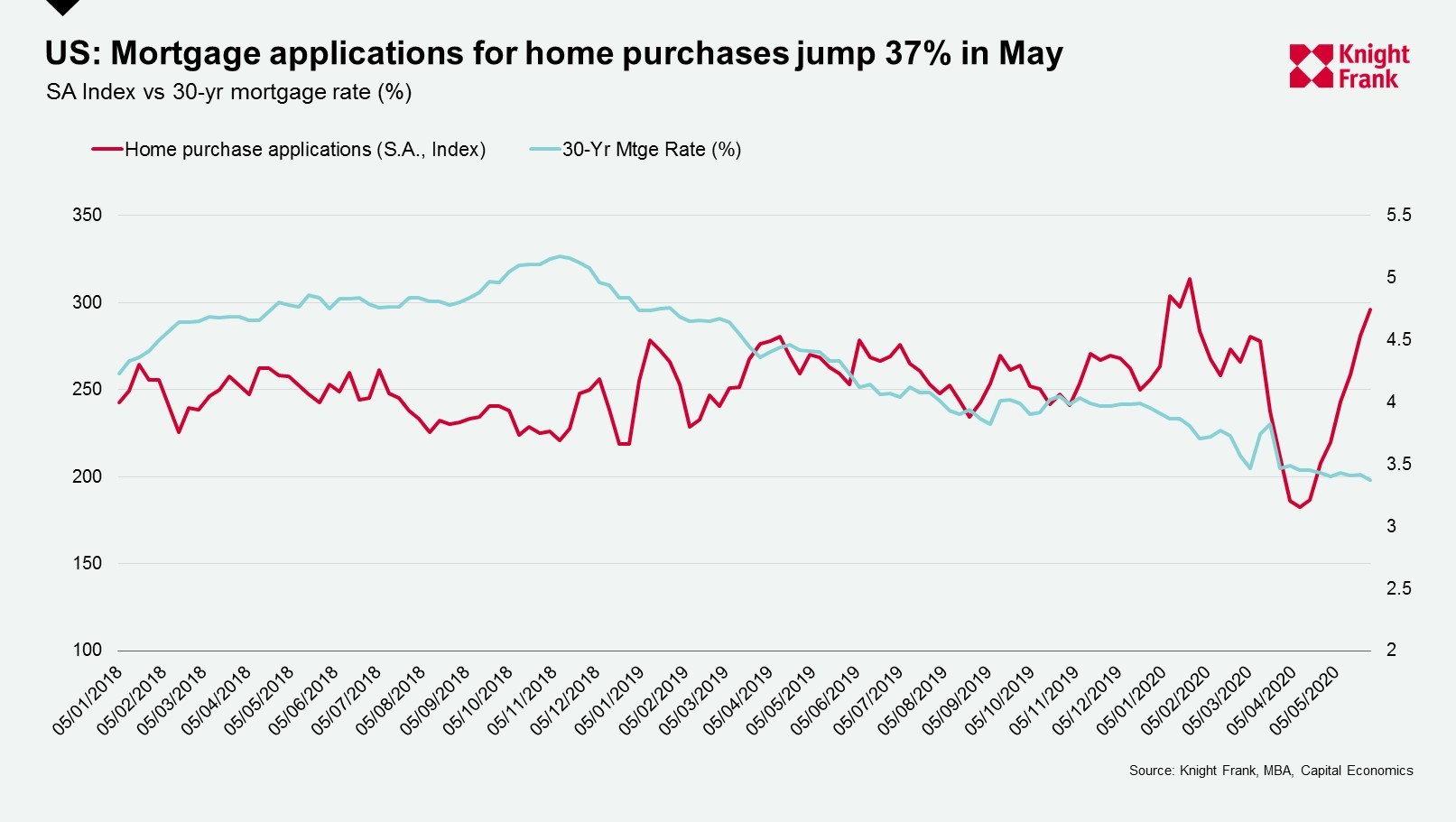

Add to this, news this week that mortgage applications in May recorded a 37% jump month-on-month, the largest monthly increase on record. In the midst of a pandemic, with the US unemployment rate set to rise above 20%, this seems counter-intuitive. However, record low mortgage rates, an extended lockdown to reflect on living arrangements and in some US cities, weaker pricing over recent years and the prospect of a discounted purchase may be behind the rise.

Data from Skyscanner’s global travel survey suggest a third of Americans are ready to travel this summer, with beaches and national parks their preferred destinations, whilst in Canada, domestic bookings last week reached their highest volumes since 16 March.

- Listen to our latest global podcast which looks in detail at what impact Covid-19 has had on Asia’s property markets

- Listen to my colleague Tom Bill, a guest on the Telegraph’s daily Coronavirus podcast, talk about the complexities involved in judging what will happen next to property prices