Taking advantage of exciting counter-cyclical retail opportunities

There is an exciting counter-cyclical opportunity, but only for the right stock says Charlie Barke, Head of Retail Investment at Knight Frank.

3 minutes to read

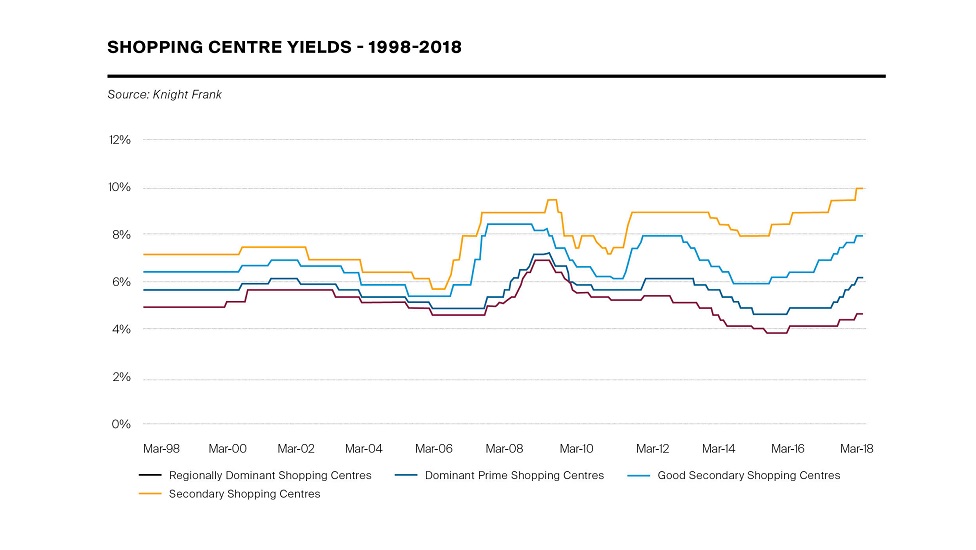

At the turn of the century, like now, some 100+ shopping centres were available “off-market” to any credible buyer willing to come forward at a sensible price. Many of these centres had been marketed and withdrawn, as is also the case today.

2009/10 saw another downturn, with a significant fall in values leading to an excess of investment supply over demand.

So, what lessons can we learn from these two previous cycles? And how best can one position oneself to take advantage of the fall in pricing?

After the fall in values of the late 1990s, there was a general market recovery where virtually all assets then benefited from the boom period to 2007.

One of the early counter-cyclical investors were Kevin McGrath’s REIT Asset Management, who acquired numerous distressed sales, in total around 20 centres, at an average yield of close to 8%.

REIT then sold out of these assets at an average yield of 6.75% within just a few years, arguably too soon as the sector continued to boom for several years thereafter.

"Whilst part of the market has further to fall before stabilisation (or at least the valuations of such assets need to crystallise a further correction), the market is starting to offer some good value set against historic contexts, other sectors and other geographies."

Another to take advantage of the cycle were Charterhouse, who built a portfolio of 11 schemes over several years. They exited as a portfolio in 2003 at in excess of £325m, selling at ca. 30% more than their respective acquisition prices.

CIT, the buyer of the Charterhouse package in 2003, went on to also make a significant return, selling on all of these properties again within three years, capturing significant capital growth off the back of further yield shift.

The 2009/10 downturn was shorter and the upside mirrored that. However, despite the short cycle, several savvy buyers got in and out, making significant profits simply by holding for yield shift, rather than by making significant further investment to transform assets.

Some examples of these are provided below. What this latest cycle points to is careful stock selection. Individual deals fared very well but a blanket strategy of just buying the market en masse has left a few investors in difficult positions.

Also, notable from the list below is that schemes are generally at the better end of the market. Therefore, the best strategy was to buy good value prime stock, rather than chasing double-digit yields.

We are firm believers that we are being presented with a similar counter-cyclical opportunity now. Whilst part of the market has further to fall before stabilisation (or at least the valuations of such assets need to crystallise a further correction), the market is starting to offer some good value set against historic contexts, other sectors and other geographies.

It is this relativity, combined with the eventual stabilisation of the local occupational market, that will encourage investors return to shopping centres in due course.