European residential investment volumes set to rise

Globally, the volume of capital targeting real estate investments continues to rise.

7 minutes to read

According to Preqin, private equity funds are sitting on more than $338bn of unspent money for this purpose, up from $236bn in 2015, while pension fund allocations to real estate are still creeping up.

Whilst some of this capital will be deployed in traditional commercial real estate sectors, increasingly income-producing residential property, including multifamily residential blocks and student housing, is becoming a key focus. Accordingly, the residential investment sector is growing rapidly throughout Europe supported by structural shifts in both demographics and lifestyles. Urban populations are growing, yet the supply of housing remains inadequate.

For many investors, this presents a compelling opportunity, particularly given initial data suggests that the residential sector has weathered the impact of COVID-19 remarkably well, especially when compared with other managed real estate assets. Whilst there have been practical challenges to managing and letting residential accommodation over the past couple of months, anecdotal evidence suggests renewal rates have risen as tenants choose to stay in place, whilst income, in the form of rent collection, has remained strong..

Increased uncertainty often means households looking for a home will turn to the rental market first to meet any immediate housing need, which should support future demand. Long-term fundamentals also underpin student housing markets across Europe. In the short-term, there are concerns surrounding income, the differing approaches being taken by individual institutions with regards the 2020/21 academic year and international student numbers, although these concerns are expected to be allayed once the coming academic year stabilises and we expect to see a swift recovery in this market segment.

Prior to COVID-19, by modelling various scenarios, Knight Frank research suggested that within the next decade some investor groups may devote up to half of their real estate allocations towards these sectors. The last few years have already seen the launch of a number of ‘residential focussed’ European real estate funds, in a clear stamp of approval for the sector. The current backdrop may well accelerate this trend.

Stuart Osborn, Head of European Residential Investment Transactions, at Knight Frank, notes: “Institutional and more opportunistic investors alike have been keeping a keen eye on the sector in the past three months, anticipating and analysing any value movement. Pricing has remained relatively stable with no real distress visible. As a result, we expect to see renewed activity in the market, tentative at first but confidence is growing.”

Data from RCA shows investment in residential stock (which includes build-to-rent, as well as purpose-built student accommodation and senior living) across Europe rose by 13% in the first quarter of 2020, compared with the first quarter of 2019. Residential investment sectors accounted for 24% of overall investment activity in Europe, including the UK, between January and March, up from 19% back in 2014.

The growth in investment volumes within the residential sector in Europe has come against a backdrop of yield compression in a number of core commercial property markets. In this environment, residential sectors offer both diversification and long-term income-driven benefits.

The demographic arguments which underpin this investment case have been made multiple times; urbanisation, growing employment opportunities and an ageing population all ensure the outlook remains attractive. As new generations increasingly opt to both live and work in larger towns and cities (putting pressure on current low supply levels), development and investment opportunities will grow in tandem.

“Residential investments have weathered the recent storm relatively well in comparison to some other traditional sectors,” Stuart adds. “One thing we have seen from the disruption in the last few months, as people have been confined to their homes, is that the home has remained the one constant, becoming an essential asset for living, working and playing.”

European multifamily

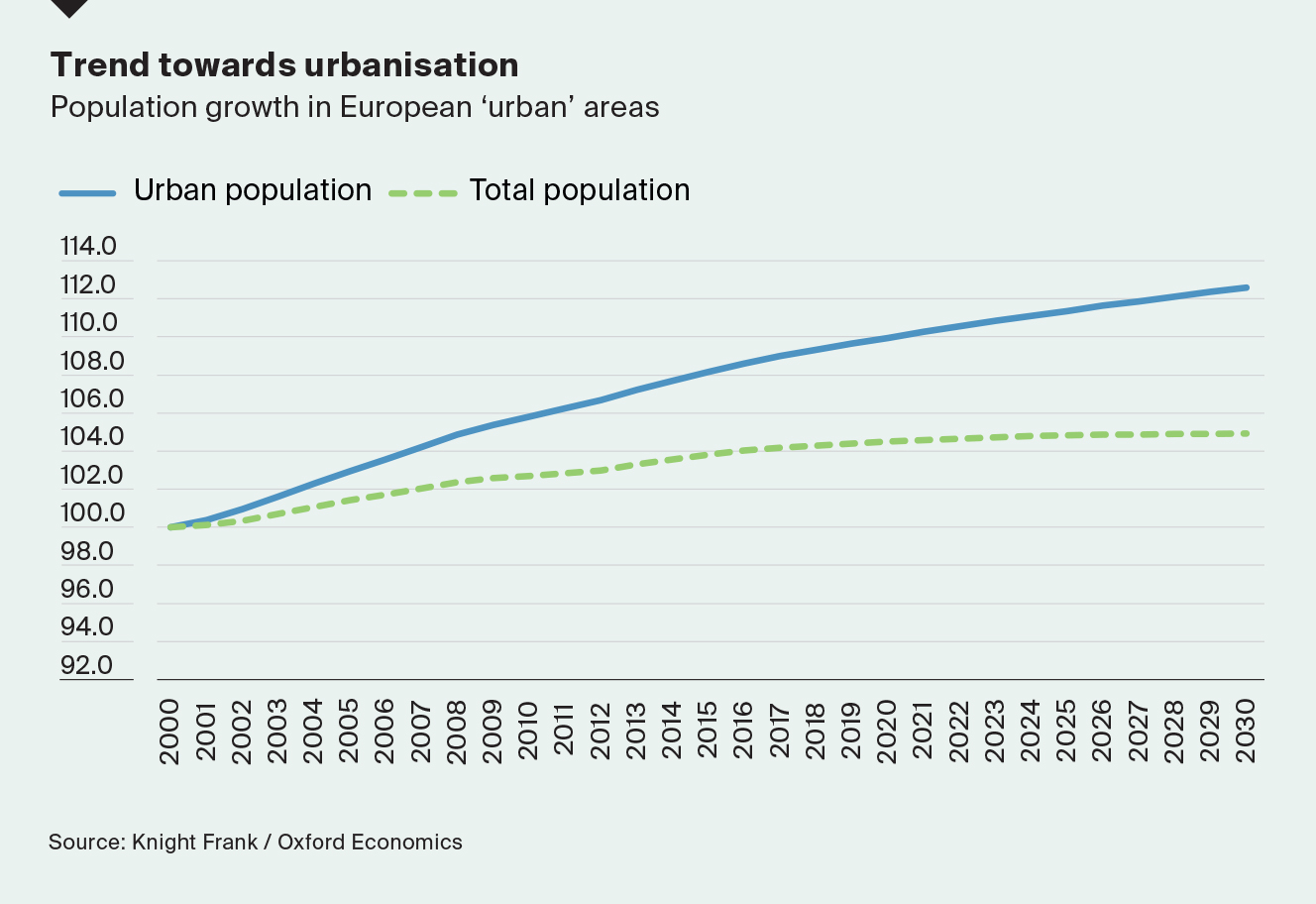

The multifamily sector has long been considered a defensive asset. It is a sector more closely tied to demographic trends as opposed to economic cycles and, as such, we expect demand from investors across Europe will bounce back swiftly, despite the current crisis. The long-term trends that have underpinned the sector’s ascent over the last few years are unchanged. European cities continue to grow with the share of people living in urban areas steadily rising and out pacing overall population growth for more than two decades. Forecasts from Oxford Economics suggest this trend is set to continue over the coming decade.

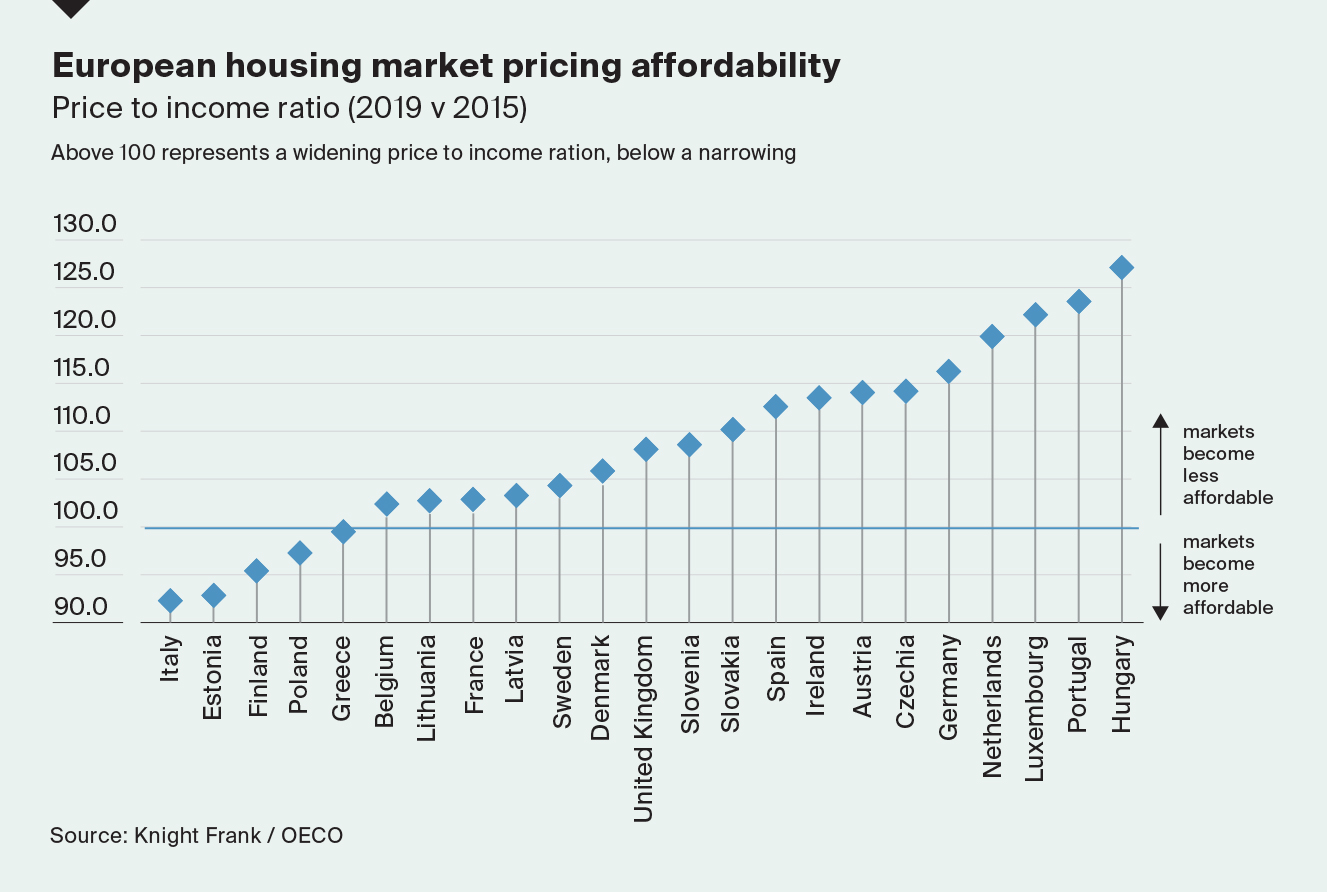

Elsewhere, shrinking households and rising house prices have been driving demand for rental accommodation. Data from the OECD, suggests that nearly 80% of housing markets within the European Union have seen house price-to-income ratios widen over the past five years.

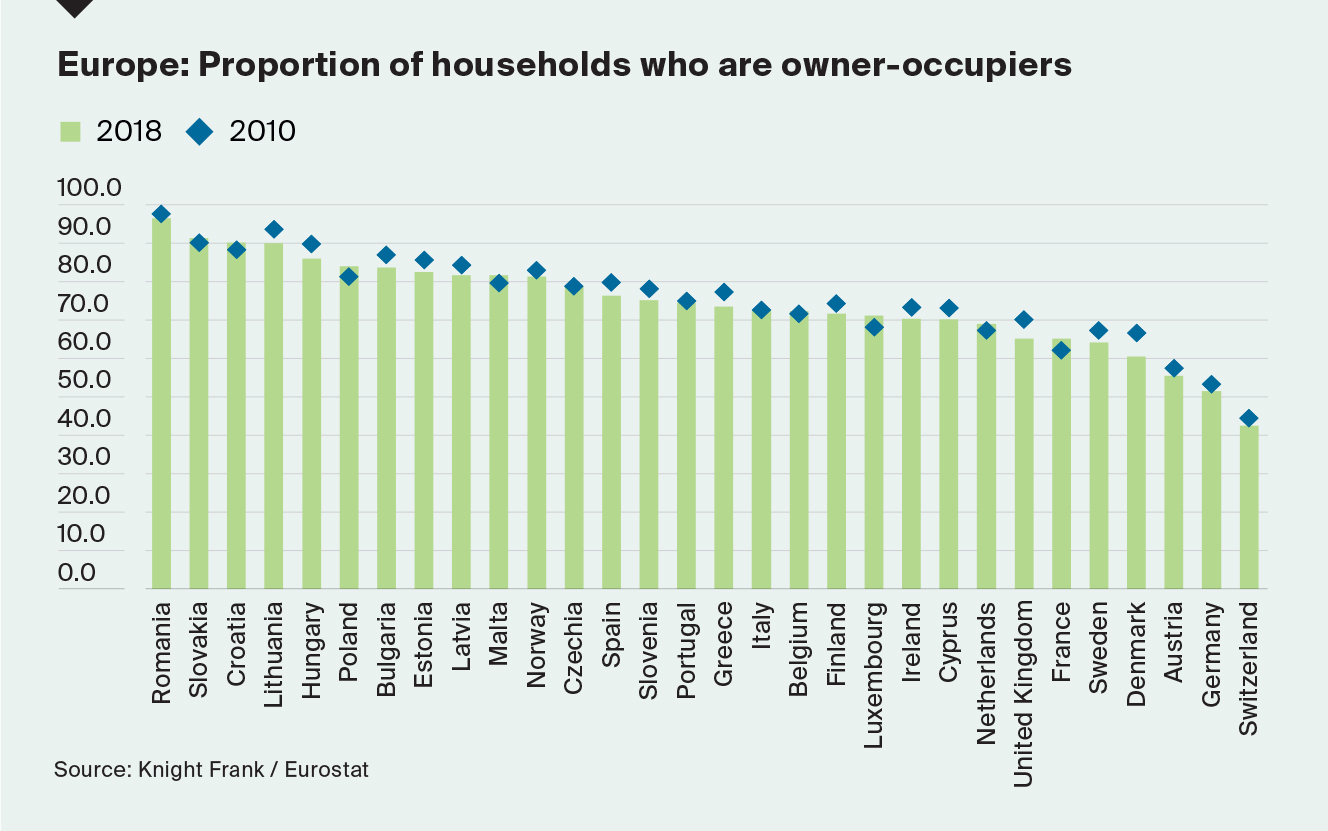

At the same time the supply response has been inadequate – a trend only likely to intensify given the recent pause in construction across the continent. Partly as a result, homeownership rates have been gradually declining, though this is part of a longer term trend. Data from Eurostat suggests that, since

2010, the proportion of owner-occupiers has dropped in nearly 70% of Euro-area countries where data is available.

That’s not to say there aren’t challenges. Rising unemployment and jitters about the macroeconomic outlook will dampen rental growth prospects in the private rented sector, but the need for housing across tenures in major European cities has not decreased and this will underpin demand.

Stuart observes that “As we see working methods change, flexibility and specialist amenity are likely to move higher up the priority list that, coupled with continued undersupply, economic uncertainty, rising unemployment and a frustrated mortgage market means the rental market will remain in high demand. This in turn will underpin a significant uptick in investment activity.”

European Student Housing

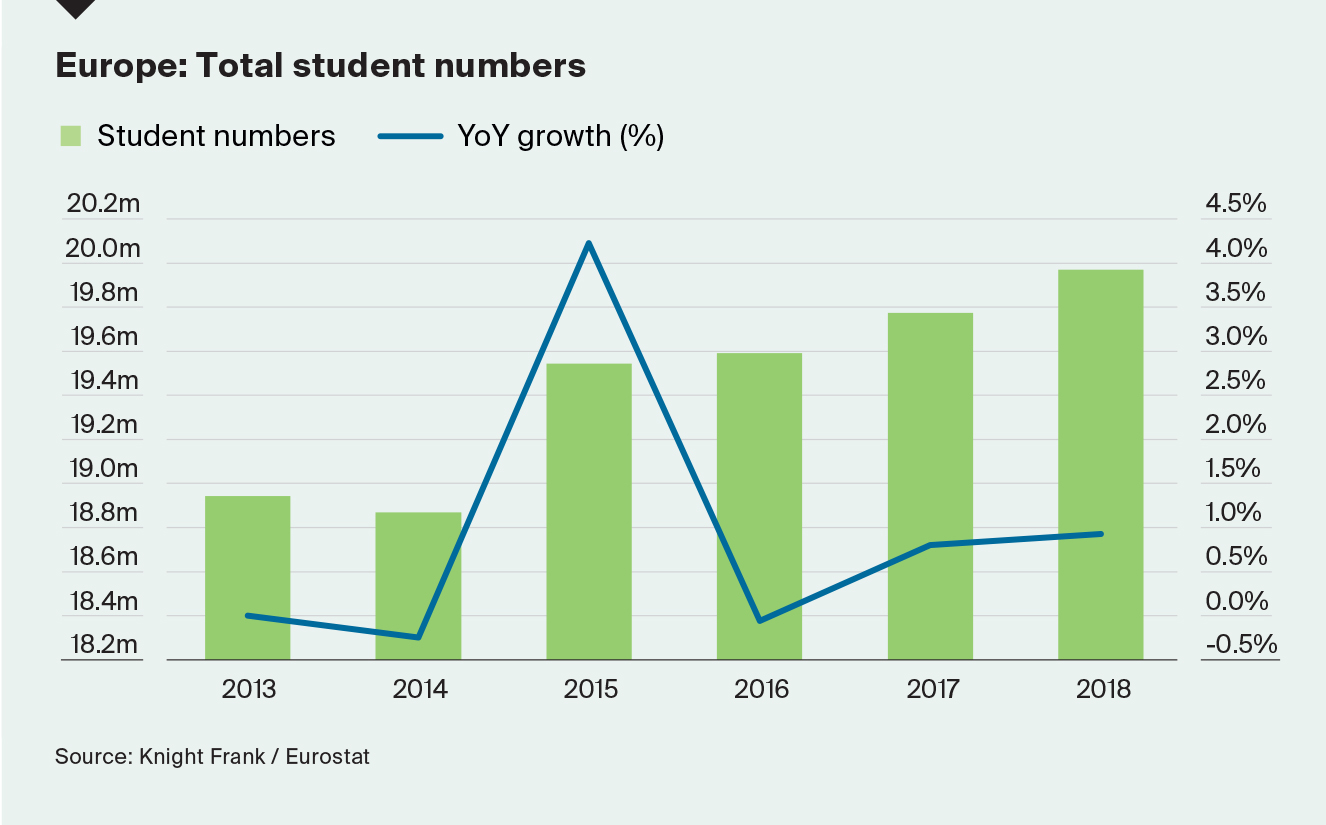

The European student market has grown significantly in the past decade. There are currently around 15 million full-time students across the region studying at 3,300 institutions. Eurostat data indicates that full-time undergraduates have increased by 7.7% over the past three years alone.

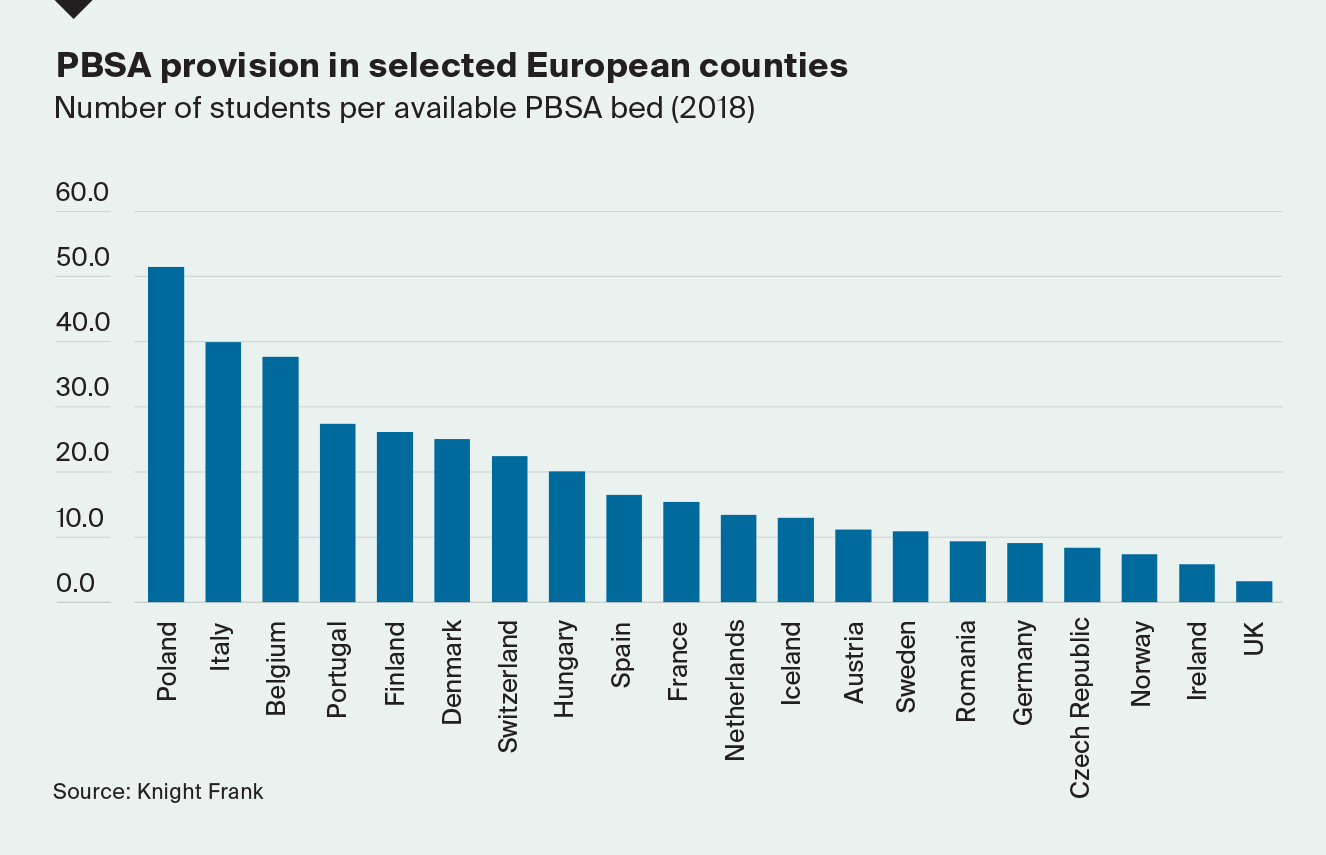

Meanwhile, the supply of student accommodation hasn’t kept pace. Currently, the average provision rate (the number of beds relative to students) across major European cities in continental Europe is around 20%, which is low compared with the UK which stands at 35%. The already skewed supply and demand dynamics in key markets, alongside a scarcity of new product, has been a key factor underpinning investor appetite.

The sector has undoubtedly been left in a state of flux as a result of COVID-19, with potential disruption to the next academic cycle likely to have an impact on the operational side of the purpose-built student accommodation (PBSA) market. This is likely to be further complicated by the fact that not all universities will adopt the same approach. The other big question mark surrounds international student numbers, especially given they typically make up a high proportion of those living in PBSA. Universities, and PBSA operators, face an anxious wait to understand the impact travel restrictions may have, although there are a number of positive signs in that regard. In the UK, UCAS, the admissions body, has noted that the live cycle data it is processing does not show any 'red flags' for international students withdrawing or deferring. A separate study of Chinese students, done in conjunction with the British Council, found that only 1% of respondents had already cancelled or deferred.

Regardless, any drop off in international student numbers may well be offset by a rise in domestic students, with past experience suggesting that student numbers tend to rise during periods of uncertainty as people look to upskill. However, across the region, differing tuition fee structures may prove more attractive than others for EU and international students alike, we expect to see an increase in competition from European universities for such students.

“The student sector will not emerge completely unblemished,” says Stuart. “In the short term however, we expect this to quickly stabilise. The sector has proved resilient in past years and we predict a strong bounce back in the next year as normality resumes.”

Longer term, improved access to visas and study permits, more English Taught Programmes (ETPs) and lower tuition fees (relative to the UK and US) will continue to underpin the appeal of European universities.