Europe: Tariffs, Interest Rates and Prime Prices

Plus, which European markets have led the PIRI rankings over the last decade?

4 minutes to read

Tariffs

A fortnight ago, President Trump upended global trade with major consequences for key asset classes not least equity markets, before rolling back on his tariff threats……..for 90 days at least, making Tuesday 8th July the date to circle in your diaries.

Europe is on a sticky wicket.

What do we know? The EU’s original 20% tariff was reduced to 10% after Trump’s climbdown.

One positive is that since ‘Liberation Day’ President Trump has treated the EU as a single trading bloc. Europe would have experienced more discord had he applied different rates to different countries, pitting them against each other.

What next? John Stepek of Bloomberg sums it up nicely, “This is the stark choice countries face: reduce the cost of tariffs but keep suffering the damage from uncertainty; or eliminate the damage from uncertainty but pay the cost of extracting yourself from your US relationships.

The world in which the former choice makes sense is one in which you think US policy uncertainty will fall — in other words, Trump’s policymaking to become more normal. Countries that don’t believe Trump will change, however, should look to free themselves from their vulnerability to his policy choices.”

The EU’s retaliatory tariffs have been put on ice and this week EU trade chief Maros Sefcovic met his counterparts in Washington for talks. One other factor for consideration will be the impact on the euro which hit a three-year high last Friday. A stronger currency may put downward pressure on consumer prices in the eurozone but it also makes exports more expensive.

Mortgage rates

The European Central Bank (ECB) is expected to lower rates again today, making it the seventh cut in the latest easing cycle which began as recently as June 2024.

Capital Economics envisages rates will sit at 2.00 by the end of this year.

Whilst this is good news for European households with rates as low as 3.2% already on offer in Spain (or even as low as 2.25% if you take out other bank services) according to John Busby of KF’s Traverse International Finance, the reason for the cuts is less positive.

Things were starting to look up and an ECB pause was on the cards this month. Germany’s fiscal U-turn and a strong commitment from European Governments to spend more on security and defence had improved the eurozone’s growth outlook. However, since ‘Liberation Day’, a pause is no longer an option.

Already weak economic growth will be pushed lower by tariffs and this will be the key motivating factor for the ECB’s rate setters.

The ECB is in a tough spot. It needs to lower interest rates to boost economic growth, but it also has to be ready for potential inflation spikes, especially with the ongoing trade war between the US and China, where tariffs exceed 100%.

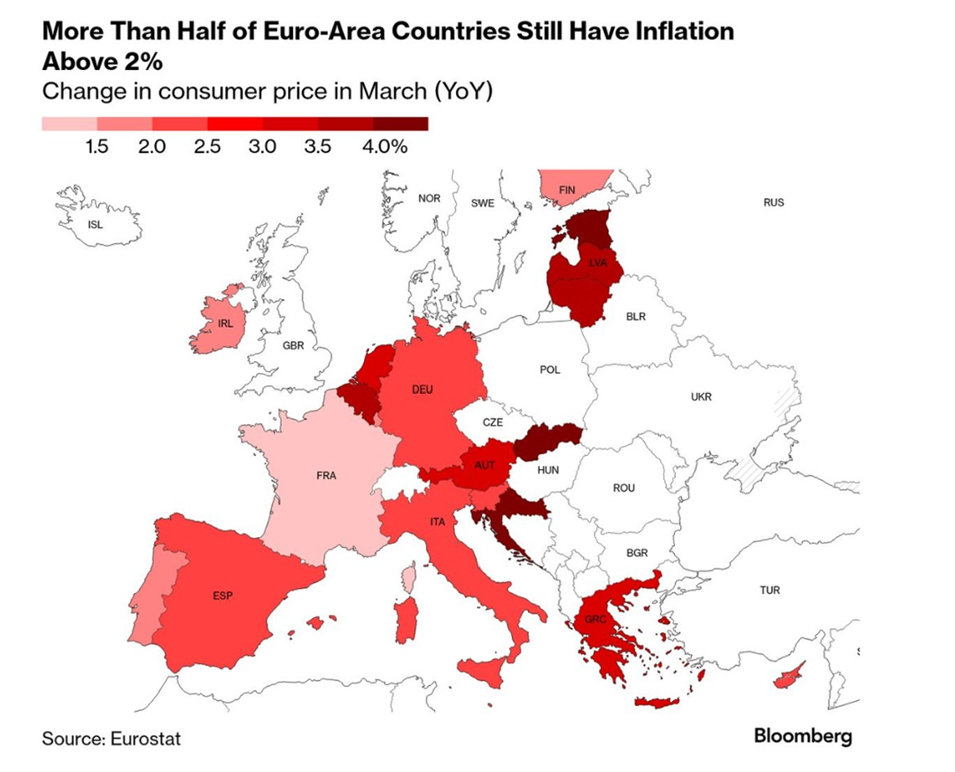

Eurostat recently reminded us that over half of the eurozone still has inflation above the 2% target.

Prime markets

What does this all mean for Europe’s prime residential markets as we enter the peak season for second home buying?

Buyers will likely fall into two groups: those who are unsettled by recent uncertainty and choose to wait, and those who, after experiencing events like Covid-19, election year excitement, tax changes, rising debt costs (now easing), and volatile stock markets, decide it's time to move forward with their home-buying and life goals.

There will also be some investors looking to turn the risk into a competitive advantage by navigating uncertainty and unlocking investment opportunities.

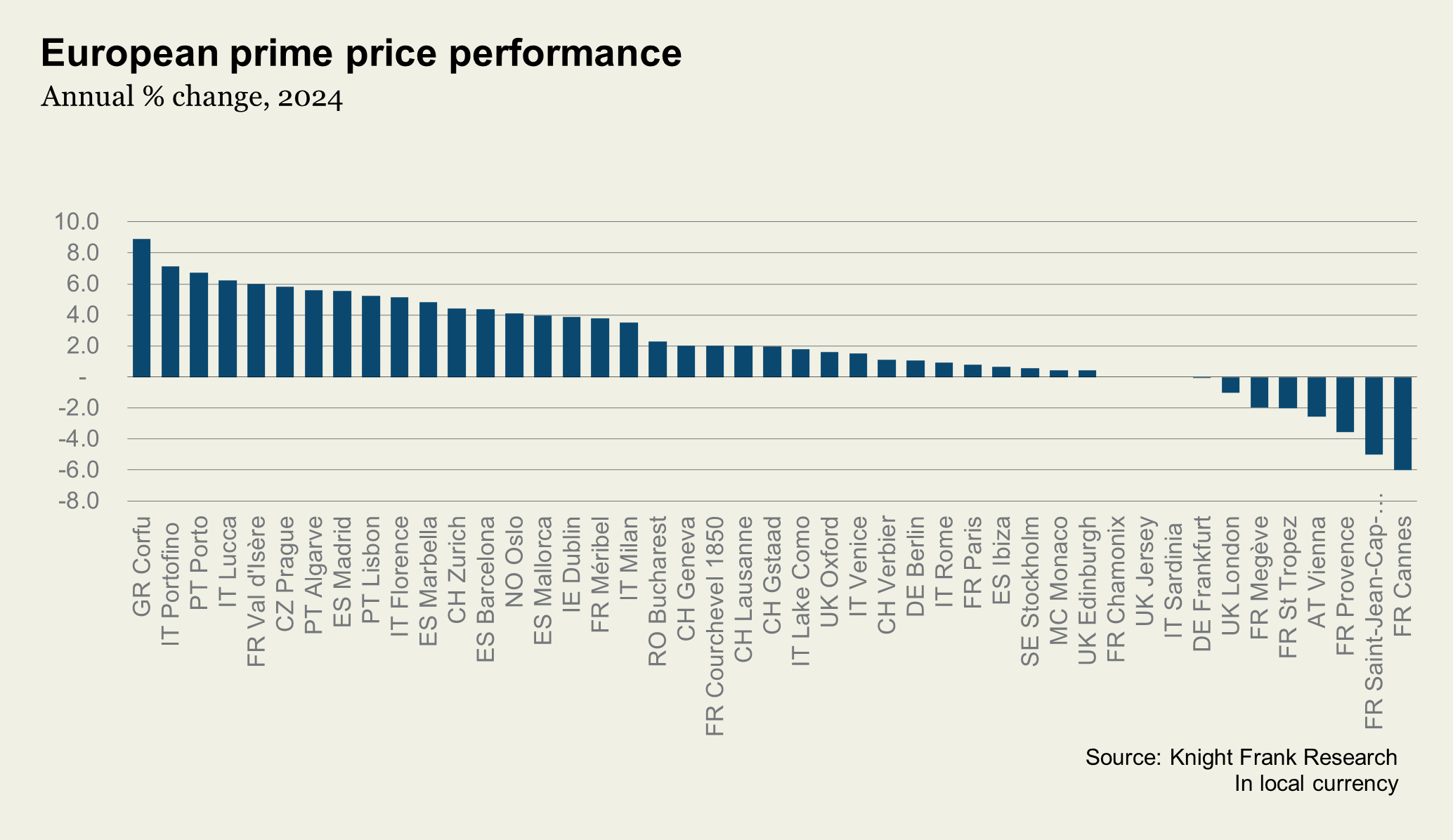

For those individuals, Knight Frank’s Prime International Residential Index (PIRI), which tracks movements in luxury residential prices on an annual basis, reveals stark differences between key European markets with some now looking like a good buying opportunity. The gap between the strongest and weakest performers in Europe is almost 15 percentage points.

This month, I’ve also taken the long view and extracted the top ten European markets in our PIRI index from the past decade.

Please click on the image below to expand

Key Takeaways:

1. The centre of gravity has shifted from northern Europe to southern. In 2016, three German cities were in the top ten, but none have featured since 2018.

2. Madrid and the Algarve have made the most appearances, both totted up seven entries in the last decade. Italian markets have been late to the party but notched up three entries in 2024.

3. Alpine markets feature consistently - Val d'Isere, Verbier and Chamonix have three or four entries each over the last decade.

…. but note the absence of London since 2014 – I refer you to my previous note above regarding buying opportunities.

In other news…

Travel hotspots are tempted to copy Venice's visitor fee (FT) Switzerland’s Central Bank is resisting urge to go negative in fight over Franc gains (Bloomberg) and Europe's markets are winning from ebbing of "America First" trade (Bloomberg)