A new dynamic: Mapping the future M25 office market

The conventions of market supply and demand are under attack says Lee Elliott, Global Head of Occupier Research. An effective understanding of, and response to, the emerging market dynamic is essential for the future competitiveness and performance of the M25 and South East office market.

5 minutes to read

Dynamic (Adj.)

i. (of a process or system) characterised by constant change, activity, or progress

ii. (of a person) positive in attitude and full of energy and new ideas

The new dynamic emerging within the M25 office is challenging both our thinking about the source and needs of future occupiers and about how we, in the property industry, can create in the second sense of the definition, more dynamic places and workplaces.

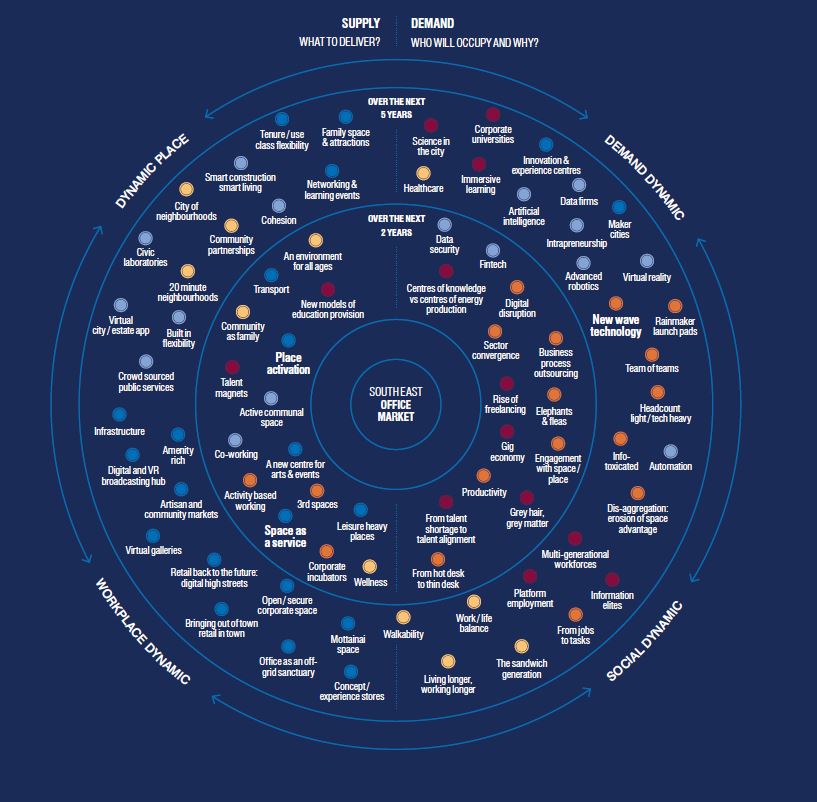

Knight Frank have sought to define, through our Future Gazing mind-map, this emerging market dynamic. The map outlines aspects of change that could alter the demand and supply dynamic over the next five years.

We must be mindful of these issues when making occupational or investment decisions. It is how such decisions can be future-proofed and de-risked. Amongst the many themes, there are three which present the strongest challenge to landlords within the M25 market and hence are worthy of further elaboration.

Click to enlarge Future Gazing mind-map

New wave technology - disruptor or enabler?

The South East office market is no stranger to occupational demand from the technology sector. In fact, the tech sector has accounted for, on average, 23% of annual office take-up over the last five years and has absorbed some 3.8 million sq ft during that period.

Similarly, occupiers drawn from other sectors have been transformed by the application of new technology to business processes, often fuelling new property requirements. This pressure will intensify as new wave technologies such as artificial intelligence, virtual reality, augmented reality, robotics and automation take greater hold.

The occupational market will therefore continue to see demand arising out of disruption. The application of new wave technologies also has a positive impact on supply.

The use of sensors, mobile telephony and monitoring hardware and software – the raw materials of the so called ‘Internet of Things’- will allow the emergence of smart buildings within the M25 market.

This technology, or more accurately the data emerging from it, enables more effective and pro-active workplace and asset management.

It also creates much needed evidence to support the business case for a prospective occupiers real estate move – cases that are now typically focused on metrics relating to increased productivity, staff retention, space utilisation and total real estate spend or savings. Used correctly, data will shape future built products or reconfigure existing stock to better meet occupier needs.

"Landlords must adapt to a new supply side dynamic, with innovation moving beyond the design of the built product and towards the provision of soft-services, community and well-being."

Space as a service - going beyond the physical product

The use of data derived from within office space to influence future product design has been central to WeWork’s meteoric rise across the globe. It is just one way in which the emerging flexi, co-working phenomenon – which is not of course limited to WeWork - should be influencing more traditional supply side players.

Key amongst these influences is the necessary transition from viewing real estate simply as a physical product and towards the concept of ‘space as a service’.

Co-working and flexi providers – to date relatively limited within the M25 market – place tremendous emphasis on providing real estate and associated services that support the creation of a highly connected, collaborative community housed within a modern, curated and highly serviced environment.

The strength of connection and satisfaction that the ‘customer’ (note the language) has with the space will be key as co-working providers increasingly seek to compete for occupiers of scale through their emerging enterprise model.

In this sense, traditional landlords must recognise the threat and nullify it through, at the very least, the adoption of its key features. Landlords must adapt to a new supply side dynamic, with innovation moving beyond the design of the built product and towards softservices, community and well-being.

Place activation - active management to create vibrancy and buzz

This drive towards highly serviced environments that create a physical and emotional connection is something that landlords must pay growing attention to.

Occupiers want to attract and retain talented staff. They will locate in buildings and locations that support them in this task. They are seeking what I have referred to previously as talent magnets; locations that have a buzz, vibrancy and cohesion.

"For landlords the market dynamic demands change. As the saying goes ‘old ways won’t open new doors’."

Landlords must invest more time (and yes money) in activating their schemes and buildings. This encompasses the creation of a brand identity which supports the marketing of a scheme to occupiers and employees.

The best practice example of this remains, almost twenty years since its inception, Chiswick Park. The ‘Enjoy Work’ brand has proven to be a marketing masterstroke in raising profile and challenging preconceptions of the location. Yet as Chiswick Park also ably shows, place activation is about much more than a catchy slogan.

It is about creating events, educational programmes, temporary installations, site specific apps and even concierge staff to consistently and continually bring substance to the brand.

To date, many traditional landlords have baulked at such active asset management, but in a world where staff retention is the key to retaining occupiers and avoiding expensive voids it is becoming an essential part of the investment process.

A new dynamic is emerging in the M25 market. Several of the key centres are well placed to address the opportunities this dynamic represents. Traditional market orthodoxies are being challenged by occupier activity and demands. New market entrants will be ushered in.

More importantly it will create new opportunities for those investors and developers bold enough to recognise that, as the saying goes, ‘old ways won’t open new doors’.

The M25 Report is a comprehensive study of the South East office market from inception to future prospects. The report considers both location and the changing needs of the occupier. Through expert opinion and analysis, it identifies market hotspots and offers insight into influential trends.